“`html

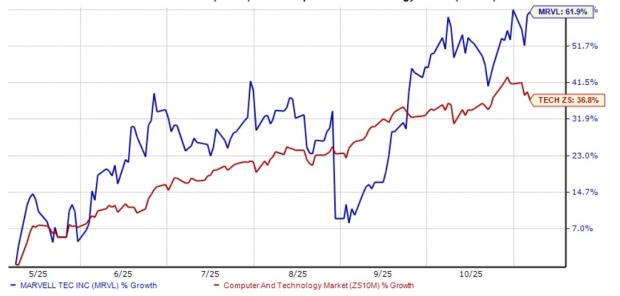

Marvell Technology (MRVL) has seen its shares rise 61.9% over the past six months, significantly outperforming the Zacks Computer and Technology sector, which grew by 36.8%. As of the second quarter of fiscal 2026, Marvell’s data center segment reported a 69.2% year-over-year growth, reaching $1.49 billion.

Key growth factors include the demand for custom XPUs and advanced interconnect products, driven by increasing AI applications in hyperscale and enterprise environments. However, Marvell faces challenges from competitive players like Broadcom and Advanced Micro Devices (AMD), as margin pressures grow in the sector.

Currently, Marvell’s stock is valued at a forward price-to-sales ratio of 8.88X, exceeding the industry average of 6.84X. Analysts suggest investors should hold the stock due to its strong long-term fundamentals but remain cautious due to overvaluation and competitive pressures.

“`