The Nasdaq 100 Faces Major Decline Amid AI Investment Concerns

The Nasdaq 100 has experienced its largest quarterly drop in nearly three years, falling 8.3%. This downturn is fueled by increasing worries about a potential artificial intelligence (AI) bubble. The tech-focused index, already under pressure from tariff uncertainties, government spending cuts, and possible recession threats, saw renewed selling activity following warnings regarding a slowdown in AI-driven infrastructure investment.

AI Stocks Hit Hard

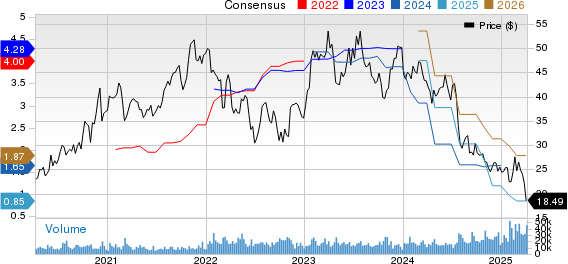

Leading tech companies that previously drove market gains have suffered steep declines. NVIDIA Corp. (NVDA) has dropped 28% from its January peak, while Broadcom Inc. (AVGO) has decreased by 33% since its December high. Other significant players—including Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), Alphabet Inc. (GOOG), and Meta Platforms Inc. (META)—have all seen at least a 20% reduction from their respective record highs.

Scrutiny Over AI Investments

Tech firms have invested heavily in data centers and AI chips to facilitate AI model development. Yet, concerns are mounting that this investment surge exceeds actual demand. Additionally, the emergence of DeepSeek, a Chinese startup that unveiled its R1 AI model in late January, has added to investor anxiety. According to Yahoo Finance, training the R1 model cost only $5.6 million—substantially lower than the $100 million needed for OpenAI’s GPT-4 model. This disparity raises important questions regarding AI investments and the potential for more cost-effective AI solutions to disrupt market stability.

Factors Behind Investor Concerns

Investor apprehension escalated last week when Alibaba’s co-founder warned that the growth of AI infrastructure exceeds the demand for AI services. Moreover, reports indicated that Microsoft, despite allocating $80 billion for data center growth in 2024, has canceled certain projects in the U.S. and Europe due to concerns about market oversupply.

Future Outlook

Even amidst this uncertainty, Microsoft, Alphabet, Amazon, and Meta have committed to over $300 billion in capital expenditures for their current fiscal years. While recent sell-offs continue, some analysts identify possible buying opportunities. The Nasdaq 100, which had more than doubled from its December 2022 low by February 2024, is facing valuation scrutiny. Presently, the index trades at 24 times estimated profits, above its two-decade average of 20 times, according to Bloomberg.

In recent months, the Nasdaq 100’s price-to-earnings (P/E) ratio has decreased from 41.24X in early September 2024 to 29.27X by the end of March 2025. Ben Reitzes, an analyst at Melius Research, suggests that NVIDIA—a significant AI beneficiary—currently has a valuation of 23 times forward earnings, which appears “defensive,” as noted by Bloomberg.

Additionally, reports indicate that OpenAI expects its revenues to triple this year and is negotiating to raise up to $40 billion from investors, including SoftBank Group Corp.

Conclusion

While lower valuations may entice some investors, overall sentiment is likely to remain moderately bearish. Last year’s significant investments in the tech sector will require time to yield results. In this context, investors with a higher risk tolerance might consider the Nasdaq-100-based exchange-traded fund (ETF) Invesco QQQ Trust, Series 1 (QQQ), which currently holds a Zacks Rank #3 (Hold).

Subscribe for Key ETF Insights

Zacks’ free Fund Newsletter delivers top news and analysis, along with information on top-performing ETFs, each week. Get it free >>

For the latest recommendations from Zacks Investment Research, download the report “7 Best Stocks for the Next 30 Days.” Click to access this free report.

Alphabet Inc. (GOOG) : Free Stock Analysis report

Amazon.com, Inc. (AMZN) : Free Stock Analysis report

Microsoft Corporation (MSFT) : Free Stock Analysis report

NVIDIA Corporation (NVDA) : Free Stock Analysis report

Broadcom Inc. (AVGO) : Free Stock Analysis report

Meta Platforms, Inc. (META) : Free Stock Analysis report

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.