Top AI Stocks to Invest In as March Approaches

As winter comes to a close and March begins, one trend remains evident: investing in artificial intelligence (AI) will continue to be significant through 2025. Consequently, investors must position their portfolios to capitalize on this burgeoning investment opportunity.

Here are four stocks worth considering this month, categorized into AI facilitators and AI hardware suppliers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

AI Facilitators: Alphabet and Meta Platforms

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Meta Platforms (NASDAQ: META) play crucial roles in the ongoing AI arms race. Each company has developed generative AI models—Alphabet’s Gemini and Meta’s Llama. While their structures and uses differ, both models boast significant user bases.

By contributing to the AI arms race, these companies are securing a solid footing in a rapidly evolving market. Meta’s model is free to use, focusing on data collection from its user interactions to enhance future models. Conversely, while Gemini has a free version, its premium subscription unlocks advanced features. Additionally, Alphabet integrates its Gemini model into its core business through Google Search.

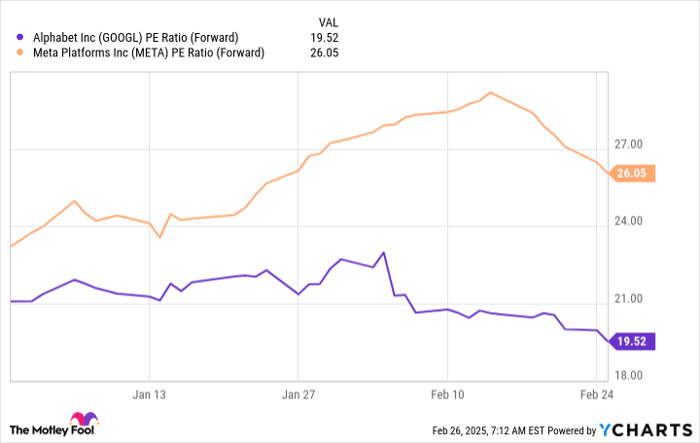

AI impacts both companies significantly, driving heavy investments in their AI capabilities. Recently, both stocks experienced a sell-off due to broader tech market declines, providing a potential buying opportunity for investors as they appear fairly priced relative to their growth projections.

GOOGL PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio.

Meta trades at 26 times forward earnings, while Alphabet trades at a lower 19.5 times forward earnings. Both stocks present strong buying opportunities given their alignment with AI trends. I recommend investors consider these stocks in March, leveraging current market weaknesses.

AI Hardware: Taiwan Semiconductor and ASML

The advancements in AI would be impossible without the critical support of chip manufacturers and their equipment, making Taiwan Semiconductor (NYSE: TSM) and ASML (NASDAQ: ASML) essential players in this sector.

Taiwan Semiconductor, the world’s leading contract chip manufacturer, produces chips for many major technology companies. The company anticipates a 45% compounded annual growth rate (CAGR) for its AI chips over the next five years, demonstrating robust demand for the hardware needed to drive AI innovations.

To meet this rising demand, Taiwan Semiconductor must invest in new machinery, highlighting ASML’s key role. ASML is the sole producer of extreme ultraviolet lithography machines, which are critical for creating advanced chip designs. Its longstanding technological edge is supported by many years of research and substantial investments, securing its position as an industry leader.

Both ASML and Taiwan Semiconductor stand to gain significantly from the AI arms race, as well as from the broader growth of chip utilization in various industries. Fortunately, both stocks are currently priced attractively for potential investors.

ASML PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio.

Given their leadership status in the semiconductor market, both TSMC and ASML stocks represent excellent investment options in March. Investors should look to increase their stakes during any market dips. Thanks to the AI arms race, these companies may emerge as long-term winners.

Should You Invest $1,000 in Meta Platforms Right Now?

Before purchasing stock in Meta Platforms, consider the following:

The Motley Fool Stock Advisor analyst team recently selected their top 10 stocks for investment, and notably, Meta Platforms did not make the cut. The listed stocks have immense potential for impressive returns in the future.

For instance, consider Nvidia, which was featured on April 15, 2005… if you had invested $1,000 at that time based on our recommendation, you’d have $736,343!*

Stock Advisor provides investors with a straightforward path to success, including portfolio-building advice, regular analyst updates, and two fresh stock picks each month. Since its inception, the Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of February 28, 2025.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a member of The Motley Fool’s board. Keithen Drury holds positions in ASML, Alphabet, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and endorses ASML, Alphabet, Meta Platforms, and Taiwan Semiconductor Manufacturing. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.