Morgan Stanley Lifts Nutanix Outlook, Forecasts Significant Growth

On October 28, 2024, Morgan Stanley upgraded Nutanix (NasdaqGS:NTNX) from Equal-Weight to Overweight.

Optimistic Price Projections Indicate 15.46% Upside

The average one-year price target for Nutanix stands at $74.03 per share as of October 22, 2024. Estimates range from a low of $60.60 to a high of $89.25, suggesting a potential increase of 15.46% from the latest closing price of $64.12 per share.

Check out our leaderboard featuring companies with the largest price target upside.

Robust Revenue Expectations

Nutanix is projected to generate annual revenue of $2,444 million, reflecting a growth rate of 13.74%. The anticipated annual non-GAAP earnings per share (EPS) is estimated at 0.70.

Institutional Involvement on the Rise

A total of 974 funds and institutions currently hold positions in Nutanix, marking an increase of 48 owners or 5.18% since last quarter. The average portfolio weight for all funds invested in NTNX is 0.29%, a rise of 6.15%. Over the past three months, institutional ownership increased by 5.66%, totaling 229,860K shares.

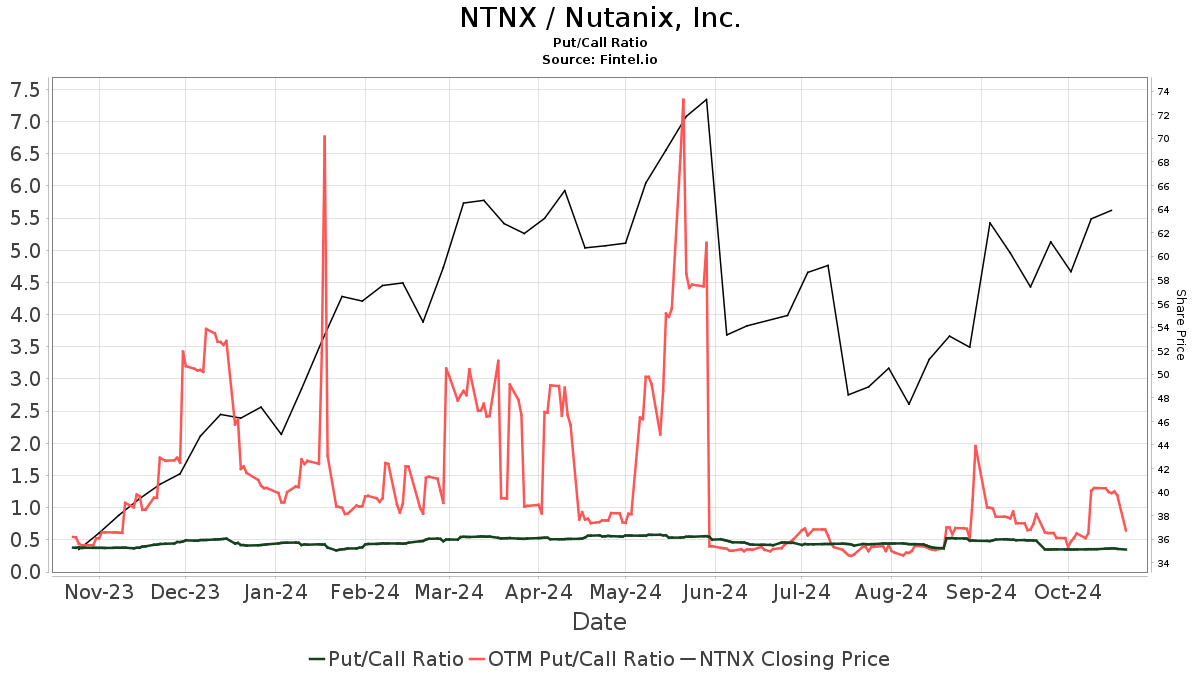

The put/call ratio of 0.38 indicates a bullish sentiment among investors.

Actions by Major Shareholders

FDGRX – Fidelity Growth Company Fund currently holds 12,141K shares, representing 4.53% ownership. This is a slight decrease from the previous 12,234K shares, marking a decline of 0.76%, with a 16.64% reduction in its NTNX portfolio allocation over the last quarter.

Generation Investment Management LLP holds 10,100K shares, or 3.77% ownership. They previously held 12,638K shares, indicating a significant decrease of 25.14% and a 22.38% reduction in allocation.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 7,744K shares, or 2.89% ownership, up from 7,636K shares, showing a modest increase of 1.39%. However, they have reduced their NTNX allocation by 9.17% recently.

NAESX – Vanguard Small-Cap Index Fund Investor Shares has 6,146K shares, or 2.29% ownership, down from 6,192K shares, which is a decrease of 0.74%. Their portfolio allocation in NTNX also saw a decline of 4.09% last quarter.

Champlain Investment Partners holds 5,774K shares, representing 2.16% ownership, up from 4,211K shares, reflecting a notable increase of 27.07%, and a 35.24% rise in their portfolio allocation.

Nutanix Overview

(This description is provided by the company.)

Nutanix is a leader in cloud software and hyperconverged infrastructure, allowing organizations to seamlessly manage applications across private, hybrid, and multi-cloud environments.

Fintel offers a comprehensive investment research platform, providing data on fundamentals, analyst reports, fund sentiment, and much more to individual investors and small hedge funds.

Click to learn more on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.