AI Stocks Dip Amid Economic Concerns: Top Picks for Investors

Artificial intelligence (AI) stocks have surged in recent years as investors sought to get in early on transformative technology. AI offers companies the potential to enhance efficiency and accelerate product development, which could lead to significant earnings growth. Current major players, including chip designers and cloud service providers, are already reaping substantial revenues from this technology, maintaining strong investment interest.

Recently, however, AI stocks have faced challenges, contributing to declines in the three major indexes. Notably, the Nasdaq Composite (NASDAQINDEX: ^IXIC) officially entered correction territory on Thursday, falling 10% from its peak on December 16. Investor unease centers around possible impacts from certain U.S. policy decisions and tariffs on imports from China, Canada, and Mexico, which may hinder economic growth and directly affect the earnings of companies sourcing production overseas.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. Learn More »

While current pressures may seem concerning, long-term thinking is vital when it comes to investing. Established companies are often adept at navigating short-term challenges and continuing their path to success. Keeping that perspective in mind, let’s explore two leading AI stocks to consider amid the Nasdaq correction.

Image source: Getty Images.

1. Meta Platforms

Many recognize Meta Platforms (NASDAQ: META) for its ubiquitous social media platforms. The company owns Facebook, Messenger, Instagram, and WhatsApp, collectively reaching over 3.3 billion daily users. This extensive user base has enabled Meta to generate significant revenue primarily through advertising, which amounted to $160 billion last year. The company has consistently increased its revenue and profit over time and even declared its first dividend last year.

However, Meta is diversifying beyond social media and setting its sights on AI as a key growth area. The company has prioritized AI investments, planning to allocate as much as $65 billion this year to enhance its operations, including the construction of a large data center.

How will this translate into growth? Meta has developed Llama, its proprietary large language model, to fuel its AI initiatives. The company is integrating AI across its applications—having recently introduced an AI assistant—and as user engagement rises, so does advertiser interest. Expect more AI-driven innovations from this technology leader in the future.

Currently, after an 11% decline over one month, Meta trades at 24 times forward earnings estimates, down from 28 times a few weeks ago, making it an attractive AI purchase right now.

2. Broadcom

Another major player, Broadcom (NASDAQ: AVGO), boasts a commanding presence in the connectivity market, with its technology handling over 99% of global Internet traffic. The company manufactures thousands of connectivity products that range from data centers to consumer homes.

Demand for Broadcom’s technology has surged, particularly from cloud service providers expanding their AI capabilities. In the quarter ending February 2, Broadcom reported a 77% jump in AI revenue to over $4 billion, while its infrastructure software revenue climbed 47% to exceed $6 billion. This growth contributed to an overall record revenue increase of 25%, nearly reaching $15 billion.

The surge in revenue can be attributed to the growing need for connectivity systems and Broadcom’s specialized chips designed for workload acceleration. Broadcom is actively developing next-generation accelerators and preparing to distribute samples of its next-generation Tomahawk switch.

Looking ahead, the prospects appear promising. Broadcom currently partners with three major cloud customers, representing a potential serviceable market of $60 billion to $90 billion through fiscal 2027. This figure excludes additional cloud players requesting support to develop their accelerators.

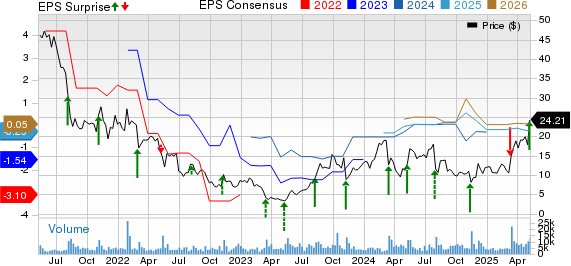

Broadcom Stock experienced a drop of 26% from late January to March 6, just before announcing its earnings reports. Prior to the earnings release, it was trading at 28 times forward earnings estimates. Despite market reactions, the stock remains below its valuation of over 37 times earlier this year, making this an opportune moment for investors aiming to take advantage of a well-positioned stock in the AI landscape.

Potentially Lucrative Second Chances

Have you ever felt like you missed out on investing in promising companies? If so, these insights may help.

Our expert analysts occasionally issue a “Double Down” Stock recommendation for stocks they believe are poised for sharp increases. If you feel like you’ve missed your chance to invest, now is an ideal time to act before it’s too late. The statistics speak volumes:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d have $286,710!*

- Apple: If you had invested $1,000 when we doubled down in 2008, you’d have $44,617!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, you’d have $488,792!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, offering a unique opportunity that may not arise again soon.

Continue »

*Stock Advisor returns as of March 3, 2025.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.