“`html

Top 10 Stocks to Consider for Your 2025 Portfolio

As we approach 2025, now’s the time to evaluate potential picks for your investment portfolio. A diversified approach is important, but currently, the technology sector, particularly companies involved in artificial intelligence (AI), shows significant promise.

Below is a list of ten stocks worth considering as you prepare for the new year.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM) stands out as a top pick for 2025. As the leading producer of contract chips, Taiwan Semi supplies components for numerous high-tech and AI companies.

Management anticipates a tripling of AI-related revenue this year, with demand likely to remain strong into 2025. Analysts project a 25% revenue growth for the company in 2025, indicating promising returns ahead.

Currently, the stock trades at 22 times projected 2025 earnings, suggesting it is reasonably priced considering its growth potential and significance in the tech industry.

2. ASML

ASML (NASDAQ: ASML) is another essential player in the chip manufacturing process. The company specializes in lithography machines that are unmatched globally, granting it a unique position in the market.

However, stringent regulations limit sales in certain markets, including China, causing ASML to cut its revenue forecast for 2025. This shift has impacted the stock negatively in the short term.

Despite the recent downturn, many view this as a buying opportunity. Analysts expect ASML to grow by 15% next year, affirming its long-term appeal.

3. Meta Platforms

Meta Platforms (NASDAQ: META), formerly known as Facebook, thrives on ad revenue while also competing in the AI space.

The company’s generative AI model, Llama, leads the open-source segment and has potential for growth, though investors currently rely on its traditional advertising revenue, which is performing robustly. Analysts forecast a 21% revenue increase for 2024 and 15% for 2025.

Given its solid foundation and future growth from AI initiatives, Meta looks poised for a strong performance in 2025.

4. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is heavily investing in AI, with its Google Gemini model gaining traction alongside Google Cloud.

In the third quarter, Google Cloud saw a remarkable 35% growth and is significantly improving its profit margins. While it currently represents a small fraction of total revenue, its rapid expansion is exciting and could drive Alphabet’s growth.

Alphabet’s stock, trading at 25 times forward earnings, appears attractively valued compared to its tech counterparts.

5. Amazon

Amazon (NASDAQ: AMZN) presents a similar investment thesis to Alphabet. While its e-commerce platform thrives, its cloud computing sector holds significant profit potential.

Amazon Web Services (AWS) contributed 17% of total revenue in the latest quarter, driving an impressive 60% of operating profits. As AWS continues its 19% growth trajectory, it’s set to propel Amazon’s success into 2025.

6. CrowdStrike

CrowdStrike (NASDAQ: CRWD) may raise eyebrows as a controversial choice. This cybersecurity firm gained more attention following a major outage on July 19, affecting numerous devices.

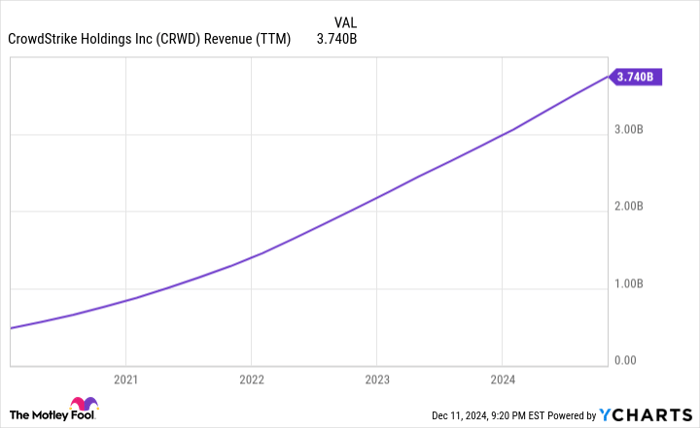

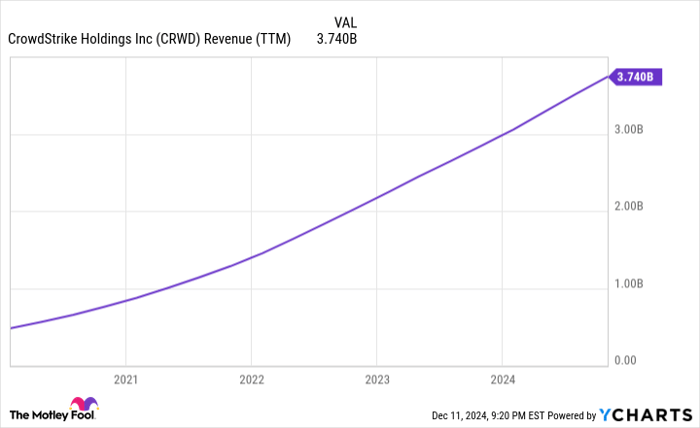

Despite the challenges, CEO George Kurtz reports a return to pre-incident levels in customer activity. The latest quarter showed a 27% year-over-year increase in annual recurring revenue (ARR) to over $4 billion, contributing to its long-term goal of reaching $10 billion in ARR.

CRWD Revenue (TTM) data by YCharts

Although it carries a higher valuation, the growth outlook for CrowdStrike makes it a strong contender.

7. dLocal

dLocal (NASDAQ: DLO) offers a unique payment processing solution for emerging markets, establishing connections that other companies might overlook. Notable clients include Amazon, Spotify Technology, and Shopify.

With a leadership change underway, new CEO Pedro Arnt aims to rejuvenate growth, drawing from his successful tenure at MercadoLibre.

The stock is trading at just 25 times its forward earnings, providing substantial value potential as dLocal repositions itself.

8. PayPal

PayPal (NASDAQ: PYPL) has seen a resurgence under CEO Alex Chriss, who has been steering the company for over a year.

While its growth isn’t the fastest with revenues up just 6% year over year in Q3, PayPal is keenly focused on developing innovative strategies to enhance its market position.

“““html

Top Stocks to Watch in 2025: High Potential for Growth

PYPL PE Ratio (Forward) data by YCharts

Evaluating PayPal’s Future

PayPal’s stock trades at 19 times its expected earnings, making it a more affordable option compared to the S&P 500, which sits at 22.5 times. Despite not being as cheap as in the past, there is still significant upside potential. PayPal’s turnaround in 2025 could turn out to be noteworthy.

MercadoLibre’s Impressive Growth

Next up is MercadoLibre, a key player in Latin American e-commerce and fintech. The company boasts remarkable performance, with its revenue jumping over 100% in Q3 when measured on a currency-neutral basis. Although it faced some challenges with bad debt this past quarter—a temporary issue—its growth trajectory remains strong.

MercadoLibre’s stock does carry a hefty price at 56 times expected earnings, but the company’s sustainability in growth makes it a worthwhile investment as we move into 2025.

Nvidia: A Tech Giant with Bright Prospects

Finally, we turn to Nvidia (NASDAQ: NVDA). Over the past two years, Nvidia has dominated the market, though expectations for 2025 may not reach the same heights. The company is poised to benefit as AI and cloud computing remain in high demand, fueling its sales of graphics processing units (GPUs).

Nvidia’s upcoming Blackwell architecture is set to significantly outpace the current Hopper model, with full-scale production expected in 2025. Regardless of its prior surge, Wall Street anticipates a 51% revenue increase for Nvidia next year, which supports the current stock valuation. Investors should approach carefully, as performance like in 2023 and 2024 is unlikely to be repeated.

Seize this Second Chance at Investment

Ever think you missed out on hot stock picks? This is a new opportunity you won’t want to overlook.

Occasionally, expert analysts issue a “Double Down” stock recommendation for companies they believe are ready to rise. If you’re concerned about missing your chance to invest, now is the optimal time to act before it’s too late. Here are some compelling examples:

- Nvidia: A $1,000 investment when we doubled down in 2009 would be worth $356,125!*

- Apple: A $1,000 stake when we doubled down in 2008 would now be $46,959!*

- Netflix: A $1,000 investment from 2004 would have grown to $499,141!*

At this moment, we’re providing “Double Down” alerts for three exceptional companies, and opportunities like these don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Members of The Motley Fool’s board include prominent figures from companies like Amazon and Alphabet. The Motley Fool has positions in and endorses a range of companies, including Nvidia, Apple, and PayPal.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.

“`