Monness, Crespi, Hardt Gives Coinbase a Boost with New Buy Rating

Fintel reported on October 28, 2024, that Monness, Crespi, Hardt has begun coverage of Coinbase Global (BIT:1COIN) with a Buy recommendation.

Analyst Price Forecast Indicates Potential Growth

As of October 22, 2024, the average one-year price target for Coinbase Global stands at €231.22 per share. Projections vary widely, with a low of €145.68 and a high of €359.70. This average target suggests a potential upside of 21.93% from its most recent closing price of €189.64 per share.

For those interested, we have a leaderboard showing companies with significant price target upsides.

Projected Revenue and Earnings Signal Challenges

Coinbase Global faces a projected annual revenue of €3,223 million, reflecting a decline of 28.30%. Furthermore, the anticipated annual non-GAAP EPS is -0.40.

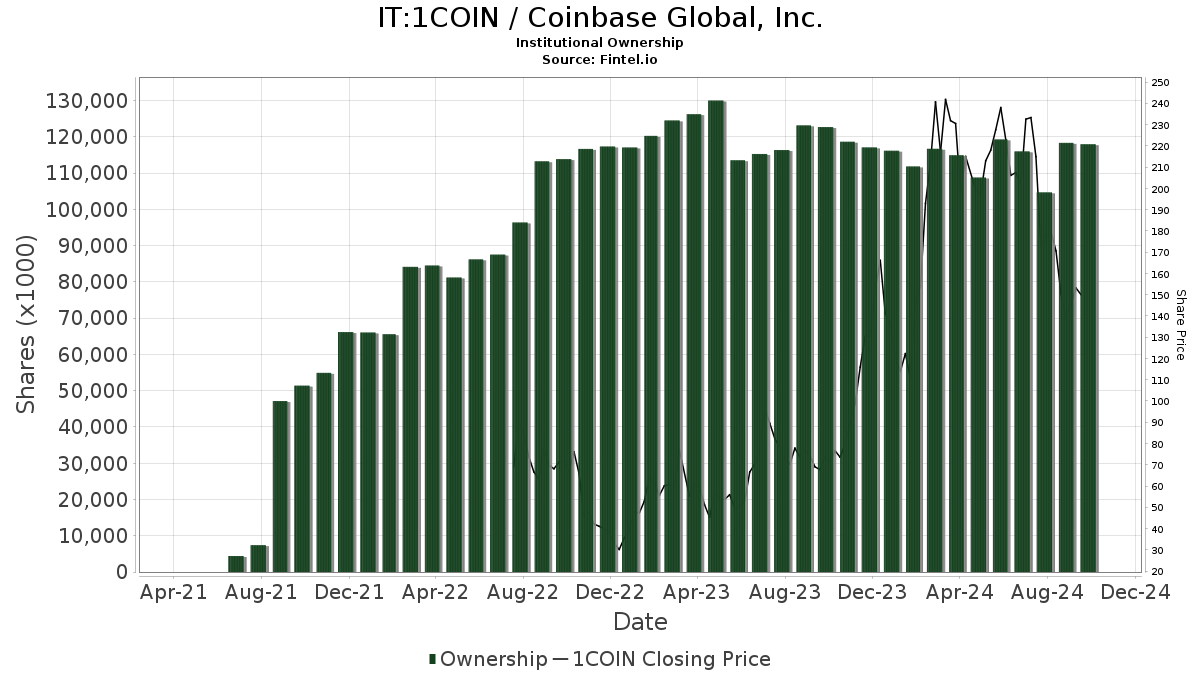

Fund Sentiment Shifts Toward Coinbase

Currently, 1,371 funds and institutions report positions in Coinbase Global, showing an increase of 44 owners, or 3.32%, over the last quarter. The average portfolio weight of funds in 1COIN is 0.46%, which has risen by 43.23%. Institutional shares increased by 9.92% over the past three months, reaching a total of 115,996K shares.

Overview of Shareholder Actions

The Vanguard Total Stock Market Index Fund Investor Shares, labeled VTSMX, holds 5,997K shares, giving it 2.95% ownership of Coinbase. This reflects an increase from 5,842K shares reported previously, equating to a rise of 2.59%. However, the firm has decreased its stake in 1COIN by 16.32% in the last quarter.

Paradigm Operations maintains 4,516K shares for 2.22% ownership without any changes over the last quarter.

The Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) own 3,665K shares, representing 1.81% ownership, an increase from 3,636K shares, up 0.79%. This fund also reduced its portfolio allocation in 1COIN by 12.77% recently.

Finally, ARK Investment Management holds 3,559K shares (1.75% ownership), down from 4,421K shares, marking a significant decrease of 24.23%. That fund also lowered its 1COIN allocation by 13.52% over the last quarter.

Sumitomo Mitsui Trust Holdings owns 3,130K shares representing 1.54% ownership, also seeing a decrease from 3,429K shares, down 9.55%, with a portfolio allocation drop of 17.73% in 1COIN.

Fintel serves as a wide-ranging research platform designed for individual investors, traders, financial advisors, and small hedge funds. Our extensive data includes fundamentals, analyst reports, ownership details, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.