The State of Affairs

In an exhaustive evaluation of Morgan Stanley (NYSE:MS), a compelling case emerges: it’s treading shakily close to being tagged as a “sell.” The reason is twofold, as highlighted in two valuation models. The first model forecasts a fair share price of $66.83, indicating a daunting 28.5% downside from the current stock price of $93.4. On the flip side, the second model, a tad more optimistic, puts forth a fair price per share at $120.91, signaling a 29.5% upside from the present stock price. However, the glass-half-empty perspective reveals a lackluster annual return, pegged at a meager 7.9% throughout 2028.

The analysis necessarily leads to a “hold” rating. It’s clear that Morgan Stanley is at risk of trailing behind financial heavyweights such as Goldman Sachs Group, Inc. (GS), and retail banking titans like JPMorgan Chase & Co. (JPM), Bank of America Corporation (BAC), and Wells Fargo & Co. (WFC), all of which offer more promising prospects. The comparative article, “JPMorgan vs Bank of America vs Wells Fargo,” serves as an eye-opener, indicating that even Wells Fargo fares better than Morgan Stanley.

The Business Canvas

A Closer Look

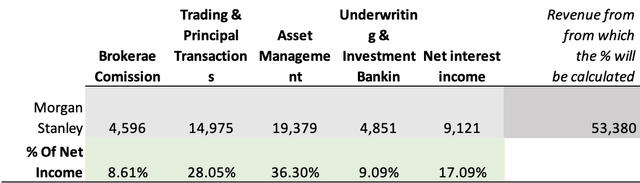

Morgan Stanley’s revenue outline is heavily reliant on trading operations, accounting for 28.05% of its revenues, and asset management, with a significant share of 36.30%. Both these segments are susceptible to market fluctuations, rendering Morgan Stanley’s stock inherently volatile. The institution earns interest primarily through stock-based loans and residential mortgages, showcasing a distinct modus operandi compared to peers in the financial sector.

Market Musings

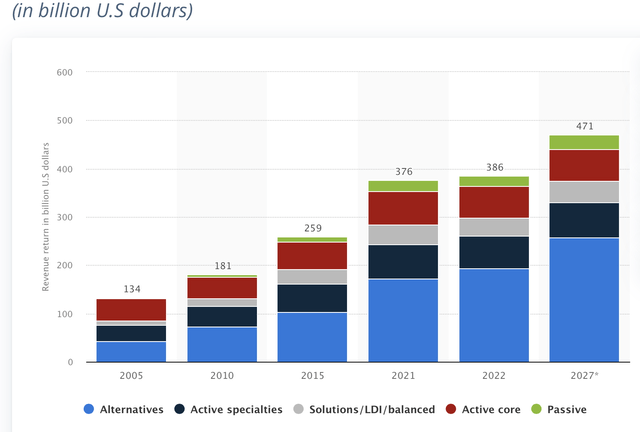

The global investment banking revenue is projected to exhibit a modest growth rate of 1.40% during 2023-2028. This somewhat lackluster performance can be attributed to the financial industry’s maturity and minimal differentiation factors. In contrast, worldwide asset management is set for a more respectable growth at 4.40% from 2022 to 2027. The standout segment seems to be global wealth management, with a projected robust revenue growth of 5.90% from 2024 to 2027, far outstripping the slower-moving traditional and investment banking sectors.

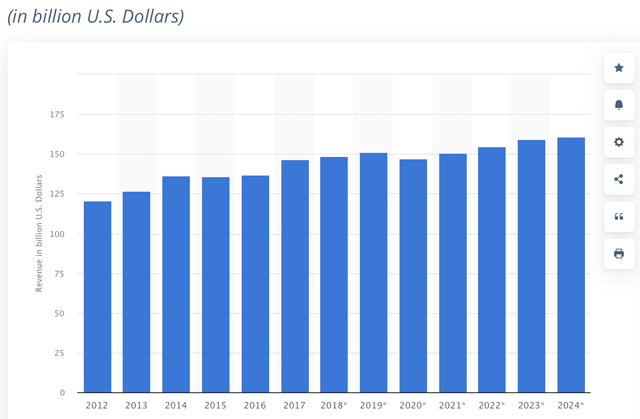

The US securities brokerage market is anticipated to hit a revenue of $160.84 billion in 2024, signifying a 2.8% growth from the 2012 figure of $120.38 billion.

Visualizing the Financial Landscape

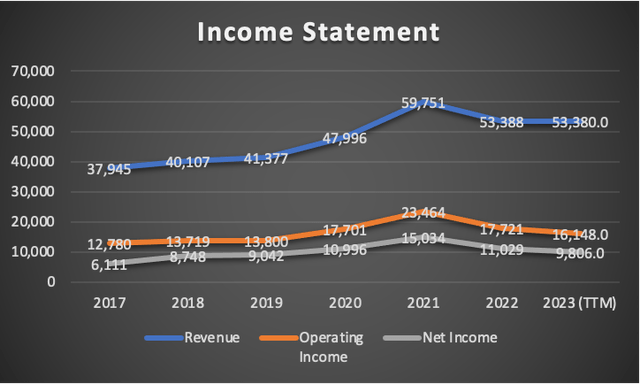

From 2017 to 2023 TTM, Morgan Stanley showcased commendable performance metrics, including a robust 6.8% revenue growth rate, a 4.4% surge in operating income, and a 10.1% escalation in net income. The institution also maintained solid operating and net income margins at 30.25% and 18.37% respectively.

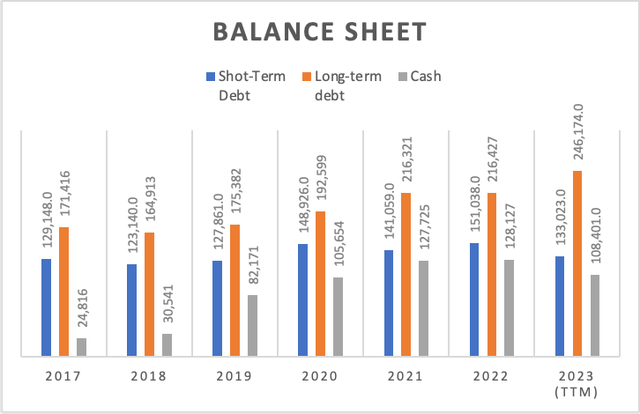

Morgan Stanley’s financial structure reflects a conservative approach to debt, with an annual growth rate of 4.4%, primarily driven by a 7.3% uptick in long-term debt. Simultaneously, the institution bolstered its cash reserves by an impressive 56.1% annually, offsetting the surge in its debt levels. However, the free cash flow remains problematic, standing at a disconcerting -$35.58 billion, with an average negative free cash flow margin of -5.4% over the period.

Morgan Stanley Valuation Analysis

Morgan Stanley, a pivotal player in the financial realm, has recently come under the microscope for an in-depth valuation analysis. Let’s delve into the nitty-gritty of its financial standing, projections, and stock value estimations.

Valuation Models

The valuation process for Morgan Stanley begins with the implementation of two distinct residual earnings models. These models meticulously assess the net operating assets and book value, providing a comprehensive basis for the valuation.

Through meticulous calculation, the operating assets are computed, followed by the determination of the book value, facilitating an intricate and precise valuation process.

Residual Earnings Model

Subsequently, a Capital Asset Pricing Model (CAPM) takes center stage, derived from beta, the risk-free rate, and the average market return. This meticulous approach provides an extensive and accurate assessment of Morgan Stanley’s valuation.

Analysts’ Estimates

In this comprehensive analysis, analysts’ estimates play a pivotal role. The projections for revenue and net income serve as vital components in ascertaining Morgan Stanley’s fair price per share and future stock value.

Furthermore, the extension of revenue and operating income projections beyond 2024 incorporates a forward revenue growth rate and a 3-5 year long-term EPS growth rate, enriching the depth of the valuation assessment.

Fair Price Estimations

It is evident from the available estimates that Morgan Stanley’s fair price per share is set at $66.83, indicating a -28.5% downside from the current stock price of $93.4. However, the model suggests a future price per share of $130.52, projecting a promising trajectory for the stock value.

Unlocking Morgan Stanley’s Future: A Tale of Growth and Risks

Forecasting the future of a leading investment bank like Morgan Stanley is akin to predicting the weather during a tempest. The tempest of competition, economic storms, and market volatility swirls and shifts, challenging even the most astute analysts.

Estimates and Projections

Peering through the crystal ball of market revenue growth projections, it becomes evident that Morgan Stanley stands to ride the wave of growth, albeit with caution. The estimates indicate a steady return of 7.9% throughout 2028, a figure that may appear promising to some, but hides the tumultuous nature of the investment banking sector.

The operating income margin for the period 2023-2028 will be fixed at the average recorded from 2017 to 2023 TTM, standing at 34.40%, grounding these projections firmly in historical context.

The challenge arises in predicting trading revenue, notorious for its capriciousness. Analyzing historical data from 2009 to 2022 reveals a steady annual growth rate of 7.14%, a trend expected to continue shaping the landscape of trading revenue for the coming years.

Revenue Dynamics and Valuation Models

An insightful comparison of revenue dynamics over the forecast period sheds light on the potential trajectory of Morgan Stanley. The model suggests a fair price per share of $120.91, indicating a 29.5% upside from the current stock price of $93.4. As per the model, by 2028, the stock should be priced at $230.49, translating into annual returns of 29.4% – a tantalizing prospect for investors seeking robust growth.

Navigating Risks

The primary risk associated with Morgan Stanley lies in the limited differentiation within the industry, compounding the inherent volatility of investment banking and trading activities. Success hinges on the management’s strategic decisions and its ability to attract new clients, as the key asset for Morgan Stanley, like its peers, is concentrated in talent, providing a potential differentiator.

Furthermore, in a market characterized by minimal growth, companies may be tempted to explore new ventures. Morgan Stanley, in contrast, has maintained a conservative approach, avoiding the pitfalls of unwise risk management. However, the increase in debt by an annual rate of 4.4% from 2017 to 2023 cannot be overlooked. The industry’s reliance on talent further compounds the challenge, requiring competitiveness in salaries and bonuses, potentially increasing costs in what is already considered a low-growth sector.

In Conclusion

Upon comprehensive analysis and financial modeling, two distinct valuation models have been employed to appraise the potential of Morgan Stanley.

The first model, anchored in analysts’ estimates, foresees a fair price per share of $66.83, indicating a -28.5% downside from the current stock price of $93.4, with annual returns of 7.9% throughout 2028.

The second model, adopting market revenue growth projections, suggests a fair price per share of $120.91. This indicates a substantial 29.5% upside from the current stock price, coupled with annual returns of 29.4% through 2028, presenting investors with an enticing prospect of growth.

Considering these projections, cautiously navigating the pitfalls and potential inherent in investing in Morgan Stanley merits a prudent “hold.””

Among its peers, Goldman Sachs and the retail banking giants, even Wells Fargo, reportedly surpass Morgan Stanley, raising pertinent questions for investors as they weigh the options within the investment banking space.