Morgan Stanley Boosts Outlook for Sempra Corporate Bond, Predicting Growth

Analyst Price Forecast Indicates Growth Potential

On December 13, 2024, Morgan Stanley raised its outlook for Sempra – Corporate Bond (NYSE:SREA) from Equal-Weight to Overweight. Analysts currently set the average one-year price target for Sempra – Corporate Bond at $24.39/share, with estimates varying from a low of $22.03 to a high of $27.49. This target suggests a potential increase of 4.24% from the latest closing price of $23.40/share.

Projected Revenue Growth

Sempra – Corporate Bond is expected to generate an annual revenue of $15,192 million, reflecting a significant increase of 17.60%. The projected non-GAAP earnings per share (EPS) stands at 9.79.

Fund Sentiment Analysis

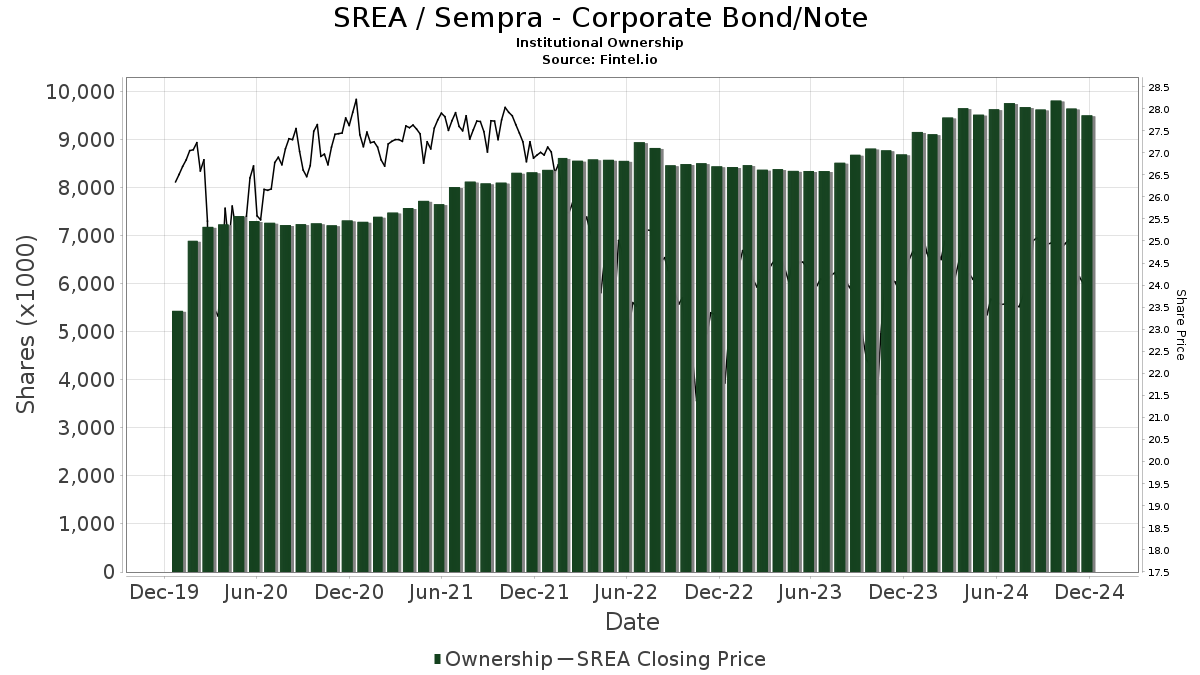

Currently, 30 funds and institutions hold positions in Sempra – Corporate Bond, with the number unchanged from the previous quarter. The average portfolio weight of these funds in SREA has risen by 10.81% to 0.55%. However, the total shares owned by institutions dropped by 1.26% over the last three months, totaling 9,501K shares.

Institutional Shareholding Activities

PFF – iShares Preferred and Income Securities ETF holds 2,890K shares, down from 2,895K in its previous filing, indicating a decrease of 0.19%. Their allocation in SREA declined by 2.32% over the last quarter.

PFXF – VanEck Vectors Preferred Securities ex Financials ETF has 1,230K shares, a slight reduction from 1,231K, showing a decrease of 0.05%. This firm scaled back its SREA allocation by 7.11%.

PGX – Invesco Preferred ETF reported holdings of 1,214K shares, down from 1,245K, reflecting a drop of 2.58%. They, however, increased their allocation in SREA by 2.30% in the last quarter.

FPE – First Trust Preferred Securities and Income ETF increased its holdings to 909K shares, up from 866K, an increase of 4.70%. Their SREA allocation rose by 0.48% over the same period.

PFFD – Global X U.S. Preferred ETF owns 607K shares, a decrease from 613K shares, reflecting a decline of 0.98%. Nevertheless, they increased their portfolio allocation in SREA by 2.82% over the last quarter.

Fintel serves as a comprehensive research platform for investors, traders, and financial advisors, offering insights on market fundamentals, ownership data, analyst reports, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.