Morgan Stanley’s Positive Outlook

On September 30, 2024, financial giant Morgan Stanley made waves by upgrading their stance on U.S. Bancorp – Preferred Stock (NYSE:USB.PRP) from ‘Equal-Weight’ to ‘Overweight’. This notable shift signifies a newfound confidence in the potential of USB.PRP in the current market landscape.

Fund Sentiment Analysis

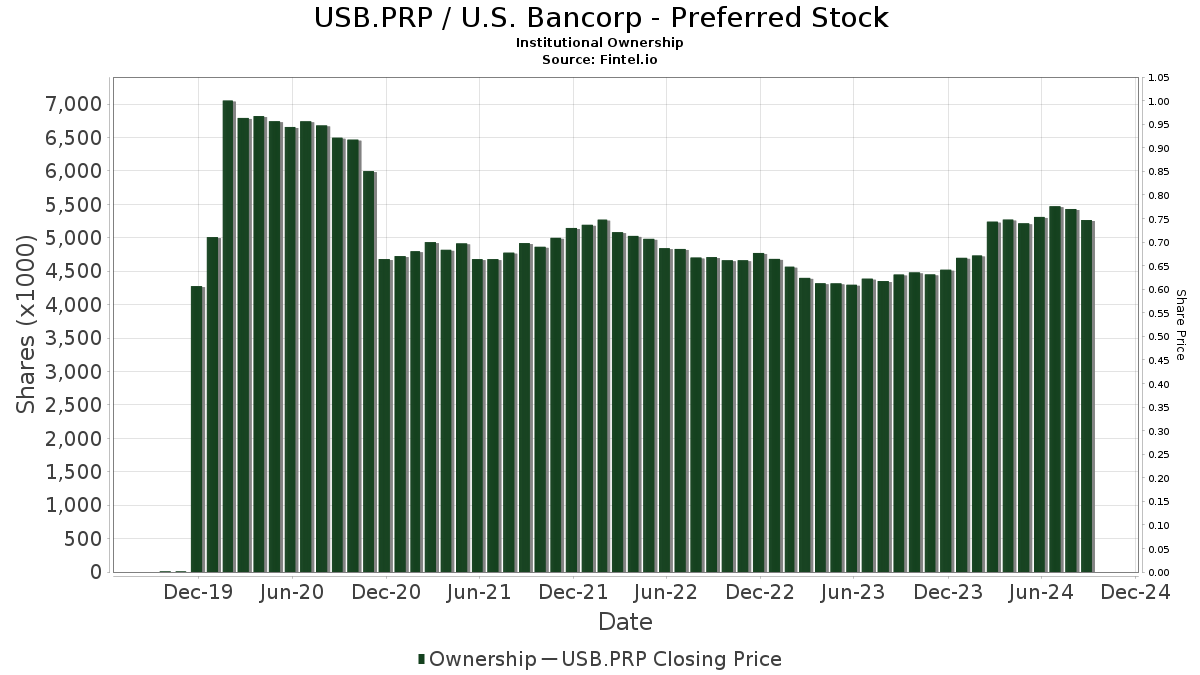

Analyzing the fund sentiment surrounding U.S. Bancorp – Preferred Stock reveals intriguing patterns. Currently, there are 21 funds or institutions holding positions in USB.PRP. Interestingly, this marks a slight decline of 1 owner(s) or 4.55% over the past quarter. Despite this decrease in ownership, the average portfolio weight dedicated to USB.PRP has seen a notable uptick, increasing by 2.56%. Total institutional shares in USB.PRP have slightly decreased by 4.23% in the last three months, totaling 5,245K shares.

Shifting Shareholder Actions

Delving deeper into the shareholder landscape, we observe notable movements by prominent entities. PFF – iShares Preferred and Income Securities ETF, for instance, have slightly reduced their holdings in USB.PRP from 2,236K shares to 2,186K shares, marking a decrease of 2.29%. Similarly, PGX – Invesco Preferred ETF and PFFD – Global X U.S. Preferred ETF have also experienced reductions in their portfolio allocations in USB.PRP over the last quarter.

Alternatively, PGF – Invesco Financial Preferred ETF has bucked the trend by increasing its portfolio allocation in USB.PRP by 1.51% over the same period. These fluctuations in shareholder actions provide a dynamic glimpse into the evolving perceptions of U.S. Bancorp – Preferred Stock within the investment community.

Fintel’s Financial Insights

Fintel, a leading platform for investing research, offers a wealth of data and analysis for investors, financial advisors, and hedge funds. Their comprehensive coverage spans fundamentals, analyst reports, ownership data, fund sentiment, and more. Additionally, bespoke stock picks powered by advanced quantitative models aim to enhance profitability for users.

For those seeking in-depth financial analysis and exclusive insights, Fintel stands out as a valuable resource in the competitive investing landscape.