Technology and Industrial Sectors Struggle Amid Market Declines

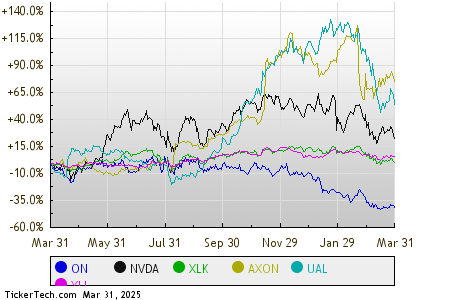

As of midday on Monday, Technology and Communications companies are experiencing notable underperformance, with share prices down by 1.2%. Key players in this sector, ON Semiconductor Corp (Symbol: ON) and NVIDIA Corp (Symbol: NVDA), both recorded losses of 3.5%. In the technology ETF space, the Technology Select Sector SPDR ETF (Symbol: XLK) is down 1.4% for the day and has decreased by 12.36% year-to-date. For comparison, ON Semiconductor’s year-to-date loss stands at 37.35%, while NVIDIA has declined by 21.16%. Together, ON and NVDA constitute approximately 12.1% of the XLK’s holdings.

The Industrial sector holds the second-worst performance with a slight 0.3% decline. Noteworthy stocks in this category include Axon Enterprise Inc (Symbol: AXON) and United Airlines Holdings Inc (Symbol: UAL), declining by 2.6% and 2.3% respectively. Related to this sector, the Industrial Select Sector SPDR ETF (XLI) is down just 0.1% in midday trading and has a year-to-date decrease of 1.05%. Individually, Axon Enterprise is down 12.37% for the year, while United Airlines has seen a larger decline of 29.35%. Collectively, AXON and UAL comprise about 1.5% of the XLI’s holdings.

To provide further context, a relative Stock price performance chart for these stocks and ETFs over the trailing twelve months is available below, showcasing each symbol in distinct colors as noted in the legend at the bottom:

You can view a snapshot of how the S&P 500 components across various sectors are performing in afternoon trading on Monday here. Notably, five sectors are experiencing gains, while four are seeing losses.

| Sector | % Change |

|---|---|

| Energy | +0.5% |

| Services | +0.4% |

| Utilities | +0.4% |

| Financial | +0.3% |

| Consumer Products | +0.2% |

| Materials | -0.1% |

| Healthcare | -0.2% |

| Industrial | -0.3% |

| Technology & Communications | -1.2% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

also see:

• WTBA Insider Buying

• AISP YTD Return

• BCAB Past earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.