Consumer Products Struggle Amid Market Challenges

As of midday Monday, the Consumer Products sector is lagging behind the broader market, registering a loss of 0.9%. Notable underperformers include Tesla Inc (Symbol: TSLA), which has dropped 5.6%, and Deckers Outdoor Corp. (Symbol: DECK), down 3.8%. The iShares U.S. Consumer Goods ETF (Symbol: IYK), which tracks the sector, is slightly up by 0.2% today and has gained 1.37% year-to-date. In contrast, year-to-date performance shows Tesla down 5.44% and Deckers down 16.02%.

Industrial Sector Follows Suit

The Industrial sector also faces challenges, with a 0.9% decrease. FedEx Corp (Symbol: FDX) and Stanley Black & Decker Inc (Symbol: SWK) are notable laggards, reporting losses of 6.0% and 3.8%, respectively. The Industrial Select Sector SPDR ETF (XLI), which closely follows Industrial stocks, is down 0.8% for the day but has risen 4.16% year-to-date. FedEx’s performance year-to-date shows a decline of 11.51%, while Stanley Black & Decker has seen an increase of 5.50%. Together, these two companies represent about 1.6% of XLI’s holdings.

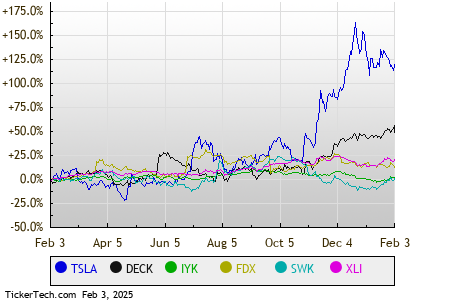

For a broader perspective, the chart below illustrates the stock performance of these companies and ETFs over the past twelve months:

Current S&P 500 Sector Performance

This afternoon’s trading data reveals that three sectors are showing positive movement while six sectors are on the decline. A closer look at the S&P 500 components offers insight into current trends:

| Sector | % Change |

|---|---|

| Utilities | +0.4% |

| Energy | +0.4% |

| Healthcare | +0.1% |

| Services | -0.4% |

| Technology & Communications | -0.5% |

| Financial | -0.6% |

| Consumer Products | -0.9% |

| Industrial | -0.9% |

| Materials | -0.9% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

• Earnings History

• SURG Average Annual Return

• AVDV Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.