Remember the insightful quote by Steve Jobs, “People don’t know what they want until you show it to them.” More than 250 articles penned on the Seeking Alpha platform and countless engaging discussions on the Seeking Alpha Investing Experts podcast may have pegged me as an ETF enthusiast. And indeed, I am an ETF geek – no surprise there! But don’t go thinking I don’t have a soft spot for stocks. There’s a particular breed of stock that has been sitting idly on the shelf, waiting for the perfect moment to shine. This neglected strategy, christened “Yield At a Reasonable Price,” or simply, YARP, is about to make a grand re-entry.

Unveiling YARP: A fresh take on dividend stock selection

Conventional dividend investing methodologies often fall short in addressing the paramount need for defense in income investing. Shielding the portfolio from market downturns is not merely about outperforming the broader stock market. It comes down to safeguarding our hard-earned dollars, preserving our retirement dreams from being shattered by the tempestuous financial markets. A 3-5% dividend yield doesn’t offer much consolation when your principal is hemorrhaging multiples of that amount.

The primary objective? Yield and total return, but with the highest priority placed on risk management. This often-overlooked facet of investment reality is crucial, especially in today’s landscape dominated by indexing, algorithms, and a surge in speculative retail investor interest.

Promoting a defense-first approach

Emotions run high when markets turn volatile, and the notion that “dividend equals safe” crumbles in the face of adversity. In severe market downturns, almost all equities fall in unison. The scarcity of stocks meeting the stringent YARP criteria during the 2008 and early 2020 downturns comes as no surprise – in a bear market or a severe market crash, very few stocks escape unscathed.

So, how should dividend investors confront this harsh reality? The answer is to play defense – not just offense. It’s about having a robust process and a mechanism that alerts when the risk of a market freefall is uncharacteristically high.

Red flags with covered calls

Covered call ETFs have their allure, but they carry a significant risk. Emphasizing the steady receipt of the call premium leaves them exposed to swift market declines. Earning 1% per month sounds enticing until a 10% downturn over three months throws a wrench in the works, steering the ETF into a disheartening downtrend.

Market conditions wax and wane, and covered call writing can turn troublesome. My investment mantra has always been to “Avoid Big Loss (ABL).” Whether it’s SPY, a dividend yield ETF, or a covered call ETF, they are all susceptible to “the big loss” when the market takes a turn for the worse.

Shedding all my covered call ETFs in favor of a strategy I crafted years ago was a bold move, especially amidst persistent relative underperformance of dividend stocks. While I remain a staunch advocate of ETF-focused investment, this reinvigorated approach has found a firm place in my investment process and can even be applied to dividend ETFs.

The YARP saga and its methodology

A few summers back, I tasked my then 19-year-old son, an aspiring investment professional, to critique my investment decisions. Amidst this enriching collaboration, the YARP strategy took root, amalgamating rigorous stock screening and dividend stock selection with my 40+ years of technical analysis experience.

The objective was to curate a watchlist of financially robust stocks and meticulously track their ex-dividend dates each quarter. The heart of YARP is to unearth stocks that offer a yield at a reasonable price – a thoughtful fusion of income and risk management.

The YARP Approach: A New Dawn for Dividend Investors

Why YARP Stands Out

For investors seeking income, the dividend stock landscape can be treacherous. Traditional approaches like Dividend Aristocrats, high-yield stocks, and covered call option writing may present pitfalls in the quest for steady returns. However, the Yield And Return Play (YARP) strategy is a unique beacon in this financial fog.

While strategies like Dividend Aristocrats failed investors during the 2020 market crash, the YARP method takes a different route. High-yield stocks may lure investors with tantalizing returns, but without understanding the associated risks, they can lead to poor investments. Covered call option writing, touted during market volatility, does not offer the same stability as dividend income. Similarly, hybrid income investments carry risks despite their appealing yields. In this minefield of investment approaches, YARP stands as a beacon of reason.

A Modern Approach to Income Generation

YARP seeks to provide a reliable stream of dividend income while proactively managing potential losses. This innovative strategy combines the best elements of algorithmic and human investing techniques, setting it apart from traditional income approaches.

The driving force behind YARP is a deceptively simple observation of the stock market. By analyzing the historical dividend yield of fundamentally solid stocks over the past seven years, the YARP Ratio evaluates their attractiveness in the intermediate and long term. This process allows for a methodical approach to income generation, setting it apart from the traditional methods of stock analysis.

Understanding the YARP Ratio

To calculate the YARP Ratio, the annual dividend yield of a stock (or ETF) is observed over the past seven years. The current annual dividend yield is then compared to its percentile within this historical data, typically using the “trailing 12-month yield.” This approach enables the identification of stocks with ‘cheap’ yields, offering an opportunity for long-term investment.

The goal of YARP is to purchase stocks when their yield is ‘cheap’ and hold them until they reach the ‘expensive’ end of their historical range. This value investing angle, combined with chart analysis, underscores the comprehensive nature of YARP’s stock selection approach.

A Total Return Approach

Unlike traditional dividend investment approaches that focus solely on the yield, YARP is designed as a total return investment strategy. By addressing the price-only component of dividend stocks, YARP ensures a balanced approach, giving equal weight to both yield and price appreciation.

This comprehensive strategy aims to provide long-term stability and growth, underpinning the YARP approach with a solid foundation for income and sustainable returns. As the financial world evolves, YARP emerges as a forward-looking strategy, reshaping the landscape for dividend investors and setting new standards for income generation.

Unlocking the Secrets of YARP Ratio Investing

Investors often seek a method to maintain a consistent purpose of steadily rising account value while mitigating risk. For those looking to implement a “low standard deviation” approach, Young’s Accumulation and Retirement Portfolio (YARP) ratio may hold the key.

What Makes YARP Stocks Unique

YARP stocks are characterized by several distinctive traits:

- A “margin of safety” due to their historically high dividend yield

- Underpricing on a long-term basis, offering higher return potential than the typical stock

- Sufficient yield, even as low as 2-3%, making them suitable for a low standard deviation strategy

- Price action indicating a potential transition from “cheap” to competitive long-term total return

Understanding YARP Ratio Yield Zones

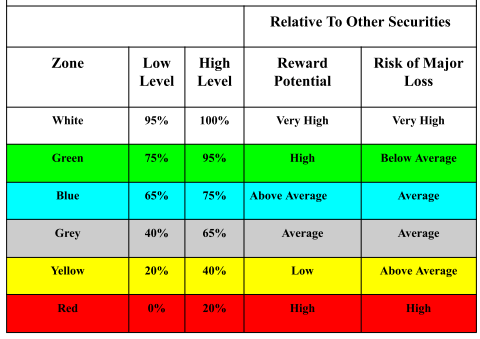

The YARP Ratio can be used to identify six distinct “risk zones” based on the calculated value, offering a roadmap for investors seeking to navigate the market terrain.

White Zone: Where Uncertainty Meets Upside

A stock’s YARP Ratio close to 100% signals the highest historical dividend yield. However, this zone also harbors the highest level of uncertainty, akin to catching a “falling knife” in the market.

Green Zone: The Sweet Spot

With a YARP Ratio between 75% and 95%, the green zone represents the “sweet spot” for potential investment. It offers a balance between value and growth.

Blue Zone: Momentum and Missed Opportunities

The blue zone signifies an existing stock upswing or a fleeting buying opportunity, emphasizing the need for supplementary data to make informed decisions.

Grey Zone: Standing at the Crossroads

Similar to a “grey area,” this zone indicates potential appreciation but with heightened risk, suggesting a holding pattern rather than aggressive buying or selling.

Yellow Zone: Profits and Watchful Waiting

A transition from green to yellow may signal a profitable position, prompting vigilance rather than immediate action, as the stock nears the end of its upward cycle.

Red Zone: High Reward, High Risk

While offering the highest reward potential, the red zone also entails significant risk, calling for cautious investment strategies and limited capital exposure.

Navigating Exceptions with YARP Ratio

When the YARP Ratio surpasses 98%, caution is advised. Similar to trying to catch a falling knife, a high YARP Ratio percentile may indicate an ongoing decline in the security’s price, warranting careful consideration before investment.

Implementing YARP in Investment Decisions

While the YARP Ratio provides valuable insights, it is not a standalone investment strategy. It must be coupled with technical analysis and price trend assessments to make well-informed buying and selling decisions, offering a comprehensive approach to value-driven investing.

The Strategic Play: Profiting from YARP Stocks

It’s important for investors to have a set of guidelines or rules to follow when navigating the unpredictable world of stock trading. Acclaimed financial analyst, Mr. X, has recently introduced the concept of YARP (Yield At a Reasonable Price) ratio as a means to gauge the viability of investing in particular stocks. This ratio, combined with a discerning analysis of stock price trends, forms the bedrock of Mr. X’s strategic investment approach. Mr. X, a seasoned professional in the financial domain, has found success in utilizing the YARP strategy across various market conditions. The intention behind this article is to provide a detailed insight into Mr. X’s YARP-based investment philosophy and spotlight three promising stocks – Entergy (ETR), International Paper (IP), and Gilead Sciences (GILD).

The YARP Framework: Rules of Engagement

In a bid to demystify the YARP approach, Mr. X delineates his set of ‘BUY’ and ‘SELL’ rules. A YARP ratio falling within the range of 95% to 75%, coupled with a declining trend, signifies a promising purchase opportunity. On the other hand, the decision to sell hinges on two occurrences – a YARP ratio surpassing 98% or a 10% decline from the stock’s highest point after purchase. This tactical strategy is finely calibrated to optimize portfolio performance in the rollercoaster of market dynamics. The YARP strategy, as conceptualized by Mr. X, is inherently dynamic and adaptive, tailored to seize growth opportunities while mitigating potential downward shifts in stock value.

Top 3 YARP Stock Picks

The current YARP landscape presents three alluring investment prospects in the form of Entergy (ETR), International Paper (IP), and Gilead Sciences (GILD). These selections, emblematic of three distinct sectors – utilities, materials, and healthcare, showcase the diverse scope of YARP investment opportunities. Notably, Mr. X’s stringent fiscal prudence is evident as he gravitates toward stocks with valuation grades in the B range, reflecting his cautious optimism in the current market scenario. Emphasizing the criticality of the profitability grade, Mr. X underscores the significance of stable dividend performance and a favorable yield balance within the YARP investment milieu.

Finessing the YARP Criteria: Navigating Dividend Dynamics

Supplementing the evaluation of the YARP ratio and stock price trends, Mr. X underscores the pivotal role of dividends in his investment strategy. A steady and reliable dividend payment, accompanied by a reasonable yield, is indispensable in the YARP equation. Highlighting the dividend stability, Mr. X strategically maneuvers within the tactical paradigm of YARP, ensuring a judicious balance between yield prospects and risk tolerance. Mr. X’s discerning approach to YARP investments is underscored by his consummate focus on sustaining an optimal dividend portfolio yield, transcending the transient market fluctuations.

Charting the Course: Technical Insights

Driving his investment decisions with meticulous analysis and technical expertise, Mr. X delves into the finer details of the YARP investment spectrum. The confluence of exhaustive technical charts and dividend yield history unfurls a nuanced outlook, signaling a compelling investment narrative. The intrinsic value inherent in these stocks is animated through a lucid interpretation of technical analytics, lending a comprehensive perspective to the YARP investment ethos.

The Ex-dividend Conundrum: A Tactical Approach

Hingeing on the strategic timing of ex-dividend dates, Mr. X orchestrates a tactical approach to maximize the dividend potential within the YARP framework. The sagacity of capitalizing on the ex-dividend date, juxtaposed with a long-term investment outlook, reflects the subtlety of Mr. X’s YARP investment philosophy. The deliberate synchronization of stock ownership and subsequent dividend cycles epitomizes Mr. X’s craft in harmonizing tactical investment maneuvers with enduring, long-term growth prospects.

Final Resonance: Navigating the Long-term Terrain

Mr. X’s foresight in navigating the nuanced terrain of YARP investments is underscored by his recognition of the duality embedded within the investment paradigm. The dexterous interplay between tactical maneuvers and long-term investment aspirations characterizes the holistic approach engineered by Mr. X. The profundity of strategic investment endeavors is vividly mirrored in Mr. X’s perspicacious assemblage of YARP investment principles, undergirded by a judicious blend of astute foresight and calculated risk management.