Exploring the Weekly Dynamics of Natural Gas

The recent winds blowing through the U.S. natural gas market hint at a change in direction, as Chesapeake Energy Corp. took a daring leap by slashing its 2024 production levels. This bold move was a tide-turner, stirring the waters of market sentiment and pricing volatility.

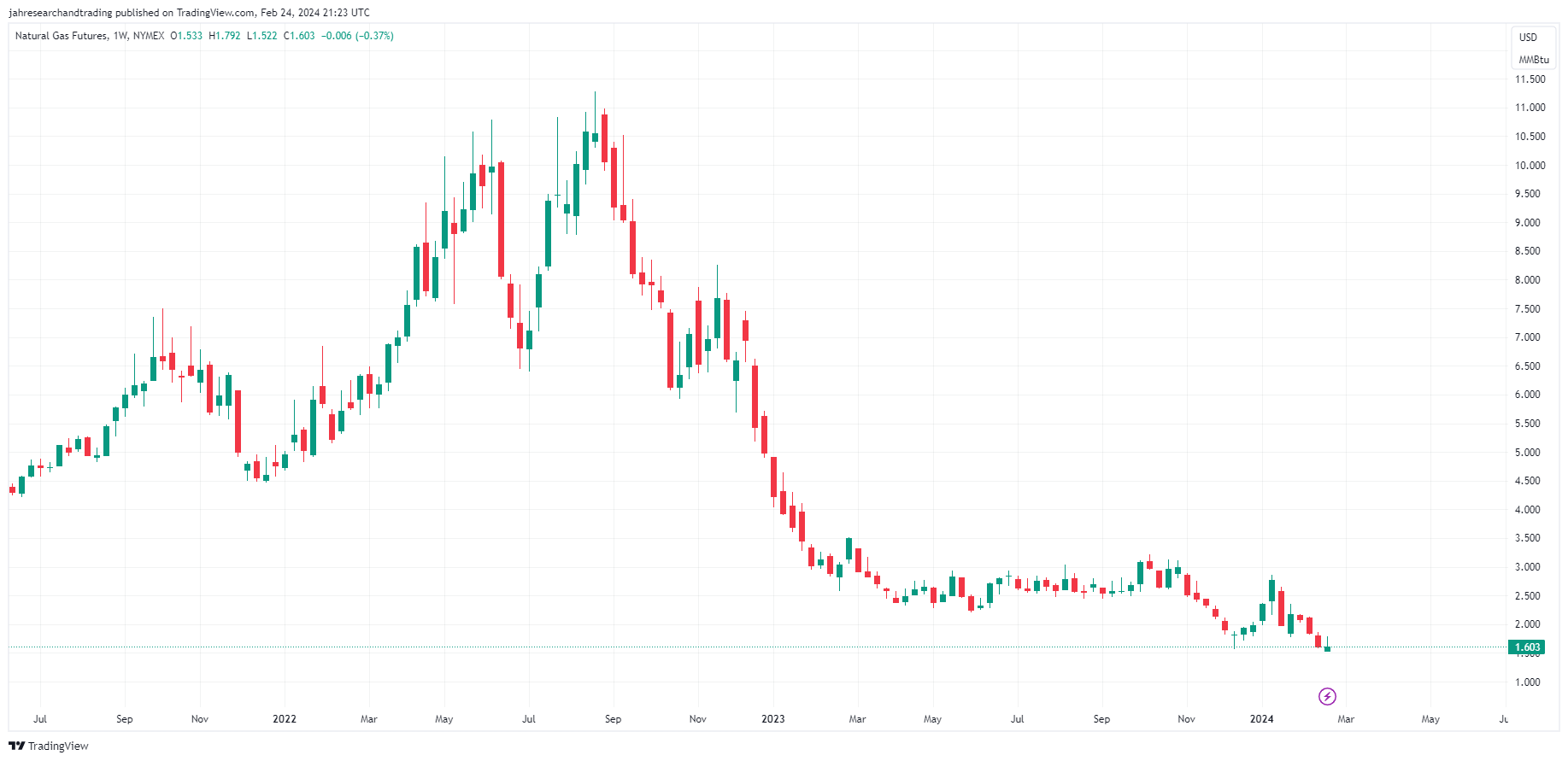

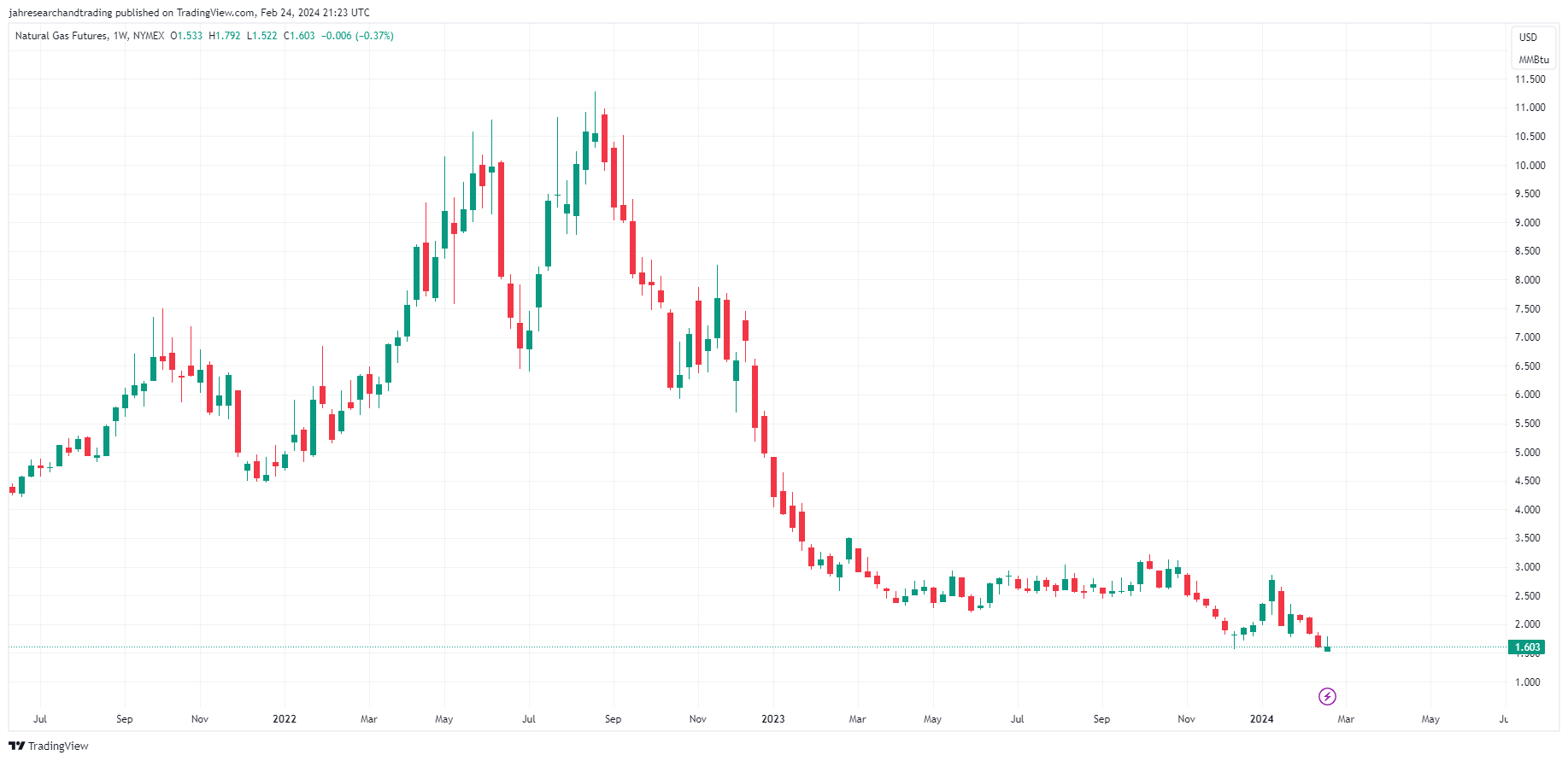

Last week, the Natural Gas futures settled at $1.603, experiencing a slight dip of $0.006 or -0.37%.

Key Event of the Week

The ripples caused by Chesapeake Energy’s decision to chop its natural gas output by approximately 30% in response to plummeting prices to a 3-1/2-year low sparked a blaze in the market. This strategic maneuver triggered a rapid 13% surge in U.S. natural gas futures last Wednesday, signaling a potentially crucial shift in market dynamics. Following suit, giants like Antero Resources, Comstock Resources, and EQT followed the lead by announcing production cuts, underlining an industry-wide endeavor to tackle the pressing oversupply predicament.

A Glimpse of Optimism

The recent price action in the natural gas sector unveiled a departure from the prolonged descent, culminating in a technical chart pattern that hinted at a potential reversal. Such patterns often serve as precursors to a looming price recovery and upward market trend. Last week’s market fervor, characterized by the most significant single-day surge since July 2022, shed light on the market’s sensitivity to shifts in the supply landscape.

Inventories and Demand Dynamics

Despite the nascent bullish signals, inventory stocks remain notably bloated compared to the five-year average, posing a hurdle to a sustained price revival. Nevertheless, the joint efforts of major producers in curtailing production could gradually chip away at this surplus. On the flip side, factors like a tepid winter have translated into reduced gas consumption, although this picture might alter with the rise in air-conditioning use as the warmer months approach.

Market Reaction and Future Trajectories

The market’s receptive stance towards Chesapeake’s production slash paints a larger canvas of the imperative need for supply adjustments in a market swamped with excess. This strategic maneuver by industry titans isn’t merely a knee-jerk reaction to current turbulence but a calculated move in anticipation of burgeoning demand in the coming years, especially amid the expansion of LNG export capacities.

Short-Term Projections

Amid the cautiously optimistic air enveloping the natural gas landscape, the short-term growth prospects are poised on the fulcrum of buyer interest and the efficacy of production management strategies adopted by key market players.

Market participants are urged to keep a keen eye on inventory levels, demand trends, and pivotal industry developments like the surge in LNG export capabilities and the consequent increase in gas production from oil-rich shale basins.

As we navigate these shifts in the market terrain, adapting to the impending surge in demand and striving to strike a fine balance between supply and demand looms crucial in the immediate future.

This article was originally posted on FX Empire

More From FXEMPIRE:

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.