Top Nasdaq Stocks to Watch for 2025: Meta, Alphabet, ASML, PayPal, and MercadoLibre

The Nasdaq Composite (NASDAQINDEX: ^IXIC) has shown impressive performance, outpacing the broader S&P 500 (SNPINDEX: ^GSPC) in 2024 with gains of 28.6% compared to the S&P 500’s 23.3%. As we look toward 2025, it’s likely that this trend will continue, and some companies in the Nasdaq Composite may exceed these impressive figures.

The stocks I recommend for 2025 include Meta Platforms (NASDAQ: META), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), ASML (NASDAQ: ASML), PayPal (NASDAQ: PYPL), and MercadoLibre (NASDAQ: MELI). All five appear to be strong investment opportunities worth considering now.

Where to invest $1,000 right now? Our analyst team just identified the 10 best stocks to buy at this moment. See the 10 stocks »

Investing in Artificial Intelligence: Meta, Alphabet, and ASML

Artificial intelligence (AI) emerged as a major focus for investors in 2023 and 2024, and it is likely to repeat this trend in 2025. Among the top picks for AI investments are Meta, Alphabet, and ASML, each contributing uniquely to this growing field.

Meta and Alphabet are widely recognized for their popular platforms, Facebook and Google. These tech giants earn most of their revenue from advertising and have made significant investments in AI technology. They leverage advanced algorithms to target ads effectively, and both companies host top-performing generative AI models, including Google Gemini and Meta’s Llama.

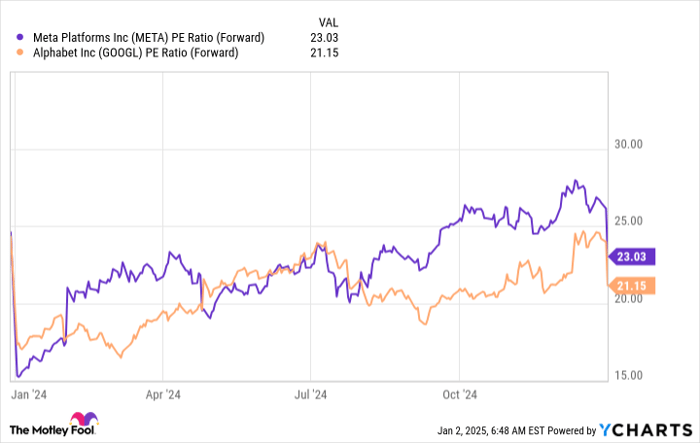

Despite their leading market roles and AI advancements, both stocks are trading at appealing valuations.

META PE Ratio (Forward) data by YCharts

Meta is priced at 23 times its forward earnings, while Alphabet is at 21.2 times, both figures considerably lower than the Nasdaq 100 index’s forward price-to-earnings (P/E) ratio of 27.1. This makes Meta and Alphabet attractive investments for 2025.

ASML represents a different angle on AI investment; it manufactures the machines essential for microchip production. The company specializes in extreme ultraviolet (EUV) lithography machines, holding a global monopoly in this domain. However, restrictions imposed by Western governments have prevented ASML from selling certain equipment to China and its partners, leading to a revision in its 2025 forecasts.

Following this news, ASML’s stock dropped significantly. Yet, management remains optimistic about the long-term growth outlook, even maintaining its previous 2030 revenue projections set in 2022.

Given its monopoly status and promising growth trajectory, ASML stands out as an enticing investment. Currently down about 35% from its peak, this stock presents a valuable buying opportunity.

Value Opportunities: PayPal and MercadoLibre

While the prior three stocks are geared toward growth investing, PayPal and MercadoLibre offer promising value opportunities.

PayPal has shown substantial recovery under the leadership of its new CEO Alex Chriss. Significant changes are yielding results, with free cash flow increasing markedly since his appointment in September 2023.

PYPL Free Cash Flow data by YCharts

This growth in cash flow facilitates share buybacks, already resulting in a 7% reduction in outstanding shares since Chriss took over. This trend may continue, suggesting strong earnings growth for PayPal and the potential for stock performance that surpasses the market average.

MercadoLibre is the leading e-commerce platform in Latin America, with a fintech division comparable to PayPal’s offerings. Recent challenges, including bad debts in its credit card segment, have impacted its profits and led to a sharp decline in stock value, down 20% from its peak recently.

However, analysts predict this dip will be temporary, forecasting a 38% increase in earnings per share (EPS) for 2025—an attractive growth rate for a stock trading at 38 times forward earnings.

With ample growth opportunities in Latin America, MercadoLibre represents a solid investment choice, one that has proven successful and is likely to continue this trend into 2025.

Considering a $1,000 Investment in Meta Platforms?

Before investing in Meta Platforms, keep this in mind:

The Motley Fool Stock Advisor analyst team has identified what they view as the 10 best stocks to buy now—Meta Platforms is not among them. The selected stocks have the potential for significant returns over the next few years.

Reflect on past winners, like Nvidia, which made this list on April 15, 2005… if you had invested $1,000 then, your investment would now be worth $915,786!*

Stock Advisor offers an accessible strategy for investors, providing portfolio-building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokesperson for Facebook, and sister of Meta Platforms CEO Mark Zuckerberg, is also a board member at The Motley Fool. Keithen Drury holds positions in ASML, Alphabet, MercadoLibre, and PayPal. The Motley Fool recommends and has positions in ASML, Alphabet, MercadoLibre, Meta Platforms, and PayPal. The Motley Fool suggests options such as long January 2027 $42.50 calls on PayPal and short March 2025 $85 calls on PayPal. Full disclosure policy can be found on their site.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.