Heartwarming Childhood Memories of Sardinia

In 1932, the acclaimed Italian author Elio Vittorini took part in a remarkable literary excursion to Sardinia, organized by a prominent Italian magazine. The purpose was to award a prize for the best travelogue on the island. From this experience emerged a slender, charming volume published a few years later under the title, “Sardinia Like Childhood,” a poignant account of rediscovering the authenticity of life. It was born from a profound desire for living and the wisdom acquired through encounters with the natural beauty, communities, people, and traditions of Sardinia.

Sardinia is not just an island but a metaphorical continent, transformed into a state of mind within the pages of this book. Examining its history, the profound influence of the megalithic culture, defined by monoliths, dolmens, ancient temples for cleansing rituals, and numerous Nuragic towers, is more pronounced than the historical developments. The island is adorned with Romanesque churches from the medieval period and Gothic Catalan works from the fifteenth and sixteenth centuries. An archaeological site, a village, or a parish church serves as a gateway to an extraordinary journey through time, measured in millennia. It offers a unique and awe-inspiring order of magnitude.

A Comprehensive Outlook on Total Return

In daily life, our time span generally covers months, years, and occasionally decades. However, in the realm of stock and bond funds, the most significant time unit is often a decade. Total Return values summarize the last ten years of a fund’s operation, providing a comprehensive overview of its performance.

Total Return signifies the actual rate of return for an investment over a specific evaluation period, typically one, three, five, or ten years. A longer evaluation period enhances the reliability of the performance assessment. For Closed-End Funds, the Total Return on Net Asset Value is calculated based on the sum of distributions plus the change in the NAV of the fund, whether positive or negative, over a given time frame.

Thus, Total Return encompasses capital appreciation along with the receipt of distributions, which are reinvested on the day of payment. It is a mechanism that facilitates an increase in total return through compound interest. However, investment decisions often involve factors beyond the technical aspects. Many investors utilize dividends or distributions as an additional source of income, altering the perspective on Total Return.

Living off dividends and distributions often entails making dividend reinvestment a discretionary choice. Opting for securities that provide a constant cash flow, with an increase in the initial capital value, should be the primary goal. The Occam’s razor principle advocates for favoring the simplest solution: investing in winning securities over losing ones.

The Power of Inversion in Investment

The inversion rule is a simple yet potent mental model, albeit seldom utilized due to its counterintuitive nature. Instead of pondering the actions required to achieve a goal, it is often simpler to start by inverting the problem. In the context of investment, negative screening—excluding securities with unsuitable characteristics—helps identify winning securities that meet specific requirements.

Having a clear understanding of the pitfalls to be avoided is crucial in portfolio construction. Being cautious of securities with a constantly declining Net Asset Value is essential. Opting for more effective securities that not only pay dividends but have also exhibited growth over time adds significant value. While past performance cannot predict future outcomes, it is vital to assess the historical track record of prospective securities.

Luck may impact short-term results, but a security’s performance over a more extensive period reflects the quality of decision-making processes by its managers. Thus, studying the track record of potential securities is imperative to exclude those that have not demonstrated income and capital growth characteristics in the past.

Investor’s Journey to Harmony of Purpose

My portfolio, akin to a well-tended garden, is a space that demands frequent vigilance and the nurturing of purposeful growth. Indeed, the ebb and flow of capital growth and dividend collection, two seemingly opposing forces, must be orchestrated into a harmonious symphony, each contributing to the overall beauty and longevity of the garden. As a meticulous gardener, I have championed this ambition, but, like any verdant haven, it requires continuous reflection, reevaluation, and at times, tough decisions. Let’s embark on a journey through the verdant corridors of my investment garden and take stock of where I stand.

Exploring the Overall Landscape

Within the verdant expanse of my investment garden lie three distinct plots, each nurturing a diverse array of securities amounting to a total of 28 holdings. These comprise 19 Closed-End Funds (CEFs), 5 Exchange-Traded Funds (ETFs), 3 Business Development Companies (BDCs), and 1 Exchange-Traded Note (ETN). In a bid to achieve equilibrium, I recently reorganized these plots, allocating small shares to FDUS and MCI to ensure a more balanced distribution of resources.

The Cupolone Income Portfolio:

- BlackRock Science and Technology Trust (BST)

- Calamos Dynamic Convertible and Income (CCD)

- Calamos Global Total Return (CGO)

- Eaton Vance Enhanced Equity Income II (EOS)

- Eaton Vance Tax-Adv. Global Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Income (EVT)

- Guggenheim Strategic Opportunities (GOF)

- John Hancock Tax-Adv. Dividend Income (HTD)

- PIMCO Corporate & Income Strategy (PCN)

- PIMCO Dynamic Income (PDI)

- John Hancock Premium Dividend (PDT)

- PIMCO Corporate & Income Opportunities (PTY)

- Cohen & Steers Quality Income Realty (RQI)

- Special Opportunities Fund (SPE)

- Cohen & Steers Infrastructure (UTF)

- Reaves Utility Income Trust (UTG)

- XAI Octagon FR & Alt Income Term Trust (XFLT)

The Giotto Income Portfolio:

- JPMorgan Equity Premium Income (JEPI)

- JPMorgan Nasdaq Equity Premium Income (JEPQ)

- Global X NASDAQ 100 Covered Call (QYLD)

- Global X Russell 2000 Covered Call (RYLD)

- Credit Suisse X-Links Crude Oil Shares Covered Call ETNs (USOI)

- Global X S&P 500 Covered Call (XYLD)

The Masaccio Income Portfolio:

- Ares Capital (ARCC)

- Crescent Capital BDC (CCAP)

- Fidus Investment (FDUS)

- Barings Corporate Investors (MCI)

- Royce Value Trust (RVT)

In October, I diversifed my holdings by acquiring shares in Fidus Investment and Barings Corporate Investors. Despite their fiscal inefficiency from an Italian perspective, I recognized their potential value and made prudent investments. The subsequent uptick in market prices, coupled with record-high distributions, warrants a judicious approach. The fear of a market correction in response to historically extraordinary distributions beguiles my decision-making, urging caution.

Confronting the Unpleasant Truth

Warren Buffett once remarked, “Just tell me the bad news; the good news will take care of itself.” This aphorism encapsulates our approach at Berkshire – an unwavering commitment to forthright communication, particularly when confronting adversity.

A panoramic survey of the Net Asset Value (NAV) since launch reveals a dichotomy within my investment garden. Among the 28 holdings, 13 exhibit a loss since their inception. However, the despondency deepens with a select few. Five securities in particular present not only dismal NAV performance, but a prolonged downward trajectory, enshrouding any near-term prospects of revival.

Let’s delve into each of these disconcerting entities:

- Guggenheim Strategic Opportunities

- PIMCO Dynamic Income

- Global X NASDAQ 100 Covered Call

- Global X Russell 2000 Covered Call

- XAI Octagon FR & Alt Income Term Trust

Guggenheim Strategic Opportunities

The downtrend in Guggenheim Strategic Opportunities commenced a decade ago, persisting with unwavering determination. The current distribution, disproportionately lofty at roughly 17% over market price, necessitates a continuous infusion of return of capital (ROC) to sustain it. Though some analysts exude optimism for its future, my confidence is less resolute, given its modest 2% share in my portfolio. Exiting this position would provoke discreet losses, exacerbating the predicament under the Italian tax regime. Thus, my stance is plagued by lingering doubts.

PIMCO Dynamic Income

A similar decade-long descent haunts PIMCO Dynamic Income, interspersed with intermittent rebounds. Despite the persistent downward trajectory, reports from CEFConnect and Morningstar indicate no recourse to return of capital at present. The distribution, surpassing 14%, raises legitimate apprehensions about its sustainability. A year has elapsed since similar concerns were voiced, yet PIMCO’s purportedly adept managers have yet to assuage them convincingly.

Ensuring Steady Growth Amid Market Volatility

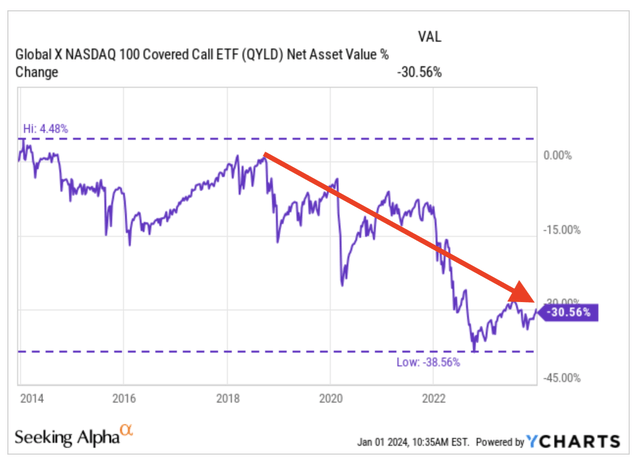

Global X Nasdaq 100 Covered Call

Global X Nasdaq 100 Covered Call, with its significant market capitalization, has shown resilience amidst a downward trend. Despite the recent decline, the stock has displayed remarkable vitality. The market is eagerly anticipating a possible turnaround, and I stand firm in my position, optimistic about its future prospects.

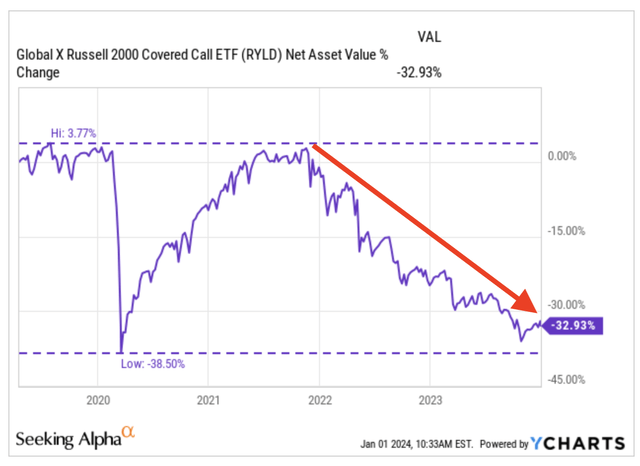

Global X Russell 2000 Covered Call

Similar to QYLD, Global X Russell 2000 Covered Call has faced a steep decline. However, I maintain confidence in its potential for recovery, attributing its current performance to the challenging market conditions. I remain steadfast in my position, anticipating an upturn in U.S. small-cap companies.

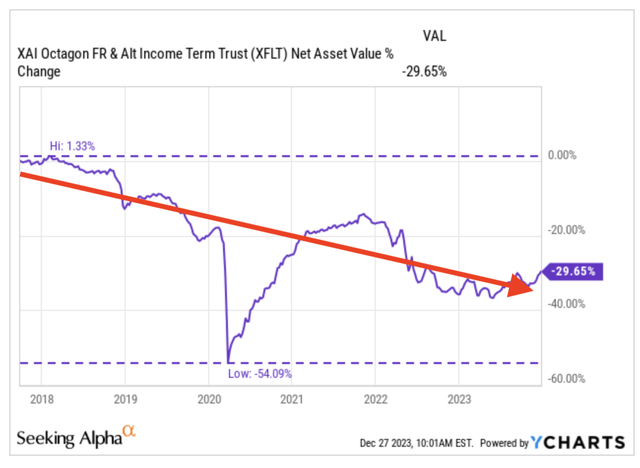

XAI Octagon FR & Alt Income Term Trust

Investing in Collateralized Loan Obligations (CLO), XAI Octagon FR & Alt Income Term Trust has shown a somewhat perplexing performance. Despite this, the recent rise has instilled confidence in a potential recovery. With a dividend yield exceeding 13 percent, I continue to hold my position, trusting in the fund’s sustainability as endorsed by experienced analysts.

In this brief analysis, I have deliberately left aside USOI, an ETN with a covered call strategy, due to its unique dividend feature tailored to my situation.

Navigating Midstream Challenges

Among the remaining stocks with negative performance, two have shown a loss of less than 5 percent:

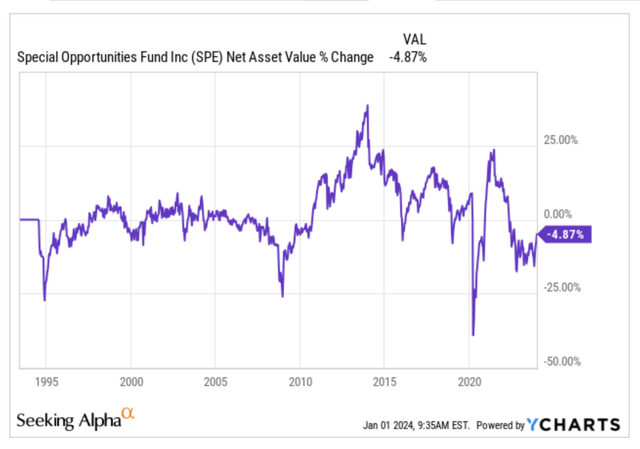

Special Opportunities Fund

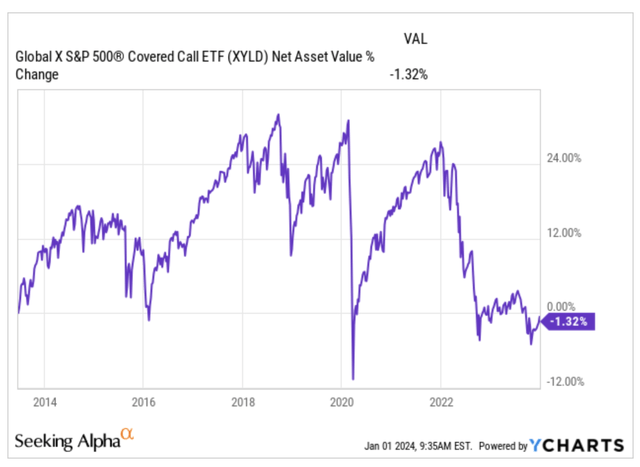

Global X S&P 500 Covered Call

Five other stocks show losses exceeding 10 percent, but I am less disconcerted by their performance compared to the CEFs and ETFs. Let’s delve into these midstream securities to understand why, despite nominal value losses exacerbated by inflation, they remain part of my portfolio.

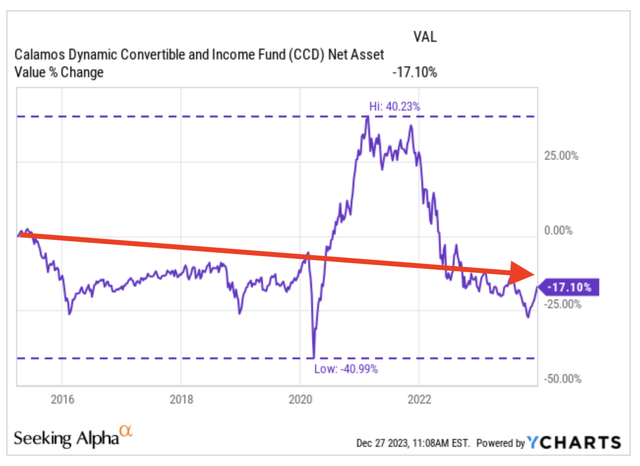

- Calamos Dynamic Convertible and Income

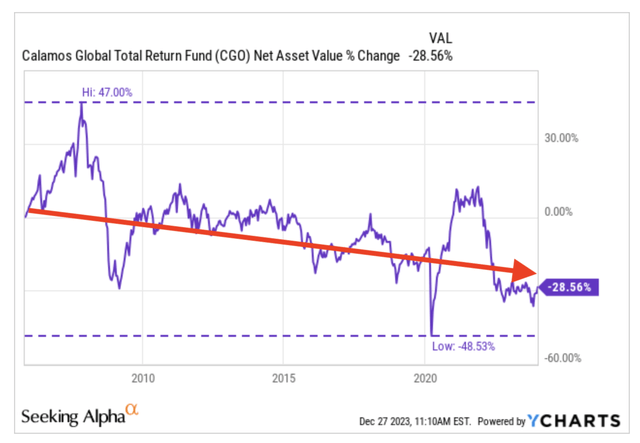

- Calamos Global Total Return

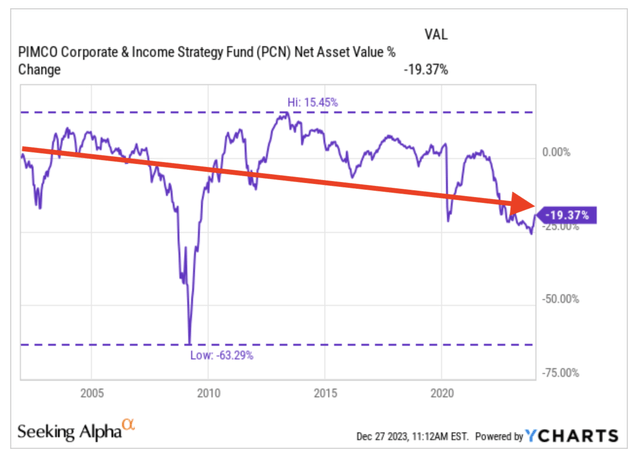

- PIMCO Corporate & Income Strategy

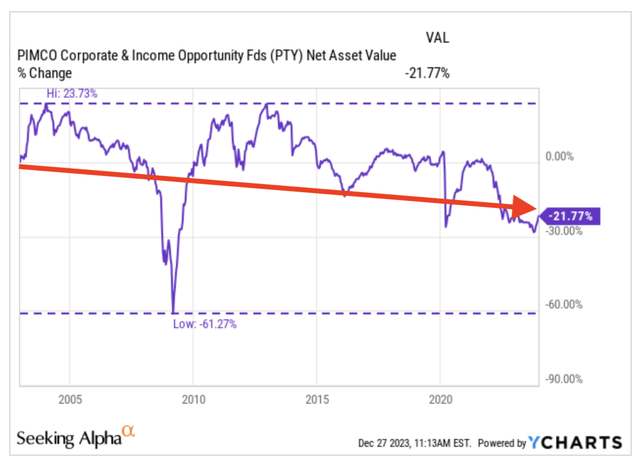

- PIMCO Corporate & Income Opportunities

- Cohen & Steers Quality Income Realty

Calamos Dynamic Convertible and Income

Despite its overall negative performance, Calamos Dynamic Convertible and Income exhibited a notable bubble, maintaining its vitality. I continue to hold it in my portfolio, confident in its potential.

Calamos Global Total Return

A low-capitalization CEF, Calamos Global Total Return, has experienced a challenging descent. While currently attempting to move away from recent lows, I hold onto this vital stock, anticipating its return to previous post-pandemic valuations.

PIMCO Corporate & Income Strategy

With a jagged performance path, PIMCO Corporate & Income Strategy has endured ups and downs. Despite recent setbacks, I maintain hope for a possible recovery, prompting me to continue with my position in this stock.

Investment Insight: Finding Hope Amidst Losses and Recoveries in the Market

After a tumultuous journey through the financial markets, some investments have tested our patience, almost like a wobbly tightrope walker teetering precariously on a suspended wire. Despite the 11% loss from the purchase price, I continue to cradle PIMCO Corporate & Income Opportunities, believing in its latent potential. The rollercoaster ride of negative performance and a jagged path has made the experience akin to a wild, erratic dance – one that has certainly spun its way into my portfolio, even with a 6.5% loss from my initial investment.

Similarly, Cohen & Steers Quality Income Realty has waded through overall negative performance, reminiscent of a ship caught amidst choppy waves before the tempest of the 2007-2009 financial crisis. However, its enduring recovery has guided it back to some period highs in positive territory. Despite its lackluster performance, I clasp it in my portfolio like a talisman, hoping for a triumphant long-term outcome.

Granted, all five of these securities may not fit the “ideal” investment label of steady distributions and positive NAV performance. Yet, beneath their seemingly bleak outlooks, their charts reveal a resilience and dynamism that sets them apart from other underperforming investments, which offer little hope of recuperation.

Bright Spots Amidst Turmoil

Amidst the trials and tribulations, the silver lining emerges in the form of 15 securities exhibiting positive NAV performance since their inception, validating the initial hypothesis that sparked this journey.

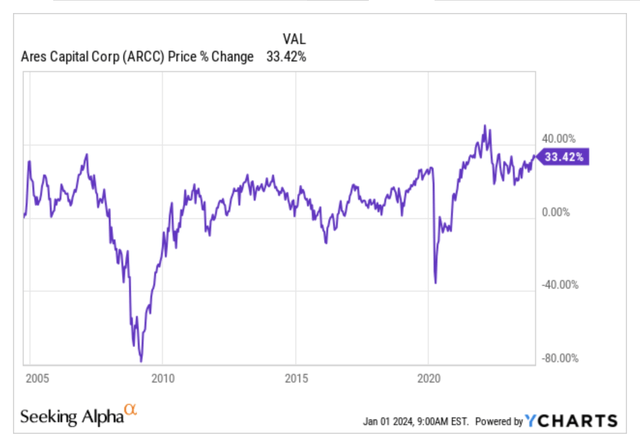

Amongst these securities, JEPI and JEPQ have stood out, their positive performance cementing their place in the category of good news. Notably, ARCC, CCAP, and FDUS have had their prices reported rather than their NAV due to the absence of trend charts depicting the underlying assets these BDCs encompass.

Increase between +0% and +10%

- Crescent Capital

- Eaton Vance Enhanced Equity Income II

- JPMorgan Nasdaq Equity Premium Income

- John Hancock Premium Dividend

In the same vein, investments like Crescent Capital and Eaton Vance Enhanced Equity Income II, which have seen an increase between 0-10%, portray the potential for a stable upswing. Similarly, the journey of JPMorgan Nasdaq Equity Premium Income has mirrored the market’s tumultuous descent, only to witness a mighty rebound starting in January 2023, aligning with its benchmark index, the NASDAQ, currently in slightly positive territory.

Increase between +10% and +30%

- Eaton Vance Tax-Adv. Dividend Income

- John Hancock Tax-Adv. Dividend Income

- JPMorgan Equity Premium Income

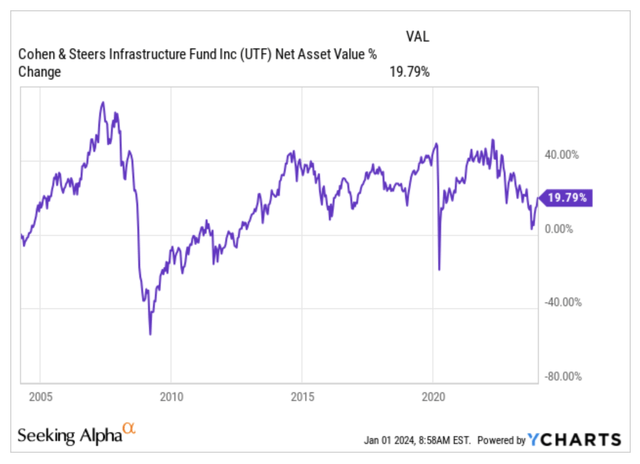

- Cohen & Steers Infrastructure

In a similar vein, investments such as Eaton Vance Tax-Adv. Dividend Income and John Hancock Tax-Adv. Dividend Income, which have experienced a commendable 10-30% increase, highlight the potential for lucrative rewards. Meanwhile, JPMorgan Equity Premium Income and Cohen & Steers Infrastructure have followed distinct trajectories, with JPMorgan Equity Premium Income benefitting from the market’s rebound post-pandemic outbreak, settling in largely positive territory.

Rising Stocks Spell Wealth

Ares Capital

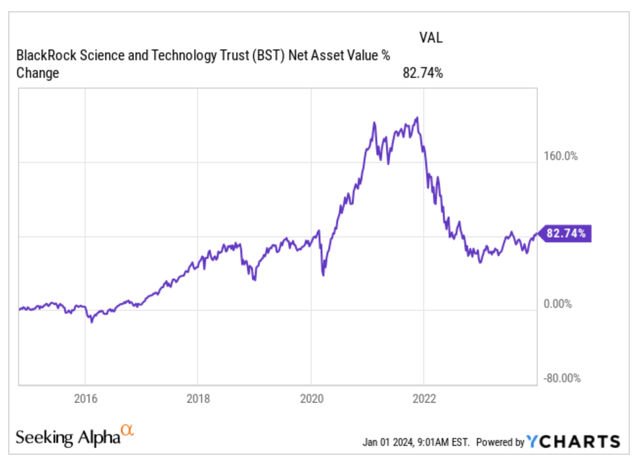

BlackRock Science and Technology Trust

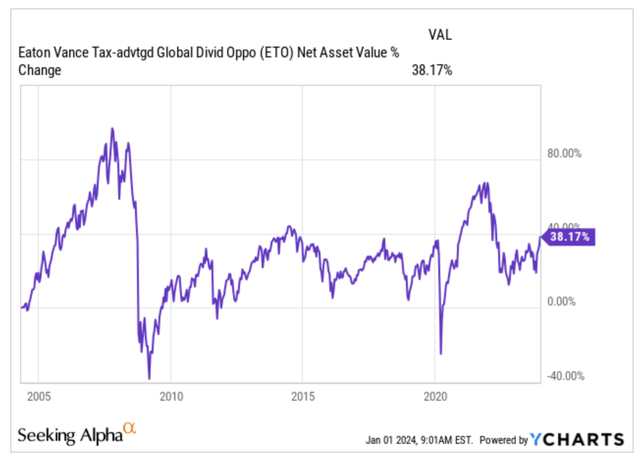

Eaton Vance Tax-Adv. Global Dividend Opps

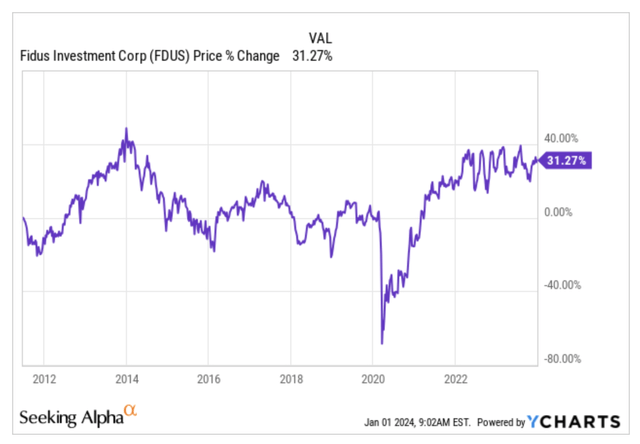

Fidus Investment

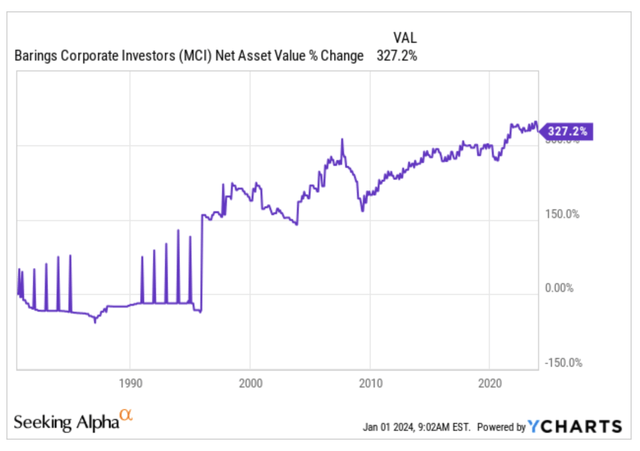

Barings Corporate Investors

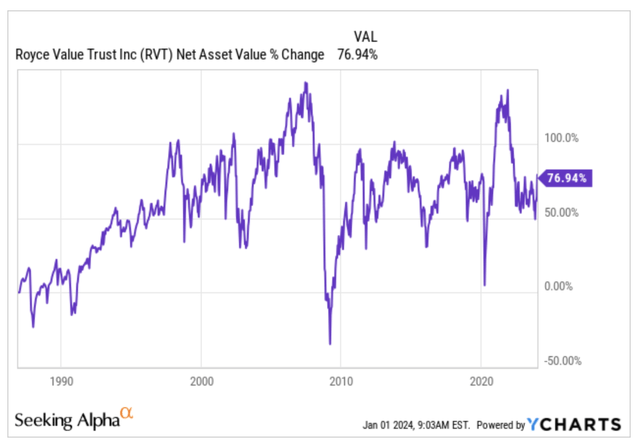

Royce Value Trust

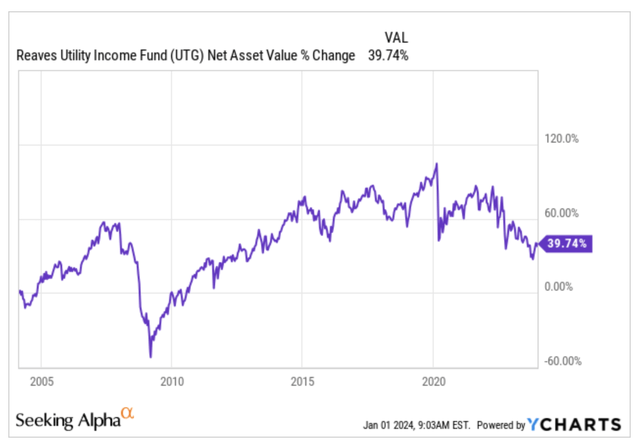

Reaves Utility Income Fund

Final Thoughts

Benjamin Graham once said that the purpose of a margin of safety is to make forecasts unnecessary. In that light, seeking out BDCs/CEFs/ETFs that have consistently added value since their inception seems to obviate the need for speculative forecasts about the future of my portfolio.

Markets are continually tasked with envisioning tomorrow, yet my aspiration is to construct a portfolio designed to stand the test of time without frequent adjustments. To achieve this, it is essential to pinpoint stable markers that allow for the gradual culling of underperforming securities, while favoring those which provide not only robust dividends but also some degree of capital protection.

Certainly, there will be bear markets when it might be appropriate, even advantageous, to increase our holdings at discounted prices by reinvesting all or part of the dividends. However, if investing implies prudently allocating capital or resources to productive ventures, then the notion that we must redeploy the cash flow from a security simply to prevent it from foundering strikes me as a disavowal of the very concept of investing. Drifting aimlessly is one matter, swimming is another.

It is apparent that there may be years when Total Return carries a negative sign because the cash flow generated by a security is less than its depreciation (inclusive of reinvestment of dividends/distributions), yielding an overall negative value. Nevertheless, if the stocks in which we have invested are adeptly managed and capable of creating value over time, rather than depleting capital to appease shareholders, all that is required is the patience to await the market’s resurgence, and presumably, the value of our portfolio will rebound accordingly.

To accomplish this, we must afford ourselves time. The ever-mounting inundation of news reports not only obstructs our ability to discern the true signal but also threatens to sow considerable confusion. The greater the frequency of the information we receive, the more susceptible we become to making erroneous assumptions by mistaking noise for signal, ultimately impairing our judgment.

To err is human, and in many cases, changing one’s perspective can be the wisest course, but if we fixate solely on brief time spans, what we would witness is portfolio fluctuation, i.e., perturbation. Subsequently, we would be bereft of a reliable gauge as to the soundness of our strategy. In contrast, while news abounds with noise, history, by contrast, is largely bereft of it.

History holds no refuge places, not even amid the inscrutable and captivating Nuraghes of Sardinia.