Morgan Stanley Boosts Sempra’s Outlook to Overweight

On December 13, 2024, Morgan Stanley raised its rating for Sempra (WBAG:SREN) from Equal-Weight to Overweight.

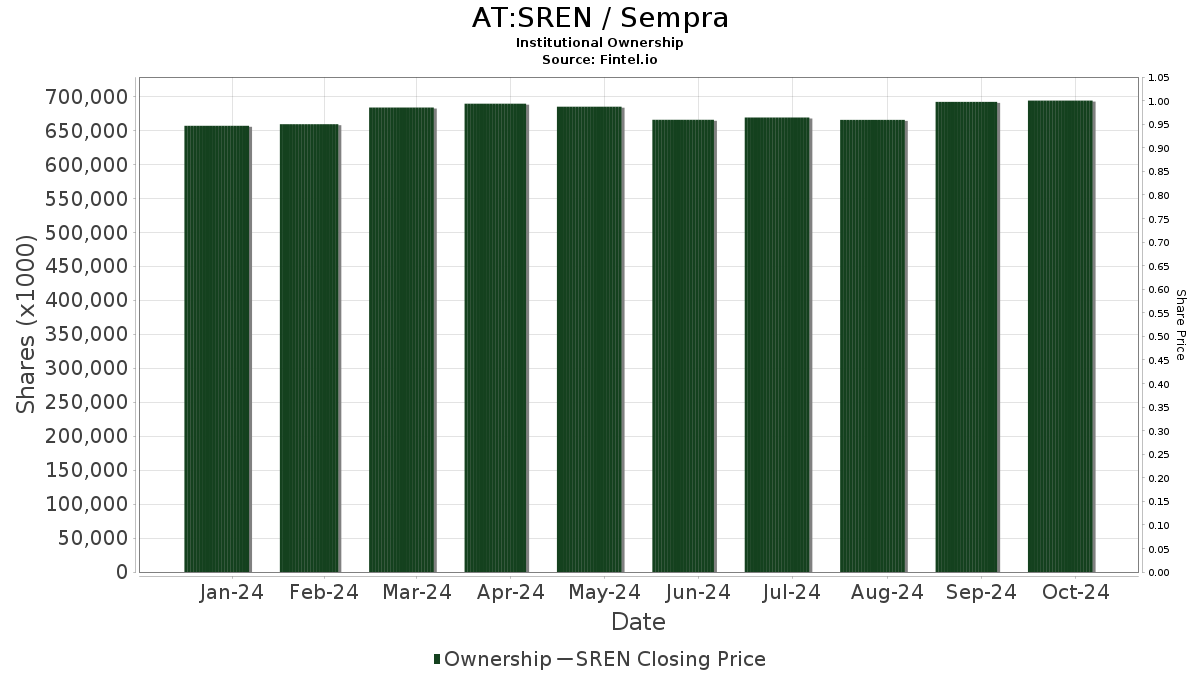

Institutional Interest in Sempra Grows

Currently, 1,922 funds or institutions hold positions in Sempra, reflecting an increase of 77 owners, or 4.17%, in the past quarter. The average portfolio weight in Seren across all funds stands at 0.11%, a rise of 74.22%. However, total institutional shares declined by 0.89% to 700,353K shares over the last three months.

Changes in Holdings Among Major Shareholders

Capital International Investors currently holds 49,871K shares, equating to a 7.87% ownership stake, down from 54,094K shares previously, indicating an 8.47% decrease. Their allocation in SREN dropped by 5.49% last quarter.

Wellington Management Group LLP owns 34,325K shares, which represents 5.42% ownership. Last quarter, their shares totaled 34,196K, a slight 0.38% increase, despite an 84.82% reduction in total allocation to SREN.

The Vanguard Total Stock Market Index Fund (VTSMX) has 20,062K shares, representing 3.17% ownership. Previously, they owned 19,995K shares, reflecting a 0.33% increase. Their allocation to SREN grew by 3.62% last quarter.

Washington Mutual Investors Fund (AWSHX) holds 19,240K shares for a 3.04% stake. The firm reported marginally less at 19,247K shares last quarter, marking a 0.03% decrease. Nonetheless, they increased their portfolio allocation in SREN by 4.35% last quarter.

The Vanguard 500 Index Fund (VFINX) owns 16,582K shares, accounting for 2.62% of ownership. Previously, they had 16,243K shares, showing a 2.05% increase. Their allocation to SREN also increased by 3.30% over the last quarter.

Fintel serves as a key research platform for individual investors, traders, financial advisors, and small hedge funds, providing comprehensive data on market fundamentals, ownership, and more.

For detailed insights and exclusive stock picks backed by advanced quantitative models, click to learn more.

This article was originally published by Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.