Nvidia Stock Presents a Strong Buy Opportunity Amid Market Corrections

The Nasdaq index has entered correction territory, experiencing a decline of more than 10% from its all-time high. While this might appear significant, such corrections typically happen every year, and investors should be prepared for these fluctuations.

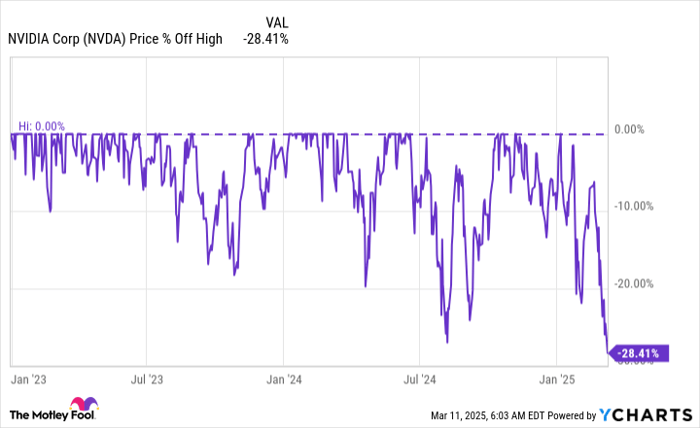

Instead of panicking, investors can focus on identifying attractive buying opportunities, particularly in stocks that may have experienced heavier losses than the broader market. Currently, my top pick is Nvidia (NASDAQ: NVDA), which is down nearly 30% from its peak and now presents an appealing investment.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Nvidia’s Stock Faces Significant Drawdown

Nvidia manufactures graphics processing units (GPUs) essential for demanding computing tasks. Their ability to process several calculations in parallel makes them especially suited for artificial intelligence (AI) training. Although competitors exist, Nvidia’s products stand out, making it a leader in this sector.

As businesses invest billions into their AI infrastructures, Nvidia has reaped substantial rewards, resulting in its stock rising 922% since the start of 2023. Such an impressive increase explains why we are now witnessing aggressive sell-offs; investors are eager to realize profits before potential losses mount. Despite this, several factors continue to support Nvidia’s growth, and this recent correction could provide valuable purchasing opportunities.

NVDA data by YCharts

Despite Market Doubts, Nvidia Remains Resilient

The year 2025 is expected to set records for capital expenditures among major tech firms, primarily targeting AI computing capacity expansion, which benefits Nvidia. Additionally, Nvidia’s new chip architecture, Blackwell, is becoming more widely adopted, prompting clients to upgrade their GPUs with more advanced models.

These trends contribute positively to Nvidia’s Stock, with Wall Street forecasting a 56% revenue increase to $204 billion this year. However, sustaining this growth hinges on tech companies continuing their robust spending, a factor that could be disrupted by potential economic weakening due to trade tensions, impacting Nvidia’s sales.

I don’t anticipate drastic changes, as companies vie for AI leadership. If competitors fear economic downturns and reduce investments, it may actually motivate others to maintain or increase spending to seize market advantages. Many tech giants possess sufficient cash flows to sustain this level of investment without issue.

Ultimately, while short-term concerns might unsettle some investors, the long-term strategy should favor ongoing spending in AI resources, which will consequently benefit Nvidia.

I believe Nvidia’s Stock remains a solid buy at current price levels, particularly given the present market conditions.

Nvidia Stock Appears Undervalued Now

Throughout Nvidia’s impressive growth, its stock has rarely been categorized as cheap. Yet, it is currently trading at 36 times trailing earnings and 24 times forward earnings.

NVDA PE Ratio data by YCharts

This valuation presents one of the most attractive entry points for investors in quite some time. While it’s uncertain when this downturn will conclude, I am confident that Nvidia will remain fundamentally robust, underpinned by ongoing substantial AI investments.

Though I view Nvidia as a strong Stock to acquire at this moment, I anticipate the market may continue to fluctuate until a favorable development triggers a turnaround.

Seize This Second Chance for a Potentially Lucrative Investment

If you’ve ever felt you missed out on buying successful stocks, now is your opportunity.

On rare occasions, our team of analysts issues a “Double Down” Stock recommendation for companies poised for growth. If you think you’ve already missed your chance to invest, this is the time to act before it’s too late. The data validates this approach:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $282,016!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,869!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $482,720!*

At present, we are issuing “Double Down” alerts for three exceptional companies, each presenting a rare investment opportunity.

Continue »

*Stock Advisor returns as of March 10, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.