Motorola Solutions (MSI) Announces Steady Dividend Payout

Motorola Solutions announced on February 21, 2024, that its board of directors has declared a regular quarterly dividend of $0.98 per share ($3.92 annualized), maintaining the same payout as before.

To qualify for the dividend, shares must be acquired before the ex-dividend date on March 14, 2024, with shareholders of record by March 15, 2024, receiving payment on April 15, 2024.

Historical Context and Average Dividend Yield

Reflecting on the past five years of data, the average dividend yield for Motorola Solutions has stood at 1.41%, with a range between 1.10% and 2.06%. The current yield of 1.19% sits 1.09 standard deviations below the historical average, hinting at a deviation from the norm.

The company’s dividend payout ratio of 38% indicates a sustainable dividend policy, with a 3-year dividend growth rate of 0.38%, showcasing a consistent commitment to rewarding shareholders over time.

Fund Sentiment and Analyst Price Forecast

With 1970 funds or institutions reporting positions in Motorola Solutions, a surge of 79 owners in the last quarter indicates a 4.18% uptick. The average portfolio weight dedicated to MSI dipped by 1.55%, holding at 0.34%.

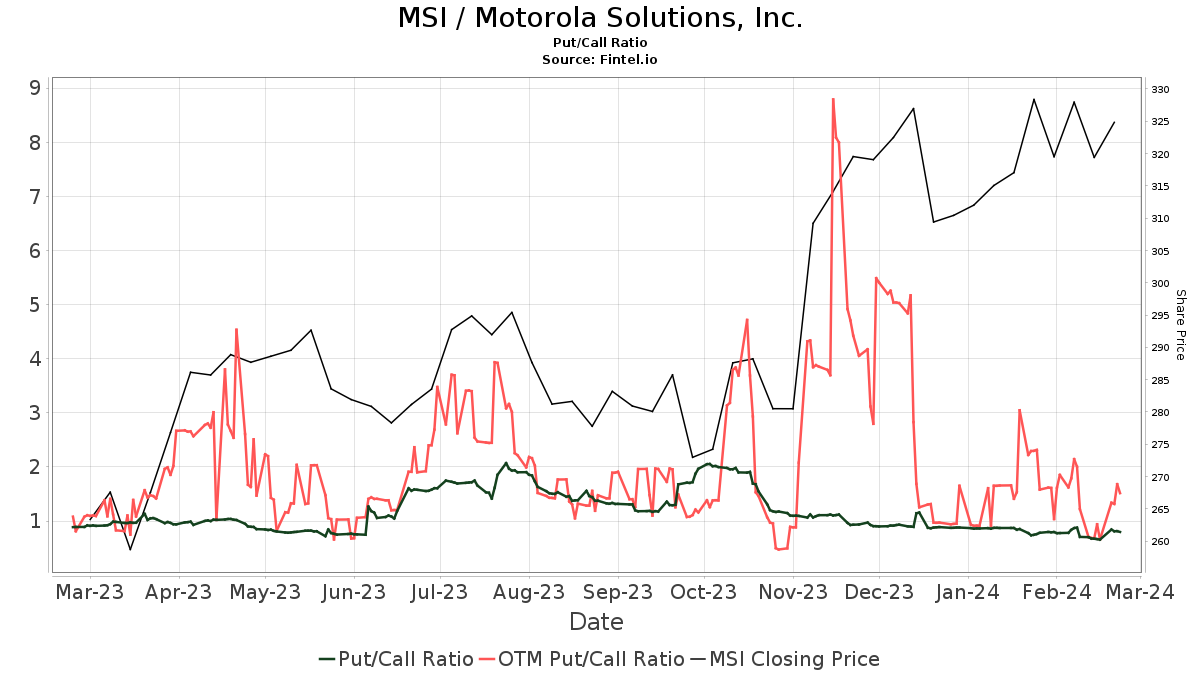

Analysts foresee an 11.81% upside potential, with a one-year price target of $367.51, ranging from $338.35 to $393.75. Additionally, the put/call ratio of 0.81 paints a bullish picture for the company’s future.

Shareholder Activity and Institutional Ownership

Capital World Investors, with a 7.33% ownership stake in Motorola Solutions, increased its allocation by 3.63% in the last quarter. Vanguard Total Stock Market Index Fund Investor Shares and Vanguard 500 Index Fund Investor Shares also saw shifts in their portfolio allocation, with Vanguard Mid-Cap Index Fund Investor Shares and GROWTH FUND OF AMERICA experiencing changes as well.

Motorola Solutions: A Beacon of Innovation and Security

As a global leader in mission-critical communications and analytics, Motorola Solutions plays a pivotal role in enhancing public safety and security through its cutting-edge technologies. The company’s focus on land mobile radio communication, command center software, and video security solutions underscores its commitment to making cities safer and businesses more resilient.

Conclusion

Amidst the fluctuating tides of the market, Motorola Solutions’ unwavering dividend policy and innovative solutions shine bright, reassuring investors of stability and growth potential in uncertain times.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.