“`html

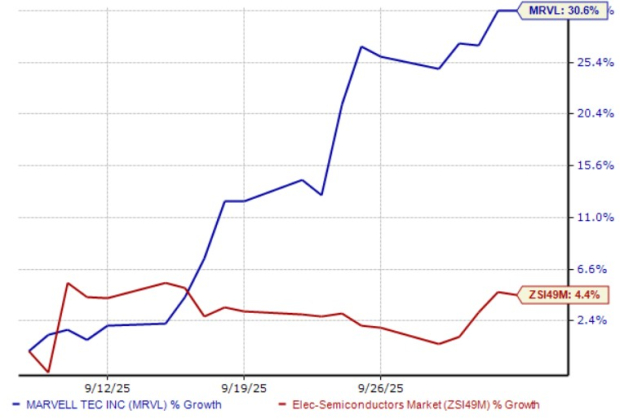

Marvell Technology (MRVL) has seen a share price increase of 30.6% over the past month, significantly outperforming the Zacks Electronics – Semiconductors industry’s gain of 4.4%. This surge raises questions about whether investors should hold or sell their shares.

In the second quarter of fiscal 2026, Marvell reported a 69.2% year-over-year increase in data center revenue, amounting to $1.49 billion. This growth is attributed to rising demand for custom AI silicon chips, electro-optics solutions, and advancements in their 200G per lane 1.6T PAM4 DSPs and 2nm custom SRAM. Marvell’s enhanced collaboration with Microsoft Azure aims to further strengthen its positioning in the AI infrastructure market.

Despite robust growth, Marvell faces stiff competition from industry giants like Broadcom, Advanced Micro Devices, and Micron Technology, which are also investing heavily in AI and memory solutions. Currently, Marvell holds a Zacks Rank #3 (Hold), with a forward price-to-sales ratio of 8.25X, surpassing the industry’s average of 3.77X, raising concerns over its valuation amidst heightened competition.

“`