Investors Eye Undervalued Health Care Stocks as RSI Signals Overselling

Finding the right time to buy a stock can be challenging. Investors often look to key indicators like the Relative Strength Index (RSI) to help gauge market conditions. An RSI below 30 typically suggests a stock is oversold, which may signal a potential buying opportunity for traders.

Here’s a current overview of major health care stocks showing RSIs near or below 30, indicating they may be undervalued.

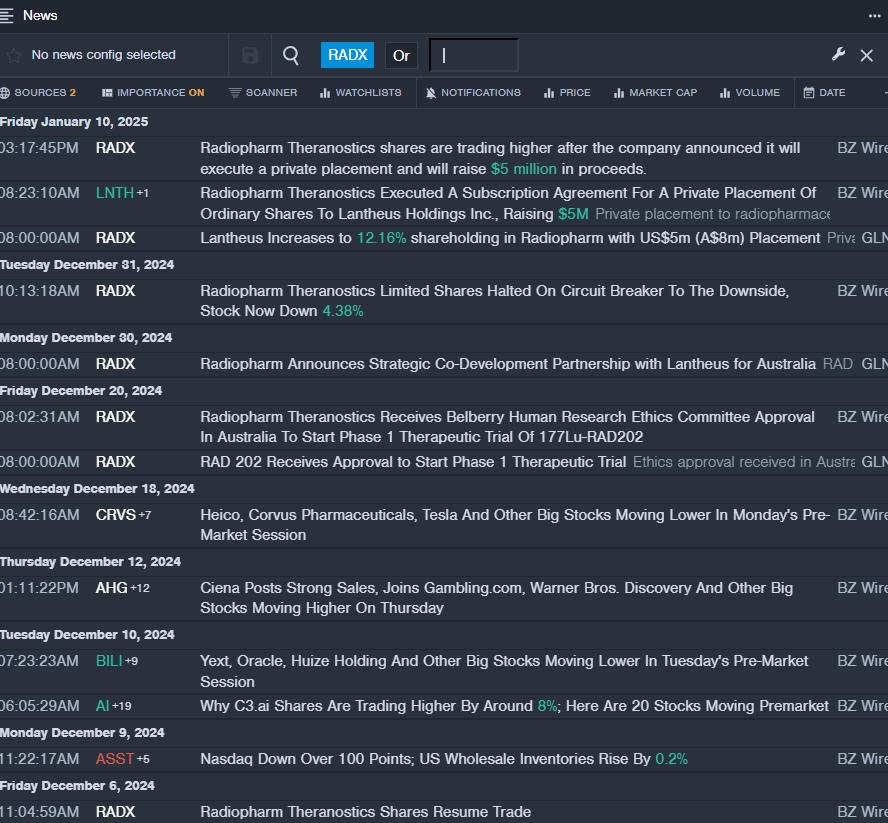

Radiopharm Theranostics ADR RADX

- On January 10, Radiopharm Theranostics announced a private placement to raise $5 million. Following this news, the stock experienced a decline of approximately 11% in just five days, reaching a 52-week low of $3.71.

- RSI Value: 27.4

- RADX Price Action: Shares closed at $4.40 on Wednesday.

- Benzinga Pro’s real-time newsfeed provided updates on RADX’s latest developments.

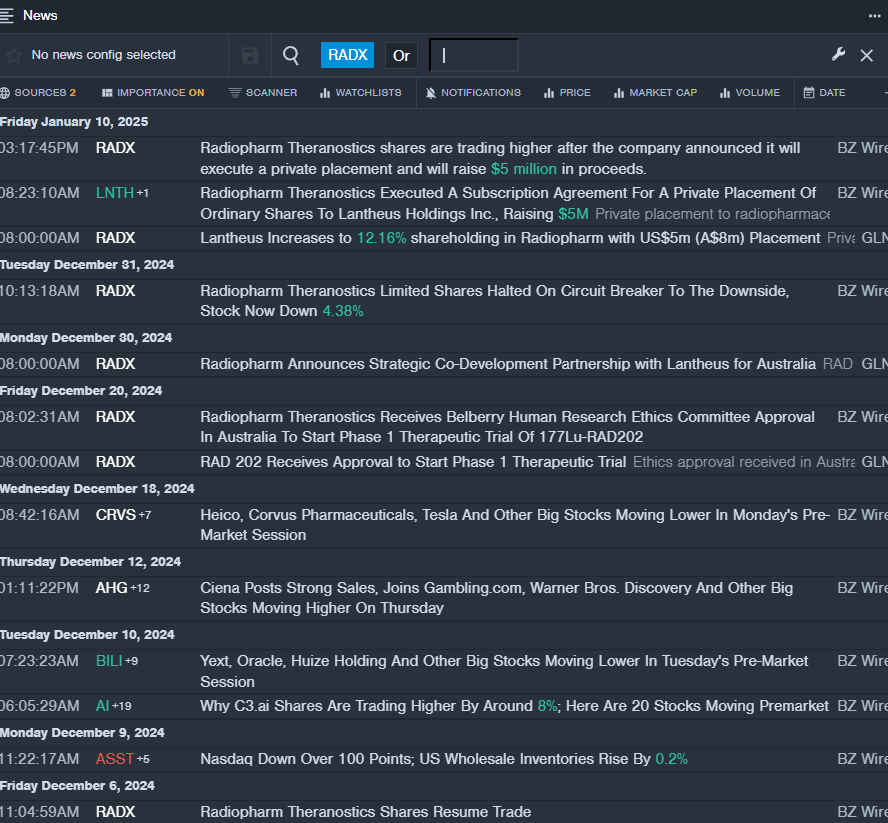

Surmodics Inc SRDX

- Surmodics reported on February 3 that its Pounce XL Thrombectomy System showed promising early clinical results for removing clots in the iliac and femoral arteries. Despite this positive news, the stock has dropped around 15% in the past month, with a 52-week low of $25.21.

- RSI Value: 29.9

- SRDX Price Action: Shares reached $33.85 on Wednesday after a slight gain of 0.7%.

- Benzinga Pro’s charting tool helped track SRDX’s recent stock trend.

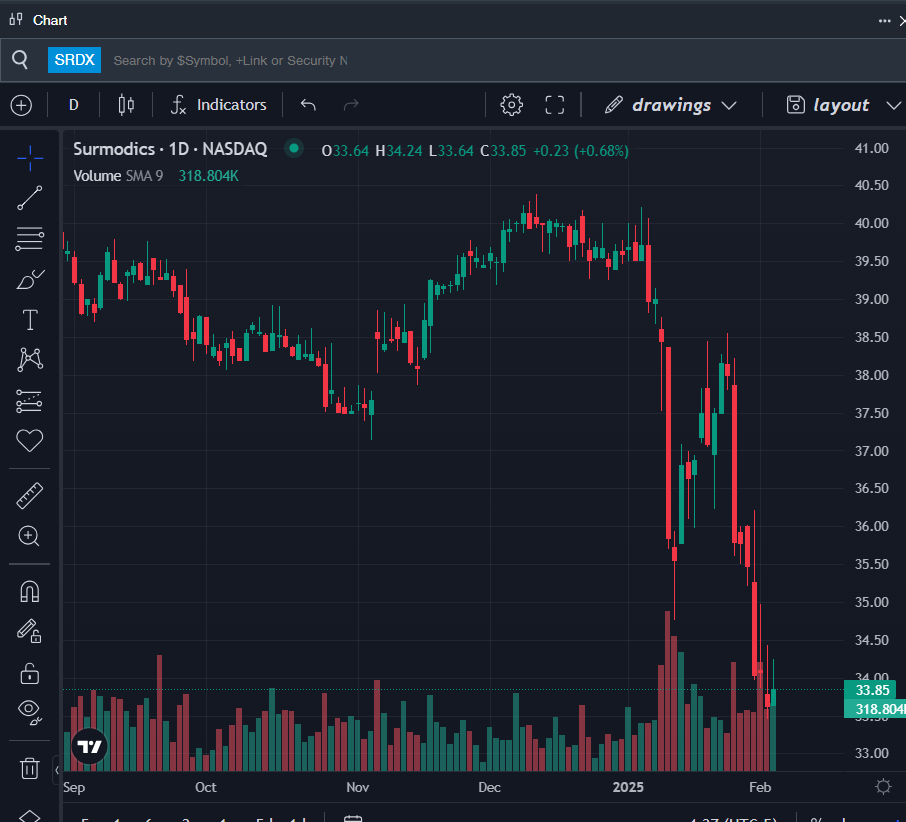

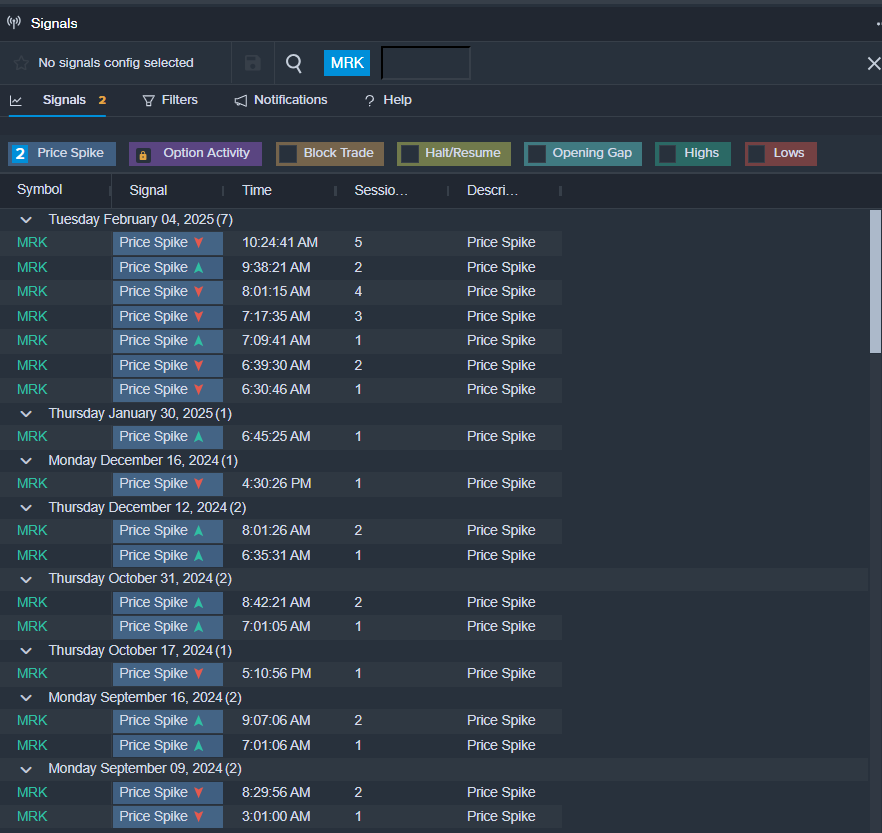

Merck & Co Inc MRK

- Merck & Co reported impressive fourth-quarter sales of $15.62 billion on February 4, reflecting a 7% increase year-over-year. This figure slightly beat the consensus estimate of $15.49 billion. Excluding currency fluctuations, sales surged by 9%. Additionally, the adjusted earnings per share rose to $1.72, a significant jump from $0.03 last year, outpacing expectations of $1.62. Despite these strong results, the stock has decreased by about 10% recently, marking a 52-week low of $87.33.

- RSI Value: 28.4

- MRK Price Action: Shares declined by 1.2%, closing at $89.67 on Wednesday.

- Benzinga Pro’s signals featured alerts about a potential breakout for MRK shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs