Market Update: Stocks Bounce Back Amid Fed Meeting Anticipation

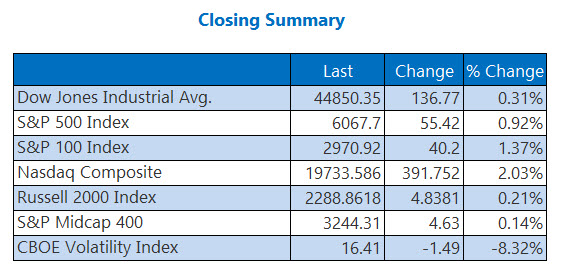

Stocks gained momentum today as investors await the conclusion of the Federal Reserve’s two-day policy meeting. According to the CME FedWatch tool, there’s a strong likelihood that interest rates will remain unchanged. The Dow Jones Industrial Average posted modest gains, while the Nasdaq and S&P 500 made strides to recover from substantial losses yesterday, which marked their largest declines since mid-December due to AI market reactions.

Discover more about today’s market highlights:

- Pharmaceutical leader prepares for earnings announcement.

- Analyst upgrade sparks a flurry of call trades.

- Additionally, travel stocks enjoy a surge after earnings; a disheartening update from Boeing; and a must-watch gold stock.

Key Market Insights for Today

- Trillions in federal funding programs face uncertainty as the Trump Administration pauses to evaluate alignment with the president’s policies. (MarketWatch)

- The U.S. Food and Drug Administration (FDA) has green-lighted the use of Ozempic for treating kidney disease and diabetes. (CNBC)

- Post-earnings excitement surrounds two travel stocks.

- A new strategic plan from Boeing seeks to improve its ongoing challenges.

- Gold stock benefits from the broader market recovery.

Oil and Gold Prices Bounce Back from Tech Sector Declines

Crude oil futures saw a positive closing yesterday, benefiting from a recovery in the tech sector after recent sell-offs. March-dated West Texas Intermediate (WTI) crude increased by 26 cents, or 0.3%, to settle at $73.43 per barrel.

Meanwhile, gold prices also rose, fueled by tariff discussions and recovery in tech. The price of February gold climbed 1.3%, settling at $2,772.60 an ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.