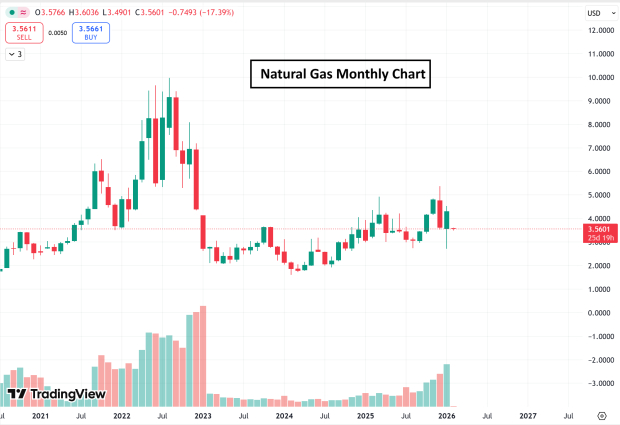

Natural gas prices have experienced a significant drop, falling by 15% on Sunday evening due to mild winter forecasts and record-high U.S. production levels. Since the escalation of the Russia-Ukraine war in 2022, the U.S. Natural Gas Fund ETF (UNG) has decreased nearly 60%, reflecting the volatile nature of this commodity.

Looking forward, several factors may lead to a resurgence in natural gas prices. Notably, the demand for energy from AI data centers is projected to double by the end of the decade, with investments in data center construction expected to surpass $450 billion. Additionally, new liquefied natural gas (LNG) export terminals set to come online in 2026 will allow U.S. producers to meet growing international demand, particularly from Europe, further supporting domestic prices.

Moreover, the U.S. Energy Information Administration reports a 11.3% decline in coal production, shifting energy reliance to natural gas due to its affordability and lower emissions. As the energy landscape evolves, the fundamentals for natural gas appear increasingly favorable for a potential upward trend in prices.