If I emphasized it once, I emphasized it a dozen times in December alone…

2023 took an unexpected turn, defying all earlier predictions.

Approximately a year ago, an article entitled “My Top REIT Picks for 2023” cited a Nasdaq article that was notably optimistic:

“In our view, 2023 will be a year of important ‘transitions.’ We believe the first transition will be away from a bear market to a potential bull.

“History suggests attractive forward returns for stocks after the type of drawdowns we witnessed in 2022, but the timing of the market boom is unclear and the process will be bumpy, in our view. Longer-term, returns for balanced stock and bond portfolios look attractive to us again, with valuations more reasonable and bond yields above long-term inflation expectations.

However, even then, I appended some caveats to that assessment:

“We believe the next two major transitions involve an evolution of investors’ concerns: away from inflation and towards recession, as well as away from pandemic-related disruptions towards geopolitical ones.”

Most individuals, including myself, were, in fact, predicting a recession.

Given the prevailing inflationary conditions, a recession seemed the most logical outcome.

Reflecting on it now, I must acknowledge my erroneous economic projections. Yet, was there any other “logical conclusion” to draw upon at the time? On that, I stand firm.

The Year of the Recession That Didn’t Happen

This leads me to reiterate another point I have been making…

The unanticipated turn of events in 2023 underscores the unpredictability of the future. This was also reflected in “My Top REIT Picks for 2023” when I stated:

“Some say we’re in for a recession in the first half of the year. Some say we’re in for a recession in the second half. Some say we’re already in a recession and that won’t change for a while. And some say we’ll avoid a recession altogether.”

Yet, “Nobody’s throwing parties of anticipation about picking up profits left and right like gold nuggets on the ground.”

Evidently, the camp predicting a no-recession scenario emerged victorious. However, I struggle to recall any of those forecasts being remotely close to accurate.

This is not to discredit anyone. It should be noted that I have already admitted, and continue to admit, the imperfections in my predictions.

The multitude of national and global factors at play, from consumer sentiment to political priorities to international conflicts, made it inherently challenging to foresee the outcome.

The extent of these factors is usually minimal or at least manageable in some years, possibly allowing analysts to make reasonably accurate predictions.

We (hopefully) scrutinize the current data from various perspectives, (hopefully) set aside our egos, and (hopefully) consider historical trends and outliers…

Only to arrive at conclusions open to critique and commentary from all quarters.

Our track records are usually shaped by our experience, education, and willingness to keep learning.

Yet, these records are never without flaws, and sometimes our forecasts miss the mark by a considerable margin.

The Year of the Value Stock That Didn’t Happen

The Nasdaq article I referred to earlier, while accurately identifying the “geopolitical” disruptions, failed to materialize the predicted recession.

Moreover, it foresaw:

“… the end of ‘growth’ stock dominance and an increased focus on consistent cash flow, dividend, and coupon generators – what RiverFront calls the ‘P.A.T.T.Y.’ (Pay Attention to the Yield) theme. Under these circumstances, we see modest upside for stocks and bonds in our base case scenario, with preferences for consistent cash flow generators, cyclicals, smaller-cap companies, and traditional ‘value’ plays like energy and financials.”

When I then remarked how, “Since REITs are ‘traditional value plays’ as well, that analysis ultimately bodes well for the sector”…

It led to two erroneous analyses rather than one.

On a similar note, I also had to acknowledge:

“2022 was a tough year for real estate investment trust (“REIT”) investors. A very tough year, in fact. This is the first time in over a decade that my top picks lost money.

“I’m always happy to show you the proof of my stock-market wins. But I have to be just as honest about the losses.”

As previously stated, seasoned analysts tend to have impressive track records, albeit not flawless ones.

This is why analysts and readers alike need to anticipate the best but be prepared for the worst. This brings me to a final point before delving into the events of 2023.

This is a quote from the previous article, appearing just after my concurrence with Nasdaq’s assessment:

“But even if that isn’t the case [that value stocks are the biggest winners of 2023], I believe the companies below are worth buying and holding onto for the long-term.”

Realty Income Corporation (O)

As many of my followers know, Realty Income is my largest holding as I view this as the ultimate “Sleep Well At Night” stock, or “SWAN” for short. The triple-net real estate investment trust (“REIT”) has been operating

Realty Income Vs Digital Realty Trust: A Financial Comparison

Realty Income Corporation (O)

Sometimes, a company stands the test of time, emerging as a venerable, beacon of consistency. Realty Income Corporation, affectionately known as “The Monthly Dividend Company,” has been a torchbearer in the real estate industry since its public debut in 1994. The company’s impressive legacy dates back even further, to 1969, and its steadfast performance has dazzled investors and analysts alike.

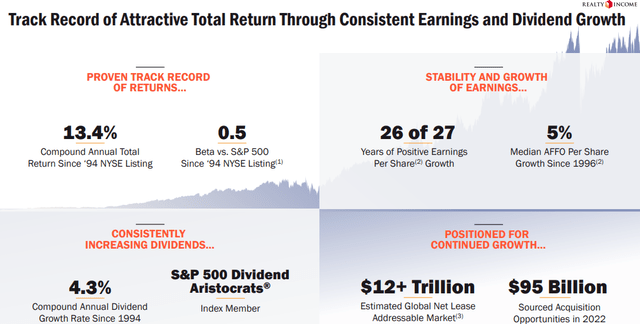

During its tenure as a publicly traded entity, Realty Income has not only consistently bolstered growth in its adjusted funds from operations (“AFFO”) per share but has also raised its dividend payouts over 29 consecutive years. The company’s resilience is underscored by its 5% median AFFO per share growth since 1996, an achievement that few can rival.

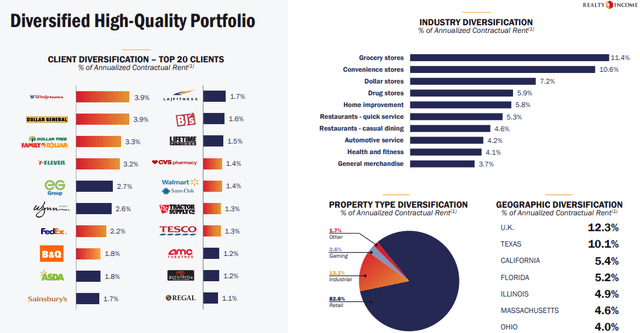

Realty Income specializes in the acquisition, ownership, and management of net-leased commercial properties, spanning a staggering 262.6 million square feet across 13,282 properties. Its diversified footprint sprawls across all 50 states, as well as the U.K., Spain, Italy, and Ireland.

Anchoring its portfolio are stalwarts such as Walgreens, Dollar Tree, and 7-Eleven. With retail properties constituting the lion’s share at 82.6%, the company’s resilience is emphasized by its balanced exposure to industrial and gaming properties, comprising 13.1% and 2.6%, respectively.

Undoubtedly, 2023 was a trying year for Realty Income, as its stock price nosedived by 10.00%. Nonetheless, the company’s resurgence, sprinting a remarkable 24.23% in the latter part of the year, exemplifies its unwavering tenacity in turbulent market waters.

For astute investors, the tumultuous landscape presents an opportunity to snap up Realty Income shares at a bargain, as the stock trades at a discount relative to its historical average, echoed by a P/AFFO of 14.32x versus its 10-year average AFFO multiple of 18.78x.

With an average AFFO growth rate of 5.28% and a dividend growth rate of 3.92% over the last decade, coupled with a sturdy 5.36% dividend yield, Realty Income emerges as a compelling proposition, warranting a “Buy” rating.

Digital Realty Trust, Inc. (DLR)

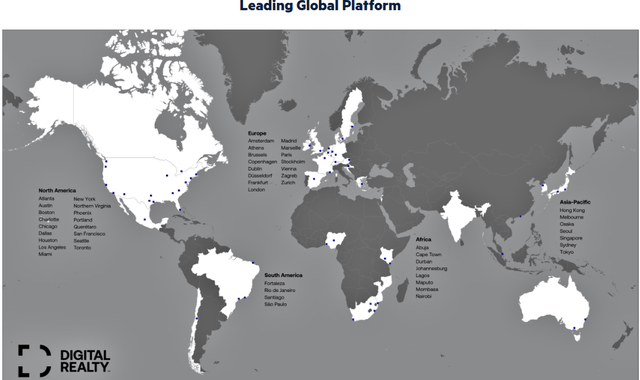

In a world dominated by data, Digital Realty Trust, Inc. has carved a niche for itself as a leading data center Real Estate Investment Trust (REIT). The company wields a global platform, boasting over 300 data centers across 25 countries, spread over 6 continents, exemplifying its extensive reach and influence.

Catering to a constellation of corporate giants like Amazon, Google Cloud, and Microsoft Azure, Digital Realty’s prowess is magnified by the fact that nearly 50% of its annualized recurring revenue (“ARR”) is derived from its top 20 customers, symbolizing an undeniable stronghold in the digital arena.

Mastering the art of adaptability, Digital Realty capitalized on the AI surge in 2023, orchestrating a remarkable feat by augmenting its stock price by a staggering 55.60% in the latter part of the year, emblematic of the company’s adeptness at seizing opportunities amidst tumultuous market dynamics.

The ascent of AI bodes well for Digital Realty, as it is expected to fuel exponential growth in enterprise computing demands, a tailwind that is poised to amplify the demand for its server rack space nestled within its data centers.

While both Realty Income and Digital Realty Trust weathered tumultuous terrain in 2023, they emerged as trailblazers in their respective domains, underpinning the notion that resilience, adaptability, and sagacity are quintessential traits for enduring market vagaries.

Indeed, amidst the tempests of 2023, these stalwarts epitomized the very essence of the age-old adage: when the going gets tough, the tough get going.

For investors, the tale of these two real estate titans surmises as a clarion call – a testament to the enduring nature of well-grounded, disciplined investment principles in the face of market vicissitudes.

Analyzing High-Potential REITs: Digital Realty Trust and American Tower

According to financial data, Digital Realty went public in 2004 and has consistently increased its dividend every year since 2005. Industry analysts predict that the dividend will remain at $4.88 per share in 2023, the same rate it was in 2022. There is also a projected moderate growth in Adjusted Funds from Operations (AFFO) of 3% for the upcoming year and a 7% growth in 2025.

Digital Realty Trust: A Closer Look

Over the last decade, Digital Realty Trust has maintained an average AFFO growth rate of 5.08% and a dividend growth rate of 5.11%. The stock currently offers a 3.63% dividend yield, well-covered with an anticipated 2023 AFFO payout ratio of 80.52%.

American Tower Corporation (AMT)

American Tower Corporation (AMT) was established in 1995 and has grown to become one of the largest global Real Estate Investment Trusts (REITs) focusing on the development, ownership, and operation of broadcast and wireless communications real estate. AMT boasts a market capitalization of nearly $101.0 billion and a portfolio of approximately 225,000 multi-tenant communication sites spread across 25 countries and 6 continents.

AMT’s diverse portfolio includes about 43,000 towers in the U.S. and Canada, over 180,000 international towers, and roughly 1,700 distributed antenna systems. Moreover, the company has 28 highly interconnected data centers based in the U.S.

Advantages of American Tower

American Tower’s communication sites cater to a wide range of clients, including governmental agencies, international telecommunications corporations, broadband and media providers, and mobile network operators. The cell tower REIT’s core business model revolves around colocation, allowing the hosting of multiple carriers on a single tower, thereby reducing infrastructure costs and increasing profitability.

AMT’s stock price remained relatively flat in 2023, with a total price return of less than 1%. However, considering the dividends paid, AMT yielded closer to 3-4% during the year. The stock price experienced a dip of approximately -26% from January to early October, but then rebounded, reflecting a gain of approximately 36% in the last few months of 2023.

Market Forces and Business Fundamentals

It’s essential to note that the amelioration in the stock price was predominantly influenced by market factors, particularly the yield on bonds, rather than any discernible business fundamentals. Similarly, the earlier decline in the stock price was more a reflection of market forces than underlying business conditions.

In terms of business performance, AMT’s AFFO growth slowed to 1% in 2022 and is projected to increase by less than 1% in 2023. Nonetheless, this is seen as a transient anomaly, given that AMT has historically delivered an average AFFO growth rate of 10.40% over the past decade. Analysts anticipate AFFO growth of 7% in 2024 and 8% in 2025.

Currently, AMT offers a 2.99% dividend yield, with an expected 2023 AFFO payout ratio of around 65%. Furthermore, the stock is trading at a Price/AFFO ratio of 22.02x, relative to its 10-year average of 22.80x.

Real Estate Investment Trusts (REITs) Report: VICI Properties and Agree Realty

VICI Properties Inc. (VICI)

Known for its strategic investments in experiential real estate, VICI Properties Inc. (VICI) boasts a vast portfolio of 127 million square feet, consisting of 93 experiential assets. Among them are 54 gaming properties as well as 39 non-gaming experiential properties, complemented by a recent acquisition of family entertainment centers through a sale-leaseback with Bowlero (BOWL).

The company’s ownership of 54 gaming facilities encompasses iconic trophy properties such as Caesars Palace, Excalibur, Harrah’s Las Vegas, The Mirage, and The Venetian Resort, collectively covering around 4.2 million square feet of gaming space and approximately 66,000 gaming units. Further enhancing its offerings, VICI owns 60,000 hotel rooms, over 500 retail outlets, and more than 500 nightclubs, sportsbooks, bars, and restaurants, alongside 4 championship golf courses and more than 30 acres of developable land adjacent to the Las Vegas Strip.

Amidst a relatively modest stock price performance in 2023, VICI saw a rally of 17.29% from its low point in the latter part of the year. The Federal Reserve’s indication of a possible halt in tightening had a pronounced impact, significantly aiding the rebound of VICI and other REITs and underscoring the influence of interest rates on market sentiment toward this sector.

In terms of financials, VICI has established an average adjusted funds from operations (AFFO) growth rate of 7.24% since 2019, and a corresponding dividend growth rate of 10.80%. Looking ahead, analysts have projected AFFO growth rates of 5% in 2024 and 4% in 2025.

Despite these projections falling slightly below the company’s historical averages, they still represent robust growth within the net lease REIT framework, with its current dividend yield of 5.21% sitting comfortably within an anticipated 2023 AFFO payout ratio of around 75%. At a price-to-AFFO ratio of 14.84x, compared to its normal multiple of 16.29x, VICI Properties Inc. remains an attractive investment prospect, warranting a ‘Buy’ rating.

Agree Realty Corporation (ADC)

Aligning itself with the net lease REIT sector, Agree Realty Corporation (ADC) specializes in acquiring, owning, and managing commercial real estate net leased to leading retailers in robust industries resistant to e-commerce and recession. Its portfolio consists of 2,084 commercial properties, totaling approximately 43.2 million square feet of gross leasable area, across 49 states, with a striking 99.7% lease rate and an average lease term of 8.6 years.

Throughout 2023, ADC experienced a 10.81% decline in its stock price, before staging a significant rally of 16.77% toward the year-end, akin to the broader REIT market’s response to the Federal Reserve’s policy stance. Analysts foresee a 4% increase in AFFO for 2024, moderating to 2% the following year yet remaining sufficiently robust within the net lease REIT framework.

With a dividend yield of 4.71% and an expected AFFO payout ratio of 73.55% for 2023, ADC’s current P/AFFO ratio stands at 15.88x, compared to an average multiple of 18.28x, indicating an opportune moment for investment, therefore warranting a ‘Buy’ rating.

In Closing

These REITs, VICI Properties Inc. and Agree Realty Corporation, constitute a significant portion of my portfolio, with exceptional investment potential anticipated. It’s noteworthy to see how the broader market dynamics, particularly the influence of the Federal Reserve’s policy, have buoyed the performance of these REITs. As an investor, I remain upbeat about the prospects of these companies, anticipating healthy returns over the coming year.

Reflecting on my investments in 2023, their performance, particularly Digital Realty Trust and American Tower, has been particularly gratifying. With significant exposure to net lease REITs, particularly in core positions such as Realty Income, Agree Realty, and VICI Properties, alongside Essential Properties Realty Trust (EPRT), 2024 holds promising prospects, further reinforced by the favorable outlook for these REITs. Here’s to a successful year ahead!