Energy Sector Leads Midday Gains as Charles Schwab and Wells Fargo Shine in Financials

The best performing sector as of midday Monday is the Energy sector, up 1.1%. Within that group, EQT Corp (Symbol: EQT) and Coterra Energy Inc (Symbol: CTRA) are two large stocks leading the way, showing gains of 4.9% and 3.2%, respectively. Among energy ETFs, the Energy Select Sector SPDR ETF (Symbol: XLE) is up 0.5% today and has increased 14.92% year-to-date. EQT Corp has seen a year-to-date rise of 13.51%, while Coterra Energy Inc is up 1.90%. Together, EQT and CTRA account for about 3.1% of the underlying holdings of XLE.

The Financial sector ranks as the second best performer, increasing by 0.9%. Leading large financial stocks, The Charles Schwab Corporation (Symbol: SCHW) and Wells Fargo & Co (Symbol: WFC) posted gains of 5.2% and 3.5%, respectively. The Financial Select Sector SPDR ETF (XLF), which closely tracks financial stocks, is up 1.4% in midday trading and has risen 33.98% year-to-date. SCHW has an impressive year-to-date gain of 14.51%, while WFC is up an astounding 50.27%. Collectively, SCHW and WFC represent approximately 5.3% of XLF’s underlying holdings.

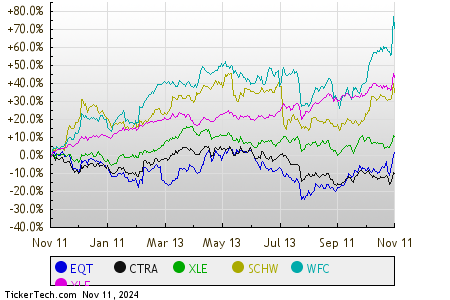

Comparing the performance of these stocks and ETFs over the last twelve months, a relative stock price performance chart is shown below. Each stock symbol is depicted in different colors as labeled in the legend at the bottom:

Below is a snapshot of how the S&P 500 components across various sectors are performing in afternoon trading on Monday. Seven sectors are showing gains, while one sector is down:

| Sector | % Change |

|---|---|

| Energy | +1.1% |

| Financial | +0.9% |

| Industrial | +0.9% |

| Consumer Products | +0.7% |

| Services | +0.7% |

| Utilities | +0.6% |

| Healthcare | +0.3% |

| Materials | 0.0% |

| Technology & Communications | -0.5% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

· Earnings History

· MERC Insider Buying

· DHIL Dividend History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.