Energy Sector Leads Midday Gains in Stock Market

As of midday Monday, Energy companies are outperforming other sectors, experiencing an increase of 1.8%. Notably, EQT Corp (Symbol: EQT) and Diamondback Energy, Inc. (Symbol: FANG) are shining with gains of 3.9% and 3.4%, respectively. The Energy Select Sector SPDR ETF (Symbol: XLE) has also followed suit, climbing 1.5% on the day and showing a robust 17.24% gain year-to-date. Currently, EQT Corp is up 16.40% year-to-date, while Diamondback Energy, Inc. boasts a 23.04% year-to-date increase. These two companies together account for roughly 4.2% of the underlying holdings of XLE.

Utilities Sector Shows Promising Growth

The Utilities sector ranks next, up by 0.9%. The standout stocks in this category include Vistra Corp (Symbol: VST) and Constellation Energy Corp (Symbol: CEG), with impressive gains of 3.9% and 2.2%, respectively. The Utilities Select Sector SPDR ETF (XLU), which tracks this sector, is up 1.0% in midday trading and has surged 28.92% year-to-date. Vistra Corp highlights a remarkable 285.11% year-to-date increase, while Constellation Energy Corp is not far behind with a gain of 97.38% year-to-date. Together, VST and CEG represent about 10.0% of the underlying holdings of XLU.

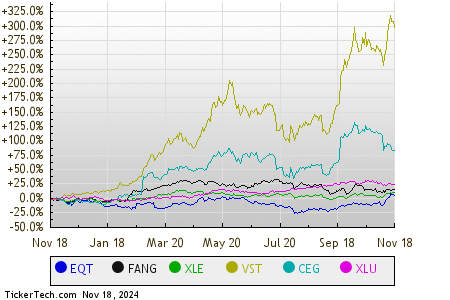

For additional context, the following chart displays the stock price performance of these securities over the trailing twelve months, with each symbol distinctively colored for clarity:

S&P 500 Components Reflect Positive Trends

A snapshot of the S&P 500 components reveals that nine sectors are increasing in value today, while none are in the red.

| Sector | % Change |

|---|---|

| Energy | +1.8% |

| Utilities | +0.9% |

| Technology & Communications | +0.9% |

| Healthcare | +0.6% |

| Consumer Products | +0.5% |

| Materials | +0.5% |

| Services | +0.4% |

| Financial | +0.2% |

| Industrial | +0.1% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Additional Resources:

ORGS market cap history

LOXO Historical Stock Prices

Top Ten Hedge Funds Holding KFS

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.