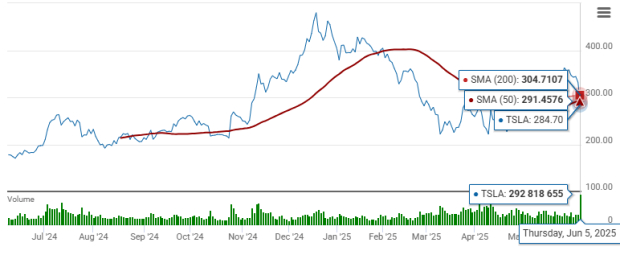

Elon Musk, CEO of Tesla, and former President Donald Trump have publicly feuded over Trump’s proposed “Big and Beautiful” budget bill, which Musk criticized as a “disgusting abomination.” This backlash has led to a sharp decline in Tesla’s stock, which fell 14% in one day, erasing over $150 billion in market value, and a total drop of more than $237 billion over five days. Musk’s claims of Trump’s “ingratitude” and a potential loss of crucial government contracts have heightened tensions.

The fallout has implications for Tesla’s future, particularly as Trump’s budget includes plans to eliminate electric vehicle tax credits that have supported the company amid rising competition from BYD Co Ltd., which recently outsold Tesla in battery EV sales. In May, Tesla sales in China declined 15% year over year, marking the eighth consecutive month of decreases, further complicating the company’s position.

The ongoing conflict may threaten Tesla’s ambitions, including its upcoming robotaxi rollout, especially with Trump potentially poised to cut federal support. With Tesla under scrutiny by the National Highway Traffic Safety Administration due to safety investigations, the company’s stock carries a Zacks Rank #5 (Strong Sell), indicating that the market sentiment is expected to remain volatile.