Spotting Opportunities: The Most Oversold Tech Stocks Ready for Recovery

Investors can find attractive opportunities among the most oversold stocks within the information technology sector. These stocks are currently undervalued and may present a buying chance.

The Relative Strength Index (RSI) serves as a valuable momentum indicator. It provides a comparison between a stock’s upward price movements and its downward price movements. Typically, a stock is considered oversold when its RSI falls below 30, as noted by Benzinga Pro. This metric helps traders gauge potential short-term performance.

Here’s a look at key oversold stocks in the tech sector, featuring RSIs near or below 30.

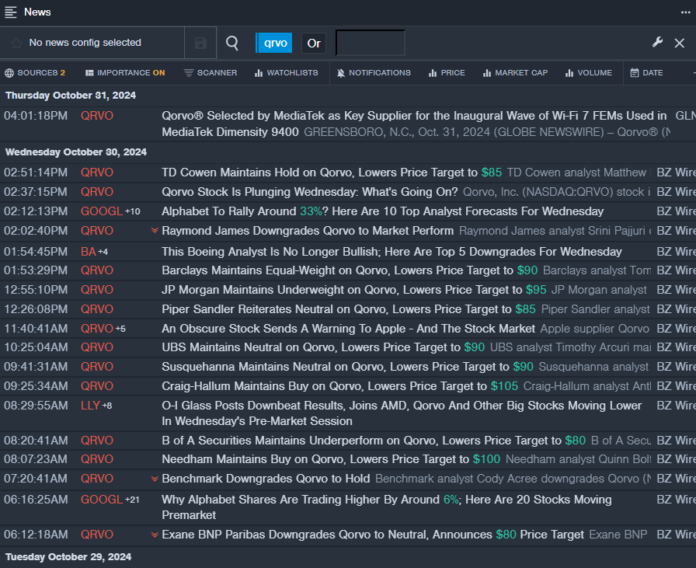

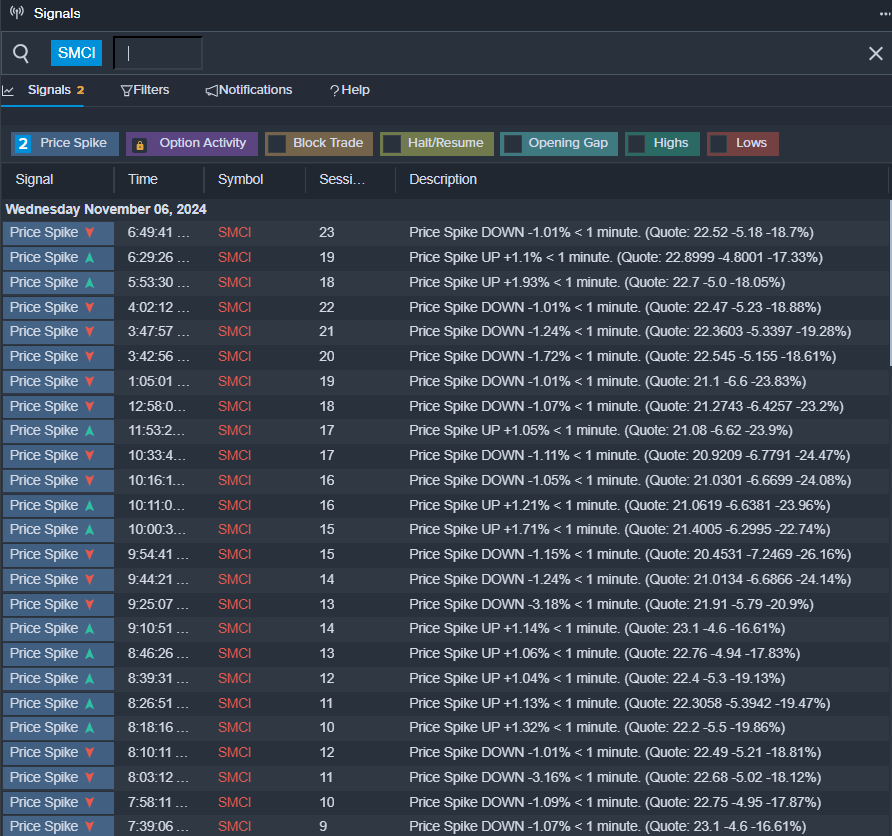

Qorvo Inc QRVO

- On Oct. 29, Qorvo announced quarterly earnings of $1.88 per share, exceeding analysts’ expectations of $1.85. Revenue for the quarter was $1.047 billion, surpassing predictions of $1.028 billion, although it represented a decline from $1.104 billion during the same period last year. Over the past month, Qorvo’s stock price has dropped approximately 27%, reaching a 52-week low of $70.38.

- RSI Value: 19.69

- QRVO Price Action: Qorvo’s shares increased by 1.5%, closing at $72.86 on Wednesday.

- Benzinga Pro’s real-time newsfeed provided the latest updates on QRVO.

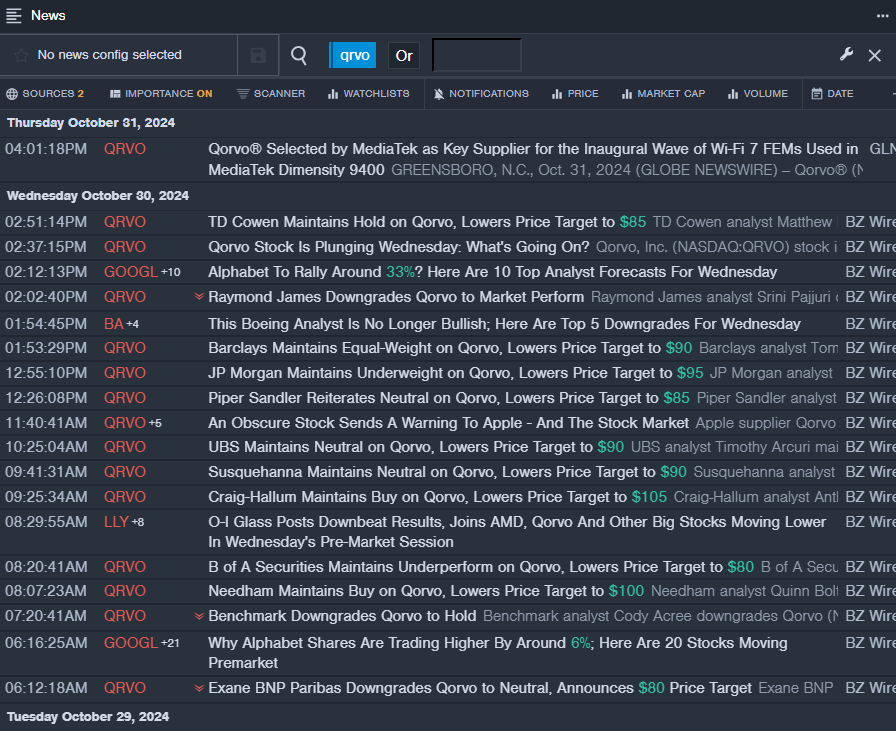

ASML Holding NV ASML

- CEO Christophe Fouquet of ASML Holding foresees increasing pressure from the United States to impose stricter regulations on semiconductor technology sales to China. Over the last month, ASML’s stock has decreased roughly 19%, reaching a 52-week low of $633.80.

- RSI Value: 29.43

- ASML Price Action: ASML’s shares fell by 2.2%, finishing at $661.43 on Wednesday.

- Benzinga Pro’s charting tools highlighted the trend in ASML’s stock performance.

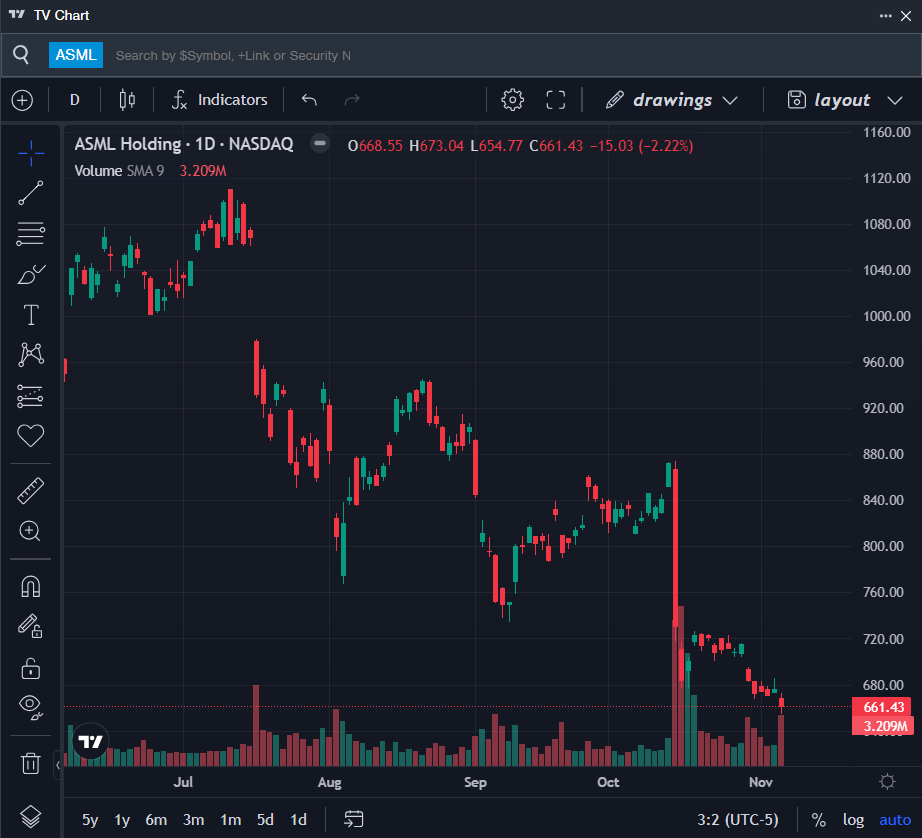

Super Micro Computer Inc SMCI

- Super Micro Computer provided a business update on Nov. 5, revealing projected first-quarter revenues between $5.9 billion and $6 billion, lower than earlier guidance of $6 billion to $7 billion. The stock has plummeted about 52% in the past month, resulting in a 52-week low of $20.20.

- RSI Value: 19.79

- SMCI Price Action: Shares fell 18.1%, closing at $22.70 on Wednesday.

- Benzinga Pro’s alerts indicated a potential breakout for SMCI shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs