The curtain rises on a new act for Money Forward (TSE:3994) as its one-year price target ascends to 6,924.67 per share, marking a 12.63% surge from the previous estimate recorded on January 16, 2024. Like a phoenix unfurling from its ashes, this significant uptick in the price projection is painting a promising future for the company’s investors.

The price target, a median derived from a multitude of analyst forecasts, now spans a spectrum from a low of 5,858.00 to a soaring high of 9,345.00 per share. This shifting landscape represents an impressive 21.68% surge from the latest closing price of 5,691.00 per share.

Peering Into the Fund Sentiment Crystal Ball

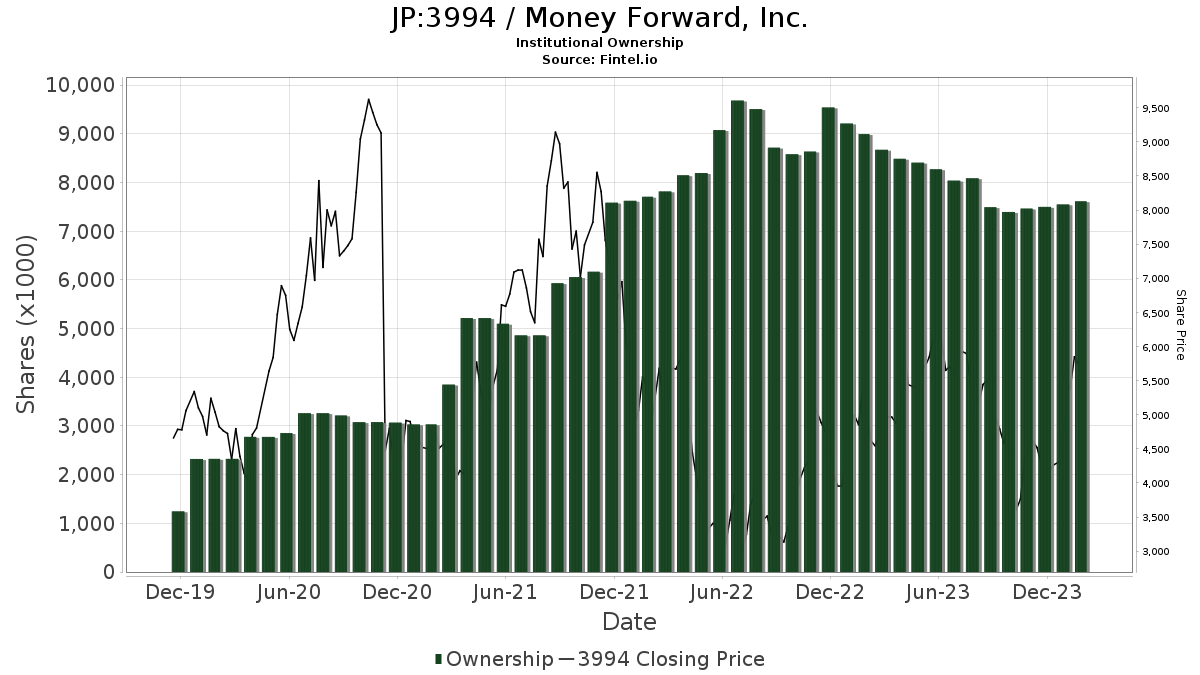

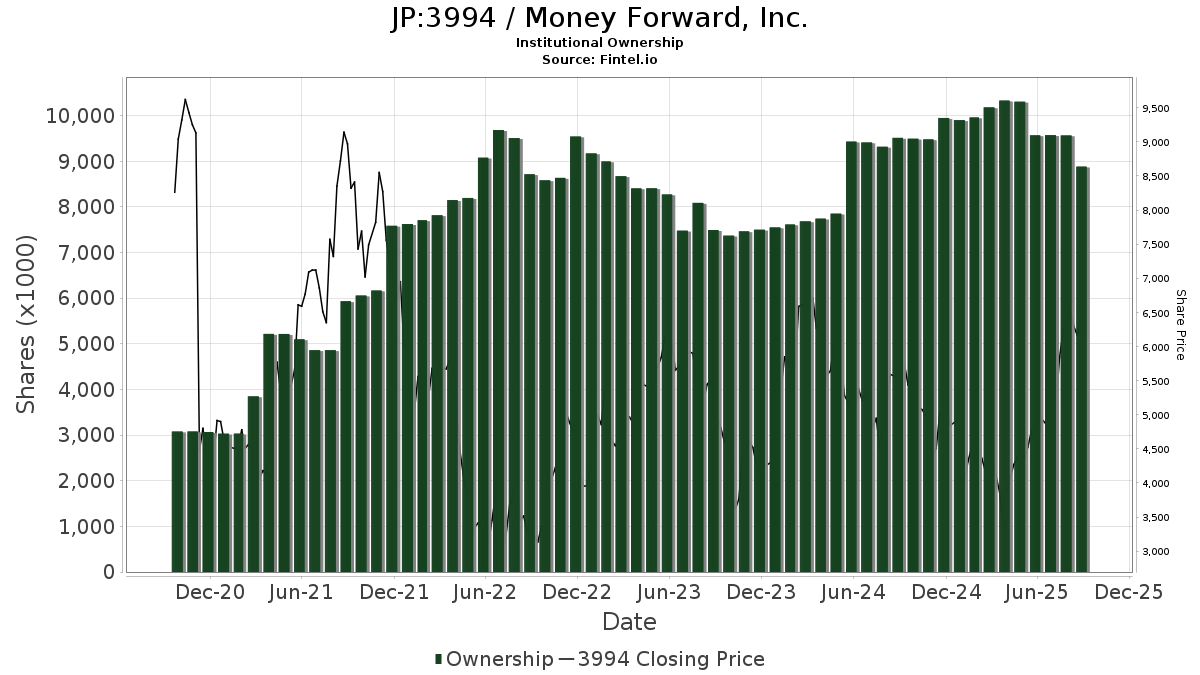

Stepping into the financial arena, we find that 51 funds or institutions have disclosed their vested interest in Money Forward. This reflects an increase of 3 stakeholders, amassing to a 6.25% growth over the last fiscal quarter. The average portfolio weight held by these magnates in TSE:3994 now stands at 0.21%, a notable decrease of 26.53%. Moreover, the collective institutional ownership has seen a 1.80% uptick, with 7,615K shares now under the guardianship of these shrewd financial entities.

Insights Into Shareholder Behavior

The plot thickens as SMCWX – SMALLCAP WORLD FUND INC retains ownership of 3,525K shares, accounting for a commanding 6.49% stake in the company. Unwavering, they maintained their position in the past quarter.

Meanwhile, ARTJX – Artisan International Small-Mid Fund Investor Shares clings onto 631K shares, translating to a 1.16% ownership in the company. Similar to its counterpart, no change was noted in their holdings during the recent quarter.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares commands 605K shares, manifesting a 1.11% ownership of the company. The previous filing showcased the ownership of a 597K share stash, indicating a modest 1.32% surge. However, the company decided to pare its portfolio share in 3994 by a bold 34.30% over the last quarter, painting a picture of calculated risk-taking.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares keeps a tight rein on 360K shares, constituting a 0.66% ownership of the company. Their previous filing disclosed 356K shares in their possession, exhibiting a modest 1.06% escalation. Yet, they opted to trim their stake in 3994 by 15.48% over the last quarter, showcasing a sophisticated dance between risk and reward.

FJSCX – Fidelity Japan Smaller Companies Fund now holds 286K shares, representing a 0.53% ownership in the company. Their previous filing unveiled 260K shares under their wing, marking a commendable 9.02% rise. However, a strategic reduction of 26.96% in their 3994 portfolio share over the last quarter reveals a carefully orchestrated financial ballet.

Fintel stands as a beacon in the foggy world of investing research, catering to individual investors, traders, financial advisors, and small hedge funds, alike.

A treasure trove of data spanning the globe, Fintel offers insights into fundamentals, analyst reports, ownership statistics, and fund sentiment, alongside options sentiment, insider trading, options flow, unusual options activities, and a myriad of other treasures. Moreover, their exclusive stock picks are backed by sophisticated, rigorously tested quantitative models, paving the way to enhanced profits.

Click to Unveil More

This narrative first unfolded on Fintel.

Opinions and perspectives articulated herein represent those of the author and not necessary reflections of Nasdaq, Inc.