Attempting to constantly outwit the market is an arduous task and frankly not on my to-do list. It involves perpetual trading in and out of stocks to capture value, while also navigating the complex web of tax implications. I’d rather stick to a different strategy; buying and holding quality dividend payers that generate a consistent income stream, mirroring solid returns against the market average, all while cashing in.

This brings me to MPLX LP (NYSE:MPLX), which I last covered here with a ‘Buy’ rating back in May of last year, citing robust operational fundamentals in its business segments as well as external growth opportunities.

While the stock price has only increased by 5% since my last piece, MPLX has returned a solid 13% overall when considering the distribution, just falling short of the 15% rise in the S&P 500 (SPY) during the same period. In this article, I revisit the stock and discuss why MPLX continues to be an appealing income stock for potentially strong investor returns from here.

(Note: MPLX issues a Schedule K-1)

The Secret of MPLX’s Allure

MPLX is a grand, diversified master limited partnership that possesses vital midstream energy infrastructure and logistics assets. Unlike Enterprise Products Partners (EPD), which is based in Texas, MPLX primarily operates in the Appalachia region of the U.S., owning pipelines, terminals, storage caverns, and NGL processing and fractionation facilities.

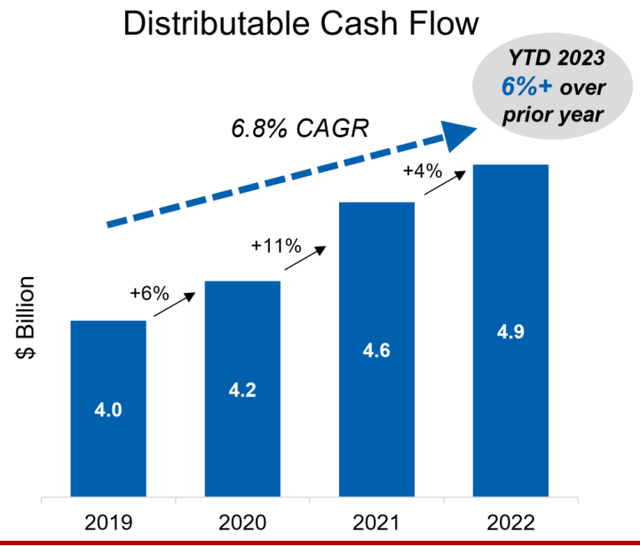

Most investors flock to MLPs like MPLX for their stable and expanding cash flows, and the company has not wavered in that aspect. MPLX has evidenced growth in distributable cash flow every year since 2019, even during the tumultuous onset of the pandemic in 2020. MPLX’s DCF has grown at a nearly 7% CAGR in the 2019-2022 timeframe.

This upward trend persisted in the third quarter of 2023, where both adjusted EBITDA and distributable cash flow surged to record levels with 8.5% and 8.6% YoY growth, respectively. This was fueled by increased pipeline throughput (2% volume growth) as well as higher gathered, processed, and fractionated natural gas volumes, each growing in the 3% to 9% range on a YoY basis during Q3. Encouragingly, this builds on a strong trend in 2023, as the DCF for the first nine months grew by 6% compared to the same period the prior year.

Looking ahead to Q4 results and beyond, MPLX is poised to sustain its recent growth momentum, having deployed $800 million of growth capital in 2023. This includes capital projects such as its joint venture natural gas, crude, and NGL pipeline projects in the prolific Permian basin, as well as the recently completed Whistler expansion to a throughput of 2.5 Bcf/day to meet strong demand for this natural gas pipeline.

Furthermore, management anticipates crude oil volumes on the Wink to Webster pipeline to ramp up over the next two years, with NGL expected to be a growth driver as well. This is bolstered by the BANGL expansion project, a joint venture that transports NGL from the Permian Basin to the NGL fractionation hub in Sweeny, Texas. This project would further fortify MPLX’s standing in the Permian Basin by adding capacity to support the movement of 200K barrels per day by the first half of 2025.

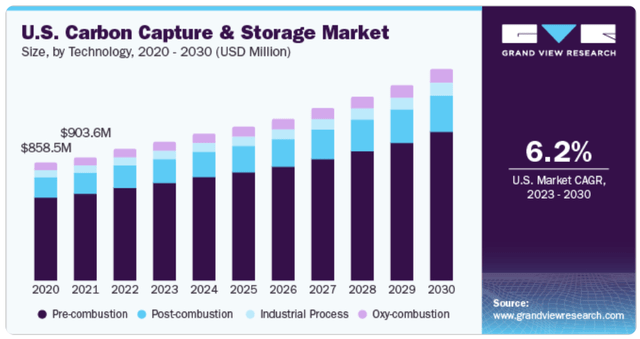

Notably, MPLX is also contributing to the energy transition, as MPLX and its general partner, Marathon Petroleum (MPC), secured funding from the U.S. Department of Energy to construct storage and transportation infrastructure for hydrogen and CO2 as part of a $7 billion overall plan to develop 7 hydrogen hubs (2 of which were awarded to MPC). While this marks an early step for MPLX, the U.S. carbon capture and storage market is projected to grow at a steady 6.2% CAGR from just under $1 billion today to the end of this decade.

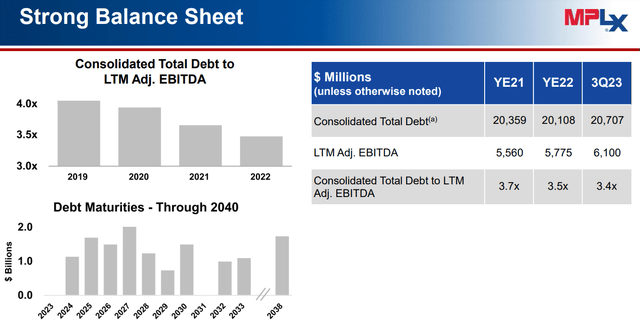

Furthermore, MPLX is buttressed by a sturdy balance sheet with a BBB investment grade credit rating from S&P. It also maintains one of the most conservative leverage ratios in the midstream sector, with a net debt to EBITDA ratio of 3.4x. MPLX has consistently slashed its leverage ratio since 2019 from the 4.0x level and has well-laddered maturities in the future, as evidenced below.

Crucially for income investors, MPLX currently offers an enticing 9.2% yield, and the DCF-to-Distribution coverage ratio remains steady at 1.6x compared to 2022 even after a 10% hike in the distribution.

Risks to MPLX may include commodity price volatility, although this is mitigated for MPLX given that the majority of its cash flows are contracted and/or fee-based. Additionally, a slowdown in the U.S. and global macroeconomic environment could dampen demand and consequently impact NGL demand, applying pressure on MPLX’s recent EBITDA growth.

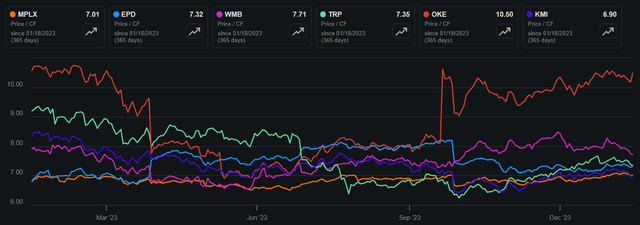

Taking all of the above into account, I still perceive value in MPLX at the current price of $36.93, with a Price-To-Cashflow of just 7.0x. As illustrated below, MPLX’s valuation remains below that of natural gas-focused peers EPD, Williams Companies (WMB), TC Energy (TRP), and ONEOK (OKE), while slightly above that of Kinder Morgan (KMI). At the current 9.2% distribution yield, MPLX could yield returns that outperform the market, even with a low single-digit DCF/share growth rate going forward, a milestone that I believe MPLX can surpass.

Key Takeaway for Investors

In summary, MPLX remains an attractive income stock for investors seeking a reliable and burgeoning cash flow in the midstream energy sector. The company’s robust financial position and growth prospects in both the traditional energy and energy transition space make it a compelling choice for long-term distribution income potential. With a valuation that lags behind most of its counterparts and an attractive +9% yield, I maintain a ‘Buy’ rating on MPLX for potentially robust returns for income investors.