“`html

Key Points

-

Motley Fool CEO Tom Gardner emphasizes that investors often make the mistake of selling winning stocks too soon.

-

Long-term investing is a cornerstone of The Motley Fool’s strategy.

-

Potential loss from selling early can eclipse any short-term gains from losing investments.

In an interview, CEO Tom Gardner of The Motley Fool identified the premature sale of winning investments as the most critical mistake investors make. He noted that failing to hold onto winners, such as investing $10,000 in Starbucks (NASDAQ: SBUX), could result in significant lost opportunities, potentially transforming that investment into $500,000 over time.

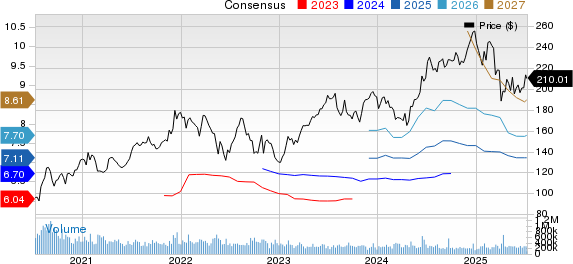

Gardner underscored that some of the biggest market successes, like Nvidia (NASDAQ: NVDA), had periods of stagnation. For instance, Nvidia saw just a 12% gain from 2010 to 2014, yet has soared by 33,000% since then.

Learning from his experience, an investor reflected on the costly decision to sell shares of Tesla (NASDAQ: TSLA) too early, which would be worth around $438,000 today from a $2,300 investment, demonstrating the importance of letting investments grow over time.

“`