Snowflake Sees Positive Upgrade Amid Mixed Institutional Holdings

On November 6, 2024, Monness, Crespi, Hardt revised their rating for Snowflake (LSE:0A93), moving from Neutral to Buy.

Fund Ownership Overview

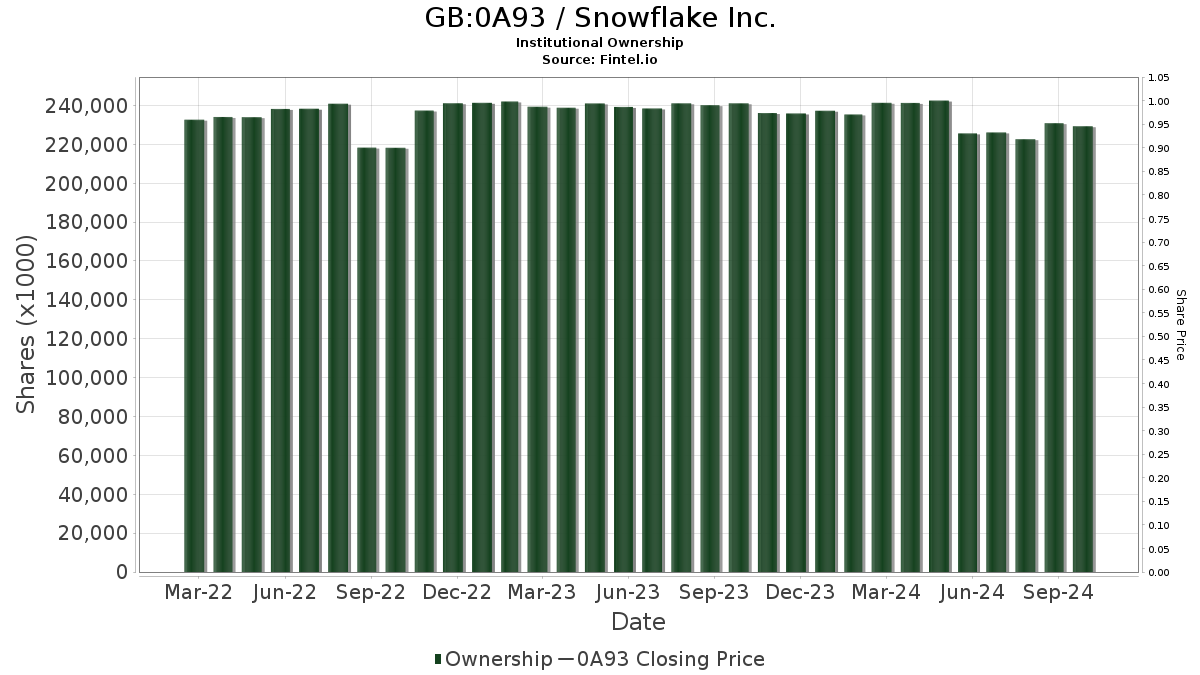

Currently, 1,575 funds or institutions have reported their shares in Snowflake, reflecting a decline of 102 owners, or 6.08%, in the past quarter. The average portfolio weight allocated to 0A93 is now 0.40%, showing an increase of 13.55%. In total, institutional ownership rose by 9.63% over the last three months, reaching 227,342K shares.

Actions of Key Shareholders

Altimeter Capital Management currently holds 9,551K shares of Snowflake, representing 2.85% ownership. Compared to the previous filing, the firm has decreased its position by 10,281K shares, a drop of 7.65%. They also reduced their allocation in 0A93 by 24.91% this quarter.

The Vanguard Total Stock Market Index Fund Investor Shares holds 9,516K shares, translating to 2.84% ownership. Previously, they owned 9,311K shares, marking an increase of 2.16%. However, their allocation in 0A93 decreased by 16.92% during the last quarter.

Bank of Montreal displays a more significant shift, holding 7,608K shares, or 2.27% ownership, up from 4,811K shares, which is a rise of 36.77%. Nevertheless, they cut their portfolio allocation in 0A93 by 58.43%.

Sc Us owns 7,501K shares, equating to a 2.24% stake, slightly down from 7,541K shares, reflecting a decrease of 0.53%. The firm’s portfolio allocation in 0A93 was reduced by 9.23% this past quarter.

Norges Bank’s holdings have notably changed, now at 6,185K shares or 1.85% ownership, a significant increase given they previously reported owning 0K shares, marking a 100.00% rise.

Fintel offers a comprehensive platform for investing research, catering to individual investors, traders, financial advisors, and small hedge funds.

The platform encompasses a variety of global data, covering fundamentals, analyst reports, ownership metrics, fund sentiment, options flows, insider trading, and more. Additionally, Fintel’s stock pick offerings are driven by advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.