Nvidia’s Stock Decline: Buying Opportunity or Cause for Caution?

Nvidia (NASDAQ: NVDA) has emerged as a leading player in artificial intelligence (AI) since early 2023. Its data center chips are essential for training and operating advanced AI models, positioning Nvidia at the forefront of a rapidly expanding market. However, similar to the internet boom of the late 1990s, the hype surrounding AI technology may have led to inflated expectations.

Recently, market sentiment has shifted. The Nasdaq Composite has dropped nearly 10% from its peak, suggesting a possible correction. Nvidia’s shares have plummeted approximately 25% since their January highs, prompting concerns among investors.

Where to invest $1,000 right now? Our analyst team has uncovered the 10 best stocks to consider today. Learn More »

While stock price declines can be alarming, this situation presents a potential buying opportunity for long-term investors. Below, I’ll explain why Nvidia might still be a solid investment despite recent market trends.

Nvidia: A Solid Investment, Not a Bubble

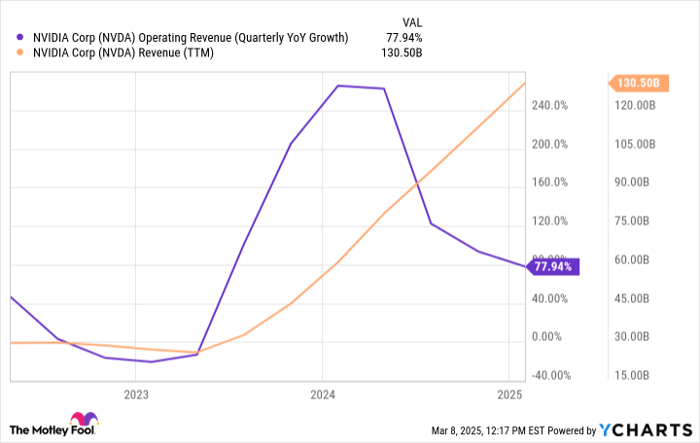

Similar to the dot-com boom, speculative hype can inflate valuations in the tech sector. Some internet stocks soared, only to crash when enthusiasm waned. This risk is present in the AI sector as well, but Nvidia appears to possess genuine growth drivers. Over the past four quarters, Nvidia has generated $130 billion in revenue, with a remarkable growth rate close to 80%:

NVDA Operating Revenue (Quarterly YoY Growth) data by YCharts

This momentum shows no signs of slowing. Major technology firms investing in AI data centers, termed AI hyperscalers, are projected to maintain their investments through 2025. Reports suggest that AI spending could exceed $320 billion in 2023. Companies like Alphabet and Microsoft have highlighted in their recent earnings reports that demand for AI in the cloud continues to outstrip current supply. Notably, OpenAI, a leader in AI development and creator of ChatGPT, has recently struggled with GPU chip shortages, delaying its product launches.

Nvidia’s growth in the AI sector looks to be robust. The stock trades at a price-to-earnings (P/E) ratio of 38, while analysts project a 50% increase in earnings per share this year, with long-term average growth expected at 34%.

Understanding the Broader AI Landscape

No stock is devoid of risk. The primary risk for Nvidia lies in competition; if key companies reduce their AI investments or shift their focus, it could substantially affect Nvidia’s trajectory. This is reflected in Nvidia’s relatively low valuation compared to its expected earnings growth.

Despite inherent risks, Nvidia is positioned to thrive even through fluctuations in AI investment cycles. The potential for generative AI extends beyond initial applications, reaching into areas such as autonomous vehicles, humanoid robotics, and AI technologies that could automate roles in customer service. As technology improves and costs decline, AI capabilities will be more accessible to smaller businesses and individuals. Recently, Nvidia highlighted a Blackwell-powered supercomputer compact enough to fit on a desktop.

The avenues for AI innovation may broaden beyond current AI hyperscalers, and Nvidia stands to benefit by leveraging its dominance in accelerator chips.

Your Investment Strategy

Nvidia consistently demonstrates strong business performance. Until that changes, the company’s relevance in AI—a technology likely to shape our future—remains clear. Even with a projected long-term earnings growth rate of just 19%, the stock’s current P/E ratio leads to a price/earnings-to-growth (PEG) ratio of approximately 2, which is reasonable compared to anticipated growth. In essence, Nvidia provides a margin of safety if its growth targets are not met in the coming years.

However, stock prices are subject to market volatility and external factors. In recent weeks, Nvidia’s valuation has tumbled nearly 25%, and continued market fluctuations might lead to further declines.

While Nvidia stands out as a commendable AI investment, a cautious approach is advisable. Consider dollar-cost averaging—purchasing shares incrementally—especially if prices decrease. It’s important to remember that investing often means encountering price dips, as few investors can predict market bottoms accurately.

Looking forward to the next decade, Nvidia presents a compelling blend of growth potential and current value.

Should You Invest $1,000 in Nvidia Now?

Before deciding to invest in Nvidia, keep the following in mind:

The Motley Fool Stock Advisor analyst team has identified the 10 best stocks for investors today, and Nvidia was not one of them. The included stocks are expected to provide substantial returns in the coming years.

If you had purchased Nvidia on April 15, 2005, you would have turned a $1,000 investment into $690,624!*

Stock Advisor offers investors a straightforward roadmap to success, complete with portfolio-building advice, analyst updates, and bi-monthly stock picks. Since 2002, the Stock Advisor service has outpaced the S&P 500 by more than four times*. Don’t miss out on the latest top 10 list — join Stock Advisor now.

*Stock Advisor returns as of March 10, 2025

Suzanne Frey, an executive at Alphabet, sits on The Motley Fool’s board of directors. Justin Pope holds no position in the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Microsoft, and Nvidia, and also recommends long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.