Financial Sector Leads Q4 Earnings Surge for S&P 500

Strong Start for Q4 Earnings Season

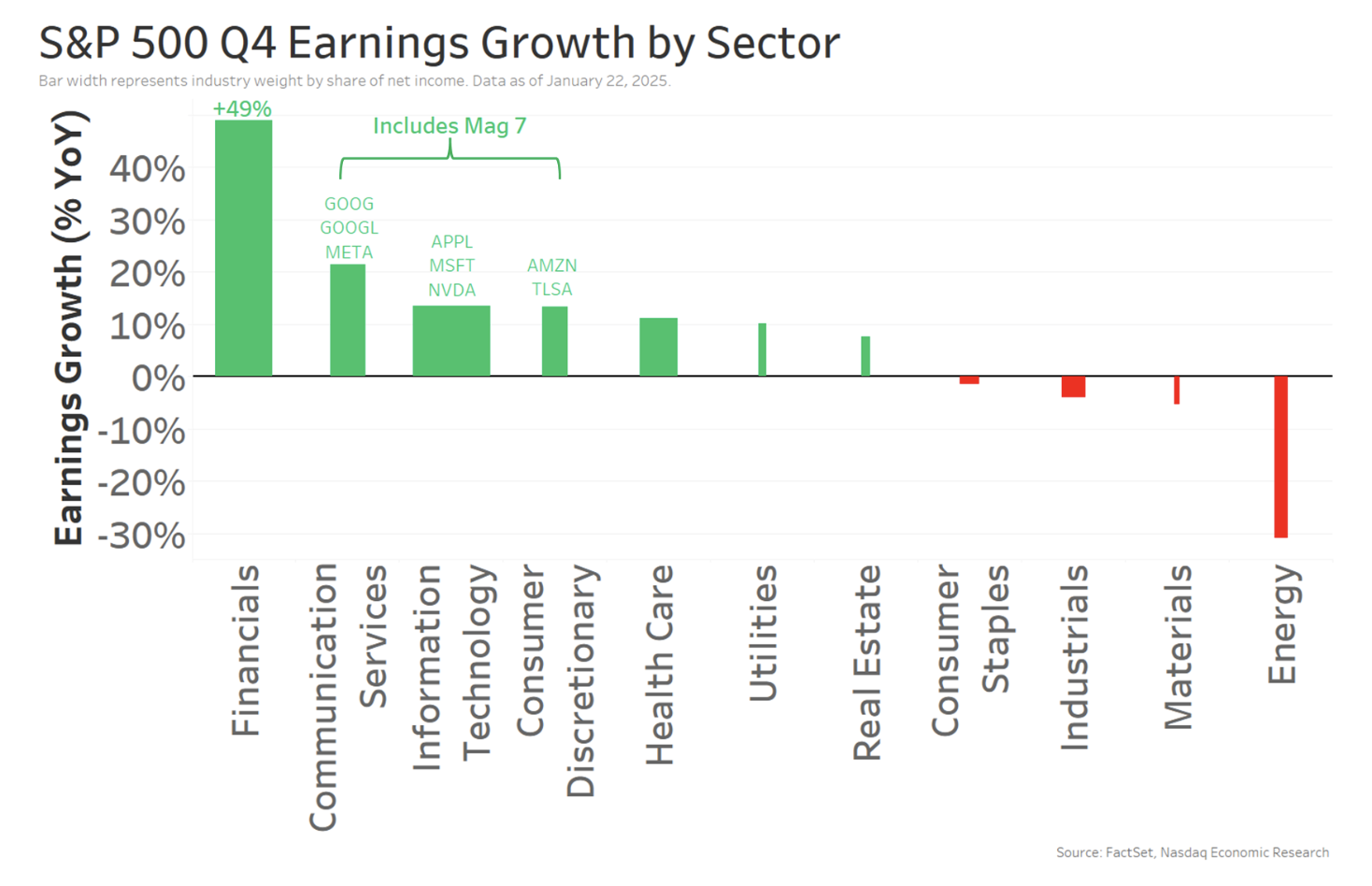

The Q4 earnings season began last week, highlighted by reports from major banks. Early indicators show that large-cap Financials are poised for the highest earnings growth of any sector, expected to rise by +49% year over year (YoY) in Q4.

Key Factors Behind Financials’ Success

Several elements are driving this impressive performance in the Financials sector:

- Election-related trading activities have boosted revenues.

- Fees from initial public offerings (IPOs) doubled at many banks as IPO activity picked up, aligning with our Nasdaq IPO Pulse predictions.

- Optimism surrounding the economy and more flexible lending and deal-making conditions contributed significantly.

- A favorable comparison to Q4 2023, when earnings declined by -14% YoY due to a $16 billion charge imposed by the FDIC to restore its insurance fund following the March 2023 banking crisis.

Other Sectors Following Suit

After Financials, the earnings landscape is dominated by sectors associated with the “Mag 7”: Communication Services (+21% YoY), Technology (+14%), and Consumer Discretionary (+13%). This trend mirrors observations over the past two years.

Conversely, challenges persist in other sectors like Industrials, Materials, and Energy, which have also reported negative earnings growth.

- The capital-intensive Manufacturing sector continues to be impacted by high interest rates affecting Industrials and Materials.

- Energy sector profits are down due to a -10% YoY decrease in both oil and natural gas prices.

Broader Earnings Growth Beyond the Mag 7

While the Mag 7 still play a crucial role in earnings, other companies within the S&P 500 and Nasdaq-100 are increasingly contributing to growth, supported by a resilient economy in 2024.

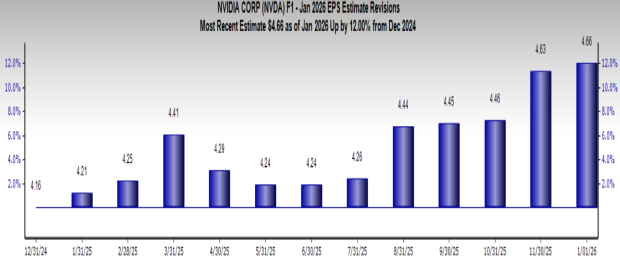

The Mag 7 are expected to see their earnings climb +21% YoY, marking their seventh consecutive quarter of at least +20% growth, driven largely by ongoing demand for AI technologies. With the U.S. government announcing a $100 billion AI initiative — potentially rising to $500 billion — future demand for these technologies seems assured.

Excluding the Mag 7, the remaining companies in the S&P 500 have reported positive earnings growth for three consecutive quarters, while growth turned positive for other Nasdaq-100 companies about a year and a half ago.

Looking ahead, analysts anticipate the rest of the S&P 500 will see earnings growth between +10% and +15% in the coming year, with the remainder of the Nasdaq-100 expected to experience even stronger growth, nearing the Mag 7’s projected earnings increase.

Nasdaq-100 Outpacing S&P 500 Due to Higher Margins

The stronger earnings growth of the Nasdaq-100 compared to the S&P 500 in recent years can largely be attributed to healthier margins.

Despite challenges from rising interest rates, the margins for other Nasdaq-100 companies have increased from 16% to 18% since early 2023, while the S&P 500 margins have remained stable at around 12%.

With margins already at impressive highs, analysts predict the possibility of record-high margins for the S&P 500 in 2025.

However, should margins fall short of expectations, companies will need to ramp up sales significantly to meet the strong earnings forecasts for 2025: +15% YoY for the S&P 500 and +21% for the Nasdaq-100. Thus, monitoring margins will be crucial this earnings season.

Disclaimer: The information contained above is for informational and educational purposes only. It should not be regarded as investment advice. Neither Nasdaq, Inc. nor its affiliates makes any recommendations regarding buy/sell activities for any securities. Statements about Nasdaq-listed companies or proprietary indexes are not reliable indicators of future performance. Investors are advised to conduct their own research and seek advice from securities professionals. © 2024. Nasdaq, Inc. All Rights Reserved.