“`html

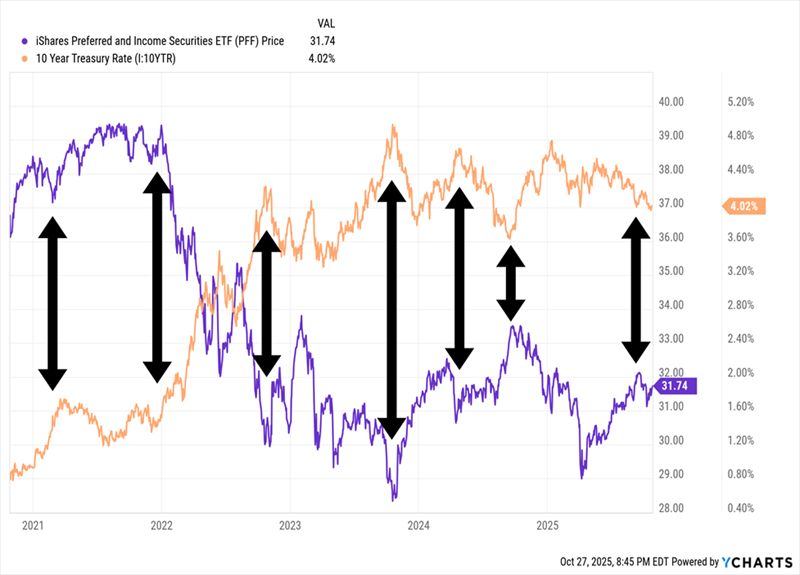

The Federal Reserve’s interest rate cuts are expected to boost preferred stocks, which have higher payouts than common shares. Investors should consider closed-end funds (CEFs) that yield between 7.2% and 9.8%, offering monthly payouts.

Three notable funds include:

- Cohen & Steers Limited Duration Preferred and Income Fund (LDP) with a distribution rate of 7.2%. The fund holds a diversified portfolio of 260 preferred stocks, half from the U.S. and half from international firms, with an average modified duration of 6.6 years.

- John Hancock Preferred Income Fund III (HPS) yielding 8.6% and employing a 37% leverage, consists largely of investment-grade preferred stocks.

- Nuveen Preferred & Income Opportunities Fund (JPC) offering a distribution rate of 9.8%, with 80% of its holdings rated investment-grade.

These funds provide attractive yields, especially as interest rates decline, making them a strategic option for income-focused investors.

“`