Current Struggles of the “Magnificent Seven”: Focus on Microsoft

The “Magnificent Seven” refers to Apple, Microsoft (NASDAQ: MSFT), Nvidia, Amazon, Alphabet, Meta Platforms, and Tesla. These companies have significantly impacted the market in recent years. However, recent weeks have not been favorable, as all seven stocks are down year-to-date.

Several factors contribute to their struggles, notably a collective decline triggered by President Donald Trump’s announcement of new tariff regulations.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The decline in the Magnificent Seven is concerning due to their significant influence on numerous major indexes—most notably the S&P 500. Despite this, their decreased prices may offer investors an opportunity to acquire strong companies at more attractive valuations.

Among the companies experiencing a slump, Microsoft presents a compelling case for investment at current price levels. Here’s why.

Impact of New Tariffs on Microsoft’s Business

First, let’s analyze how the new tariffs could impact Microsoft’s operations.

Like other major tech firms, Microsoft depends on imported electronic components and raw materials. This is true for both its consumer electronics and the data centers necessary for its cloud platform, Azure. The company imports critical equipment, servers, and networking devices from countries such as China, South Korea, and Taiwan.

The tariffs are expected to increase the costs of these components, leaving Microsoft with three options: pass the costs onto customers, absorb the extra expenses, or postpone or abandon plans for data center expansions.

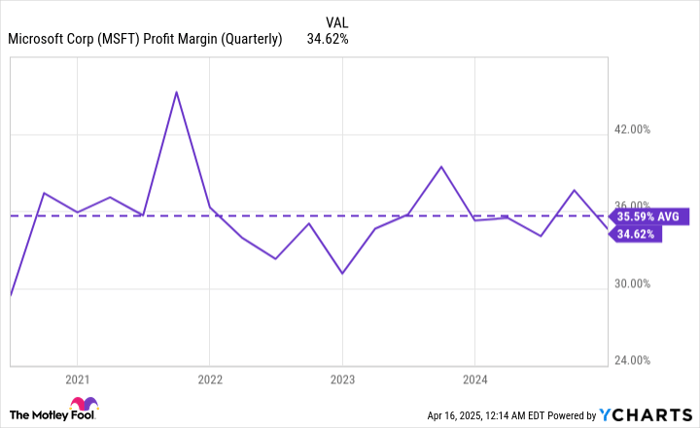

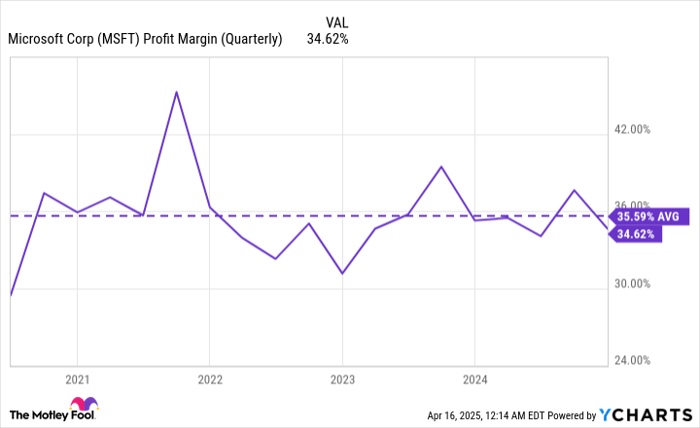

Microsoft had already retrenched from some data center expansion activities in the U.S. and Europe before the tariff announcement, making it plausible that the company may opt for that path again. If it chooses to absorb the higher costs, the company’s profit margins might provide the flexibility to explore the best long-term strategy.

MSFT Profit Margin (Quarterly) data by YCharts

Microsoft Azure: The Growth Engine

The surge in costs tied to data centers is critical, given how essential Azure is for Microsoft’s growth prospects.

In the second quarter of its fiscal year 2025, Microsoft’s Intelligent Cloud segment, which encompasses Azure, reported $25.5 billion in revenue. This marks a 19% increase from the previous year, representing over 36% of Microsoft’s overall revenue.

While Azure ranks second in market share behind Amazon Web Services (AWS), its growth remains remarkable. Although it may not catch AWS in the near future, Azure continues to gain traction, highlighting its competitiveness in the cloud market.

The cloud services industry is still developing and has substantial growth potential as more businesses transition to cloud platforms. As this trend unfolds, Azure is poised to drive Microsoft’s growth further.

Microsoft’s Stability in Economic Downturns

Across decades, Microsoft has diversified into numerous sectors, creating a robust ecosystem in the technology domain. It offers consumer and enterprise electronics, software, cloud services, social media, and gaming.

In challenging economic conditions, it is wise to invest in companies capable of generating stable, recurring revenue. Microsoft exemplifies this resilience. Corporate clients tend to spend on essential software and electronics even during tough times, unlike individual consumers who may cut back on spending.

While Microsoft might experience a slight revenue slowdown, its financial performance generally remains steady and predictable over the long term.

MSFT Revenue (Quarterly) data by YCharts

Dividend Considerations

Investors often overlook Microsoft’s dividend. However, it has been paying dividends since 2003. Although its stock price has risen significantly, resulting in a generally low dividend yield, the company demonstrates commitment to maintaining and growing shareholder dividends.

Microsoft has raised its annual dividend for 23 consecutive years, increasing it by over 160% in the past decade.

MSFT Dividend data by YCharts

With a yield under 1%, although not particularly impressive, Microsoft’s dividend can contribute significantly to total returns in the long run. Over the past decade, Microsoft’s stock price has surged approximately 810%, leading to total returns around 960% (as of April 16). This difference highlights the value of combining dividend income with stock growth.

Is Investing $1,000 in Microsoft Wise Now?

Before proceeding with a Microsoft stock purchase, consider this:

The Motley Fool Stock Advisor analyst team recently named what they believe are the 10 best stocks for investors today…and Microsoft did not make the list. The stocks included could yield significant returns in the coming years.

For instance, Netflix featured on this list on December 17, 2004; if you had invested $1,000 then, it would be worth $524,747 now!* Similarly, Nvidia was included on April 15, 2005; a $1,000 investment would have grown to $622,041!*

Notably, Stock Advisor has delivered an average return of 792%, significantly outpacing 153% gained by the S&P 500. Don’t miss out on the new top 10 list available when you become a member of Stock Advisor.

*Stock Advisor returns as of April 14, 2025

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Similarly, Suzanne Frey, an executive at Alphabet, holds a position on the board. Randi Zuckerberg, who formerly directed market development for Facebook and is the sister of Meta Platforms CEO Mark Zuckerberg, is also on the board. Stefon Walters has holdings in Apple and Microsoft. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool advises specific options involving Microsoft stocks. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.