Nabors Industries Reports Significant Loss, Stock Struggles Amid Market Gains

Quarterly Loss Exceeds Expectations

Nabors Industries (NBR) reported a quarterly loss of $3.35 per share, significantly worse than the Zacks Consensus Estimate of a loss of $1.73. This is an improvement compared to the loss of $5.40 per share from the same quarter last year. These results have been adjusted for non-recurring items.

This quarterly outcome reflects an earnings surprise of -93.64%. In the previous quarter, Nabors was projected to lose $1.77 per share but instead posted a loss of $4.29, showing a surprise of -142.37%.

Revenue Decline Continues

Over the past four quarters, the company has consistently fallen short of consensus earnings-per-share (EPS) estimates.

For the quarter ending September 2024, Nabors, part of the Zacks Oil and Gas – Drilling industry, generated revenues of $731.81 million. This figure missed the Zacks Consensus Estimate by 2.46%, and is down from $744.14 million reported in the same quarter last year. Only once in the past four quarters has Nabors exceeded revenue expectations.

Future stock movements will depend largely on insights provided by management during the upcoming earnings call and their outlook for coming quarters.

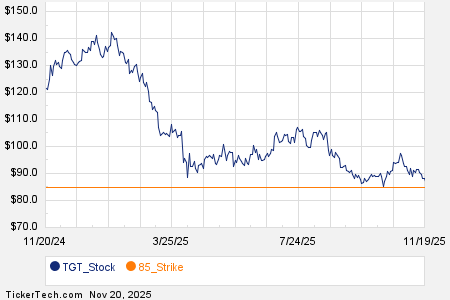

Nabors shares have dropped approximately 8.7% since the start of the year, while the S&P 500 has risen by 22.7%.

Future Prospects for Nabors

Investors are left wondering about the future for Nabors. One key approach to forecast this is to examine the company’s earnings outlook, which includes current consensus EPS expectations for future quarters and how those have shifted recently.

Research indicates a strong link between short-term stock performance and earnings estimate revisions. Investors can either track these revisions independently or utilize the Zacks Rank, a rating tool with a solid history of predicting stock performance based on earnings changes.

Prior to the recent earnings release, trend revisions for Nabors were mixed, resulting in a Zacks Rank #3 (Hold) for the stock, suggesting it will likely perform in line with the market in the near future. A complete list of Zacks #1 Rank (Strong Buy) stocks is available on their website.

Changes in estimates for future quarters and the current fiscal year will be worth monitoring. The current consensus EPS estimate is -$1.20 for the next quarter on projected revenues of $771.13 million and -$12.52 on expected revenues of $2.99 billion for the current fiscal year.

Investors should also be aware that industry outlook can greatly influence stock performance. At present, the Zacks Industry Rank places Oil and Gas – Drilling in the bottom 21% of over 250 industries. Historically, the top 50% of Zacks-ranked industries have outperformed the bottom 50% by more than two-to-one.

Industry Context with Transocean

Another player in the drilling sector, Transocean (RIG), has not yet reported its results for the quarter ended September 2024. Analysts expect Transocean to show a quarterly loss of $0.04 per share, an improvement of 88.9% year-over-year. The consensus EPS estimate has seen a notable 30% increase over the last month. Revenue expectations for Transocean stand at $936.23 million, marking a 29.9% rise from the same period last year.

Should You Consider Investing in Nabors?

If you are contemplating an investment in Nabors Industries Ltd. (NBR), you may wish to explore options that have greater potential in the next month. Zacks Investment Research offers insights into the top seven stocks to buy.

Since 1978, Zacks Investment Research has provided investors with valuable tools and independent research. Their Zacks Rank system has historically outperformed the S&P 500, showing an average gain of +24.08% per year from January 1, 1988, to May 6, 2024.

For further recommendations, including stocks poised for rapid growth, consider downloading Zacks’ free report on “5 Stocks Set to Double.”

Nabors Industries Ltd. (NBR): Free Stock Analysis Report

Transocean Ltd. (RIG): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.