Market Update: Stocks Mixed as Trade Tensions Escalate

The S&P 500 Index ($SPX) (SPY) today increased by +0.64%, while the Dow Jones Industrials Index ($DOWI) (DIA) dipped -0.14%, and the Nasdaq 100 Index ($IUXX) (QQQ) rose by +1.43%. March E-mini S&P futures (ESH25) went up +0.79%, and March E-mini Nasdaq futures (NQH25) are up +1.55%.

Market Overview

Today, stock indexes showed mixed performance, highlighted by the Dow Jones Industrials dropping to a six-month low. Conversely, the Nasdaq experienced gains bolstered by robust performance from the Magnificent Seven stocks and a rally in chip companies. Notably, Verizon Communications fell over -4%, exerting pressure on the Dow Jones Industrials.

Initially, stocks displayed optimism after the U.S. February Consumer Price Index (CPI) increased less than anticipated. However, they encountered obstacles in mid-morning trading due to rising trade tensions. The European Union announced tariffs on up to $28.3 billion worth of U.S. goods, such as soybeans, beef, and poultry, in retaliation for U.S. tariffs on steel and aluminum imports. Additionally, Canada revealed 25% counter-tariffs on approximately $20.8 billion of U.S. products, including computers and sporting goods, alongside steel and aluminum products.

CPI and Mortgage Trends

The U.S. February CPI showed an increase of +0.2% month-over-month and +2.8% year-over-year, which was lower than the expected +0.3% month-over-month and +2.9% year-over-year figures. Excluding food and energy, the CPI rose +0.2% month-over-month and +3.1% year-over-year, also falling short of forecasts that expected a +0.3% month-over-month increase and a +3.2% year-over-year rise. The +3.1% year-over-year increase marks the smallest gain in nearly four years.

In real estate, U.S. MBA mortgage applications increased by +11.2% for the week ending March 7, with purchase applications climbing by +7.0% and refinancing applications rising by +16.2%. Concurrently, the average 30-year fixed rate mortgage decreased by -6 basis points to a three-month low of 6.67%, down from 6.73% the previous week.

Analyzing Trade Policies and Market Response

Concerns regarding U.S. tariffs’ potential to disrupt economic growth and corporate earnings have negatively impacted markets over the past week. Last Tuesday, President Trump imposed a 25% tariff on goods from Canada and Mexico and increased tariffs on Chinese goods from 10% to 20%. Nevertheless, he offered some exemptions for U.S. automakers and extended a one-month reprieve on tariffs from Canada and Mexico for compliant goods under the United States-Mexico-Canada Agreement (USMCA). Despite this, Trump reaffirmed intentions to impose reciprocal tariffs on foreign nations on April 2.

This week, significant attention will be directed toward U.S. trade policies as the 25% tariffs on imports of steel and aluminum take effect. On Thursday, the final-demand Producer Price Index (PPI) for February is expected to ease to +3.2% year-over-year, down from +3.5% year-over-year in January. On Friday, consumer sentiment is anticipated to decline by -1.2 to 63.5 according to the University of Michigan’s March index. Additionally, markets are awaiting Congressional approval for a spending bill to prevent a government shutdown ahead of the March 15 deadline.

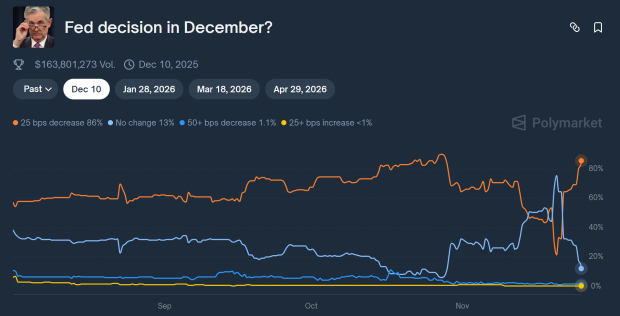

The markets currently assess a minimal 1% probability of a -25 basis point rate cut at the forthcoming FOMC meeting scheduled for March 18-19.

International Market Performance

Globally, stock markets today exhibited mixed trends. The Euro Stoxx 50 increased by +0.92%, while China’s Shanghai Composite Index slipped from a two-and-a-quarter month high, closing down -0.23%. Japan’s Nikkei Stock 225 saw a slight uptick of +0.07%.

Interest Rates Overview

June 10-year T-notes (ZNM25) fell by -3 ticks today, with the 10-year T-note yield rising by +1.3 basis points to 4.293%. T-notes face downward pressure from negative momentum following a decline in 10-year German bunds, which reached a sixteen-month low. Today’s stock rebound has also diminished the safe-haven demand for T-notes. Furthermore, supply pressures weigh on T-notes as the Treasury prepares to auction $39 billion in 10-year T-notes today, part of a larger $119 billion auction package. T-notes briefly rallied after the February CPI showed weaker-than-expected growth, suggesting a dovish outlook for Federal Reserve policy. However, losses in T-notes remained limited following a pullback in stocks when Canada announced its counter-tariffs.

European bond yields are varied today, with the 10-year German bund yield declining from a sixteen-month high of 2.940% to -1.1 basis points, now at 2.886%. In contrast, the 10-year UK gilt yield increased by +2.1 basis points to reach 4.695%.

Central Bank Insights

European Central Bank (ECB) President Lagarde noted that sudden changes in global trade and increasing Eurozone defense spending complicate efforts to stabilize inflation. Additionally, ECB Governing Council member Centeno suggested that the ECB should lower interest rates sooner rather than delay action. Market expectations for a -25 basis point rate cut by the ECB at its April 17 policy meeting stand at 43%.

Top Movers in U.S. Stock Market

The Magnificent Seven stocks have shown positive movement today, aiding market support. Tesla (TSLA) surged over +6%, leading gains in both the S&P 500 and Nasdaq 100 indices. Nvidia (NVDA) also increased by more than +5%, topping gainers in the Dow Jones Industrials. Furthermore, Meta Platforms (META) rose over +1%, while Alphabet (GOOGL) edged up +0.85%. Amazon.com (AMZN) saw a modest gain of +0.31%.

Chip stocks are experiencing notable increases. Micron Technology (MU) ascended over +5%. Other chip companies like ARM Holdings Plc (ARM), Marvell Technology (MRVL), Broadcom (AVGO), and Lam Research (LRCX) also rose more than +3%. Additionally, Advanced Micro Devices (AMD) increased over +2%, while Applied Materials (AMAT) and KLA Corp (KLAC) gained over +1%.

Groupon (GRPN) rallied over +32% after projecting full-year revenue of $493 million-$500 million, surpassing the consensus estimate of $491.3 million. Talen Energy (TLN) saw over a +7% increase following Morgan Stanley’s initiation of coverage with an overweight rating and a price target of $243. Myriad Genetics (MYGN) gained over +6% after Piper Sandler upgraded its rating from neutral to overweight, with a target price of $12.50. GE Verona (GEV) increased by over +5% when CEO Strazik emphasized an order backlog extending into 2028.

Conversely, airline stocks faced declines. United Airlines Holdings (UAL) led with a -6% reduction after TD Cowen adjusted its price target from $165 down to $150. Both American Airlines Group (AAL) and Delta Airlines (DAL) dropped over -5%, while Southwest Airlines (LUV) fell by more than -2%.

iRobot (IRBT) decreased over -40% after reporting Q4 revenue of $172 million, falling short of the consensus estimate of $181 million. Brown-Forman (BF.A) dropped over -6% as the EU initiated counter-tariffs on U.S. goods. Verizon Communications (VZ) similarly fell by more than -3%, leading declines in the Dow Jones Industrials after Wolfe Research downgraded the stock from outperform to peer perform. Other telecommunications companies such as Charter Communications (CHTR) and AT&T (T) also fell over -2%.

Stellantis NV (STLA) dropped over -3% following a double downgrade to sell from buy by Pekao Investment Banking, with a target price of $11.47. PepsiCo (PEP) saw a similar decline of over -3% after Jeffries downgraded its rating to hold from buy, citing limited upside at current price levels.

Upcoming Earnings Reports (3/12/2025)

Key reports include Adobe Inc (ADBE), Crown Castle Inc (CCI), SentinelOne Inc (S), and UiPath Inc (PATH).

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy, here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.