“`html

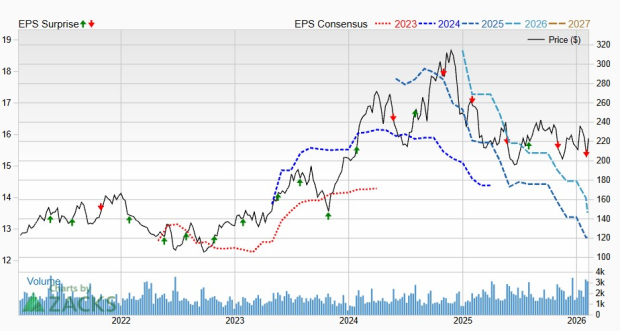

MP Materials Corp. has reported operating losses and negative margins for eight consecutive quarters, primarily due to rising costs. In 2024, the company’s cost of sales nearly doubled to $192.6 million from $92.7 million in 2023, amounting to 94% of revenues compared to just 37% in 2023. The first half of 2025 saw a 29% increase in the cost of sales year-over-year.

The increase in expenses stems from ramping up the production of separated rare earth products at its Mountain Pass site and magnetic precursor products at the Independence Facility, which are more cost-intensive to produce. Selling, general, and administrative (SG&A) expenses rose by 5% in 2024, with a 21% increase noted in the first half of 2025 as the company expanded its workforce to support this growth.

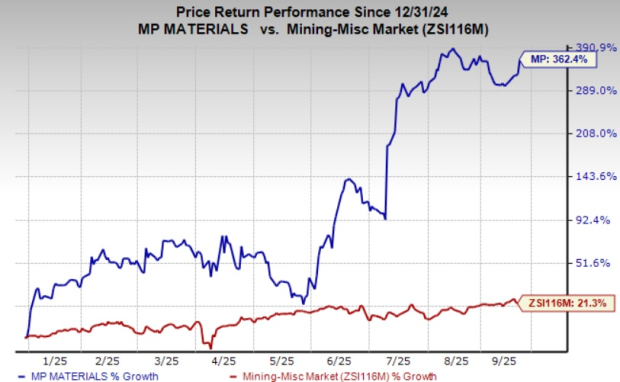

Despite the loss of $34 cents per share forecasted for 2025, MP Materials’ stock has surged 362.4% this year, outperforming the industry growth of 21.3%. The Zacks Consensus Estimate expects a rebound, projecting earnings of 91 cents per share in 2026, indicating potential improvement.

“`