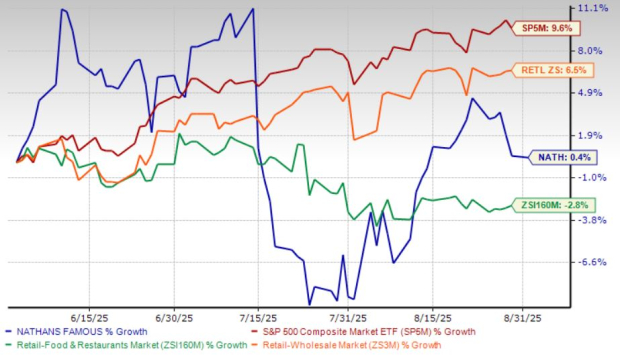

Nathan’s Famous, Inc. (NATH), based in Jericho, NY, has seen its shares rise by 0.4% over the past three months, contrasting with a 2.8% decline in the restaurant industry and underperforming the S&P 500’s 9.6% gain. The company reported first-quarter fiscal 2026 results in August, showing revenue growth driven by its Branded Product Program despite disappointing bottom-line results.

The Branded Product Program benefitted from increased average selling prices amid high beef costs, while franchise operations improved due to new openings. Despite challenges like inflation and reliance on Smithfield Foods for supply, Nathan’s Famous is emphasized its focus on disciplined operations and brand leverage for long-term growth. The company’s EV/Sales ratio stands at 2.9X, below the industry’s 4.6X average.

Franchise revenues grew year over year, and eight new franchised locations were opened, enhancing the company’s asset-light revenue streams. Ongoing challenges include commodity cost volatility and rising labor expenses, which could affect profit margins.