Biogen Faces Downgrade from Morgan Stanley: Analyst Predictions Remain Optimistic

On October 31, 2024, Morgan Stanley lowered its outlook for Biogen (XTRA:IDP) from Overweight to Equal-Weight.

Analyst Price Forecast Indicates Significant Potential Upside

As of October 22, 2024, Biogen’s average one-year price target stands at 247.45 €/share. These estimates range from a low of 177.31 € to a high of 331.79 €. This average price target reflects a potential increase of 47.38% from its most recent closing price of 167.90 €/share.

Annual Revenue and Earnings Expectations

The anticipated annual revenue for Biogen is projected at 9,573 million €, marking a slight decline of 0.36%. Moreover, the expected annual non-GAAP earnings per share (EPS) is 16.74.

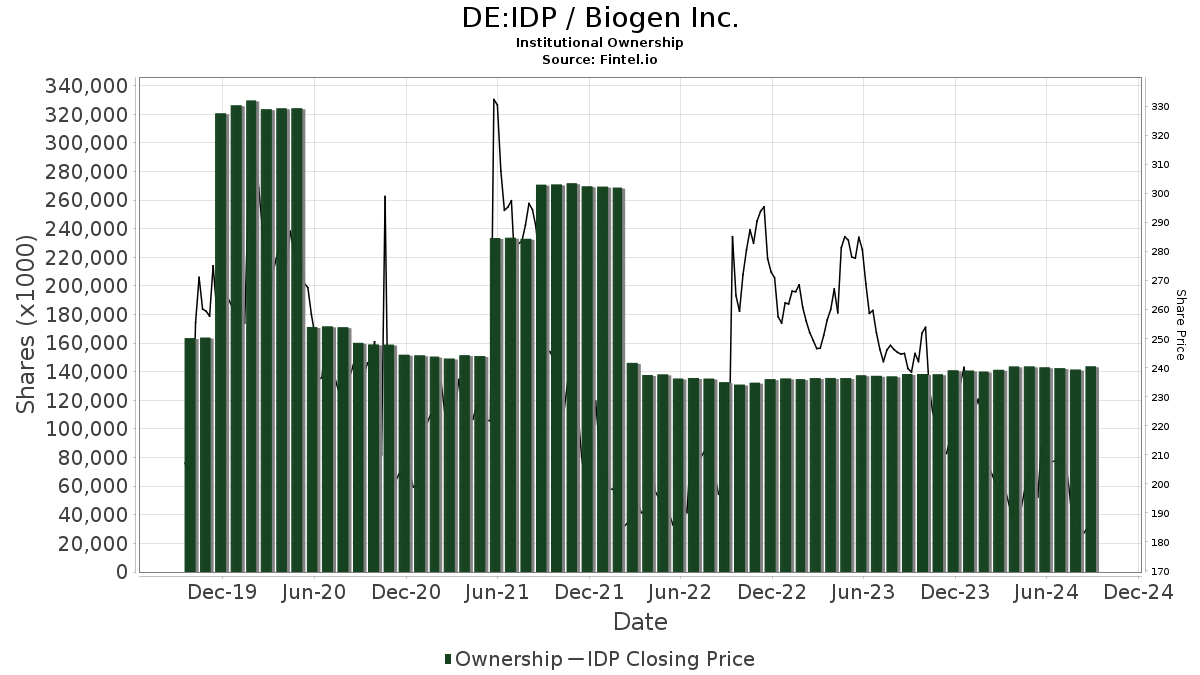

Changes in Fund Sentiment

Currently, 1,775 funds or institutions report holdings in Biogen, representing a decline of 56 owners or 3.06% from the previous quarter. The average portfolio weight of all funds dedicated to IDP is 0.25%, which has increased by 1.26%. Additionally, the total shares owned by institutions rose by 2.57% over the last three months to reach 143,295K shares.

Actions of Major Shareholders

Primecap Management owns 16,338K shares, equating to 11.22% of the company. Their previous report indicated ownership of 16,221K shares, representing an increase of 0.72%. The firm’s allocation to IDP rose by 5.11% over the last quarter.

The Vanguard PRIMECAP Fund Investor Shares (VPMCX) holds 9,155K shares, corresponding to 6.29% ownership. This is a slight increase from the previous 9,154K shares, showing a growth of 0.02%. Their portfolio allocation in IDP expanded by 3.63% in the last quarter.

T. Rowe Price Investment Management holds 5,679K shares, making up 3.90% of the company. This is an increase from 5,170K shares previously reported, reflecting a rise of 8.96%. The firm raised its portfolio allocation in IDP by 21.82% during the last quarter.

Wellington Management Group LLP owns 5,166K shares, which is 3.55% of Biogen. Their previous report indicated ownership of 5,120K shares, showing an increase of 0.90%. The firm’s allocation in IDP has grown by 9.31% recently.

J.P. Morgan Chase has 4,715K shares, equivalent to 3.24% ownership. This is up from the earlier 4,695K shares, indicating an increase of 0.43%. Their portfolio allocation for IDP rose by 4.85% in the last quarter.

Fintel provides a wide range of investing research resources for individual investors, traders, financial advisors, and small hedge funds. The platform covers extensive global data including fundamentals, analyst reports, and fund sentiment.

For more insights, click here.

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.