Morgan Stanley Boosts Entergy’s Outlook Amid Slight Price Adjustment

On November 4, 2024, Morgan Stanley changed their rating for Entergy (NYSE:ETR) from Underweight to Equal-Weight.

Analysts Forecast a 6.47% Decline

The average one-year price target for Entergy, as of October 22, 2024, stands at $133.24 per share. Predictions vary, with lows of $110.60 and highs of $158.55. This average price target suggests a 6.47% drop from Entergy’s last closing price of $142.46 per share.

For further insights, view our leaderboard of companies with the most significant price target upsides.

Growth in Projected Revenue

Entergy’s anticipated annual revenue is $12,775 million, reflecting a growth rate of 7.70%. The projected annual non-GAAP earnings per share (EPS) is set at 7.29.

Fund Sentiment Shows Positive Trends

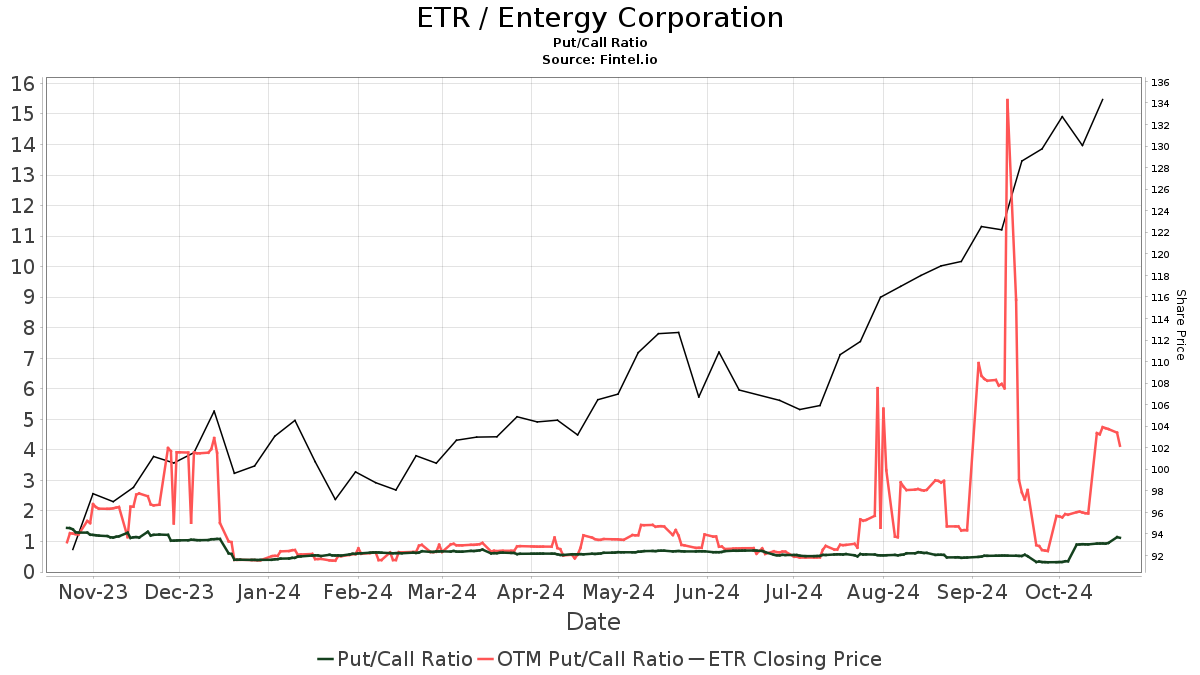

Currently, there are 1,735 funds or institutions with positions in Entergy, showing an increase of 45 owners, or 2.66%, over the past quarter. The average portfolio weight allocated to Entergy by these funds is 0.31%, which is a 3.82% increase. In the last three months, total shares owned by institutions rose by 5.46%, amounting to 235,501 thousand shares.  The current put/call ratio for ETR is 1.00, suggesting a bullish sentiment among investors.

The current put/call ratio for ETR is 1.00, suggesting a bullish sentiment among investors.

Changes in Shareholder Positions

Barrow Hanley Mewhinney & Strauss holds 6,926 thousand shares, representing 3.23% ownership, marking an increase from 6,163 thousand shares in its previous filing—an 11.03% rise. This firm expanded its ETR allocation by 16.61% last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 6,748 thousand shares, or 3.15% of Entergy. This shows a slight increase of 0.85% from the prior count of 6,690 thousand. However, the fund decreased its allocation percentage to ETR by 0.69% in the last quarter.

Ameriprise Financial now holds 6,479 thousand shares, which is 3.02% ownership. Previously, the firm owned 4,403 thousand shares, indicating a significant increase of 32.04%, despite reducing its portfolio allocation in ETR by a notable 73.49% last quarter.

Invesco’s position includes 5,533 thousand shares, representing 2.58% ownership, an increase from the previous count of 4,676 thousand shares, a rise of 15.49%. Yet, their allocation percentage to ETR decreased by 89.61% in the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) shows a holding of 5,481 thousand shares, equivalent to 2.56% ownership. This is up from 5,330 thousand shares, reflecting a 2.76% increase, but with a 1.44% decrease in its allocation to ETR last quarter.

About Entergy Corporation

(Provided by the company.)

Entergy Corporation is involved in electric power production, transmission, and retail distribution. They serve 3 million customers across Arkansas, Louisiana, Mississippi, and Texas. Entergy operates one of the cleanest large power generation fleets in the United States, with around 30,000 megawatts of electric capacity, including 8,000 megawatts from nuclear power. The company is headquartered in New Orleans, Louisiana, generates annual revenues of about $10 billion, and employs over 13,000 individuals.

Fintel serves as a key research platform for individual investors, traders, and small hedge funds, gathering a wide range of financial data.

We cover global markets, providing insights on fundamentals, analyst reports, ownership data, and investor sentiment, alongside unique stock selections backed by advanced quantitative models aimed at maximizing profits.

Click to Learn More

This story originally appeared on Fintel.

The views expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.