The Enigma of Max Pain

Microsoft (MSFT) is reaching for the stars with its steady uptrend, flirting with resistance at the 52-week zenith. But could storm clouds be gathering on the horizon?

The options market whispers a foreboding tale – a possible retreat to the realm of 410 could be in the cards for the tech titan in the upcoming week.

As investors gaze into the crystal ball of the Max Pain theory, a cryptic concept I recently dissected on Barchart, they see a prophecy unfolding – a prophecy that foretells a gravitational pull of stock prices towards the point where the largest sum of options, in dollar value, are destined to meet their demise, expiring worthless in the shadows of financial warfare.

Lurking behind this theory are the behemoths of finance, the institutional players, masters of the options game, positioned to reap the spoils as options wither away into nothingness, their value dwindling to the abyss.

With Barchart Excel as our trusted oracle, we unveil the Max Pain level – a mystic number, a harbinger of potential turmoil and upheaval.

Decoding the Oracle: Unveiling 410

Within the sanctum of our Excel database, a dance of calculations reveals the notional value of all lingering puts and calls – a labyrinth of financial intrigue.

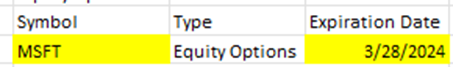

And there, shimmering in the data like a mirage in the desert, lies the magic number – 410, the elusive Max Pain level for MSFT on the fateful March 28th.

The Art of Strategic Response

Armed with this knowledge, what’s a savvy trader to do? Could the Max Pain prophecy materialize?

One strategy emerges from the fog – a butterfly spread perched at the 410 strike, a symphony of puts and calls orchestrated to harness the predicted turbulence, to ride the waves of uncertainty.

Let’s delve into the intricacies of this trade craft – a delicate balance of risk and reward that could either soar to heights of success or plummet into the abyss of loss.

Delving Into the Butterfly Spread Mechanics

The butterfly spread, an artful dance of financial instruments, weaves a tale of risk and return, of delicate precision in the world of speculative ventures.

With the March 28th expiry looming on the horizon, the stage is set – buying the $400 strike put, selling two of the $410 strike puts, and acquiring one $420 strike put, all harmonizing in a net debit orchestration.

The costs? A mere $190, the threshold of potential loss. But the winds of profit whisper of gains up to $810, a tempting melody for the risk-embracing trader.

The lower breakeven whispers at $401.90, while the upper counterpart beckons at $418.10, intricately entwined in the delicate web of options dynamics.

Microsoft’s Magnitude Unveiled

Zooming out from the battlefield of options, the grand canvas of Microsoft unfolds – a tech behemoth reigning supreme over the PC software realm, holding sway over more than 80% of the operating system dominion.

Embraced globally, the Microsoft 365 suite stands as a paragon of productivity software, a companion to millions in the quest for efficiency.

But beyond realms of software, Microsoft strides as a colossus in the cloud domain, offering a plethora of IaaS and PaaS solutions through Azure, a titan among the celestial entities shaping the digital epoch.

From operating systems to gaming consoles, Microsoft’s imprint spans over a myriad of technological realms, a kaleidoscope of innovation and evolution.

The Prelude to Resolution

As the saga of MSFT unfolds, perched delicately on the precipice of 430, a moment of decision looms – a potential retreat would necessitate a strategic reevaluation, a tactical withdrawal.

Remember, the realm of options is a treacherous one, where gains and losses dance a perilous tango – tread with caution, for the depths can be unforgiving.

Ultimately, this tale serves as a beacon of insight, a guidepost in the complex cosmos of financial maneuvers – a reminder to always navigate with prudence, to seek counsel in the stormy seas of investments.

May the winds of fortune whisper wisdom in your ears, guiding your ship through the turbulent waters of speculation.