Tech Stock Valuations Draw Parallels to Dot-Com Bubble

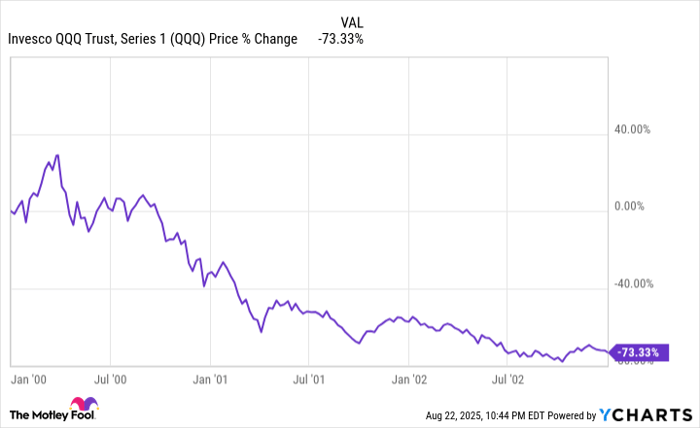

Technology stock performance is currently mirroring the dot-com bubble of late 1999, with the Nasdaq Composite Index (NASDAQ: ^IXIC) experiencing a 40% appreciation since its April 2023 low. Investors are concerned as the valuation levels of tech stocks approach those seen at the peak before the Nasdaq’s 78% drop over three years beginning in March 2000. Data shows the relative performance of tech stocks has exceeded that seen during the height of the dot-com era.

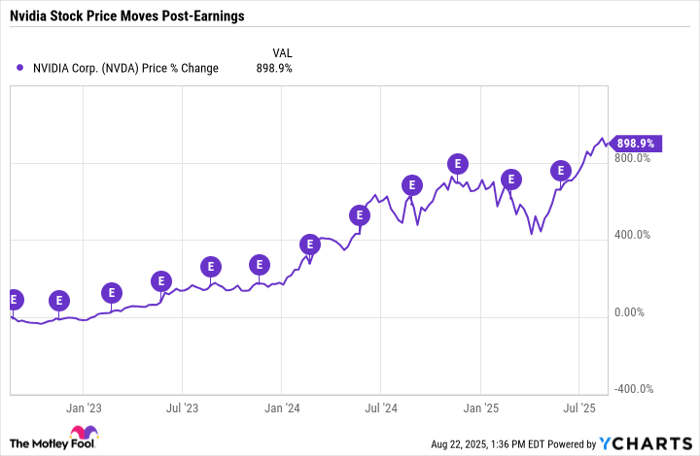

The Schiller price-to-earnings (P/E) ratio, a key indicator of valuation, has reached its highest level since 1999, indicating that tech stocks may be overvalued. In 2022, the Nasdaq fell by 33.1% but saw a resurgence driven by advancements in artificial intelligence, particularly following the debut of ChatGPT. While some investors are worried about a potential bubble, there are counter-narratives suggesting today’s tech giants, unlike their dot-com predecessors, are financially robust and diversified.