Investing in Vanguard S&P 500 ETF During Market Volatility

Volatility is a frequent occurrence in the stock market, and recent weeks have seen particularly drastic fluctuations. Consequently, many investors may feel apprehensive about entering the market, concerned about potential downturns.

It’s important to recognize that predicting the market’s direction in the near future is impossible. However, for those interested in a robust investment that stands strong during turbulent times while also fostering long-term wealth, the Vanguard S&P 500 ETF (NYSEMKT: VOO) presents a desirable option.

Wondering where to invest $1,000 now? Our analyst team has identified the 10 best stocks to consider right now. Learn More »

stock market crash chart.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F814358%2Fstock-market-crash-with-bear-in-the-background.jpg&w=700″>

Image source: Getty Images.

Navigating Stock Market Challenges with a Reliable Investment

All stocks are vulnerable to significant fluctuations during unstable market conditions, including those from fundamentally strong companies. Nevertheless, the leading businesses often endure these challenges while achieving long-term growth.

The S&P 500 Index (SNPINDEX: ^GSPC) comprises shares of 500 of the largest and most stable U.S. firms. This list includes tech leaders like Apple and Microsoft, alongside timeless brands such as Coca-Cola and Procter & Gamble. Due to their industry stature, many S&P 500 stocks are well-equipped to withstand future market volatility.

Investing in an S&P 500 ETF, like the Vanguard S&P 500 ETF, allows individuals to own shares in all 500 companies within the index by purchasing just one share of the fund.

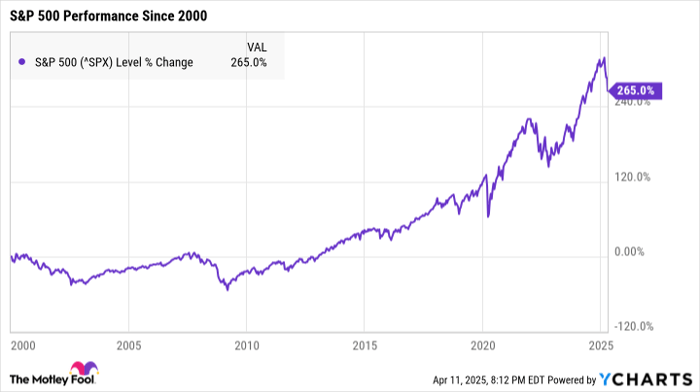

Historically, the S&P 500 has managed to recover from every downturn. Over the past 25 years, it has faced several significant challenges, including the dot-com bubble in the early 2000s, the Great Recession, and the COVID-19 market crash in 2020.

^SPX data by YCharts

Despite facing intense challenges, the index has risen by 265% since January 2000. If you had invested in an S&P 500 ETF back then and held it through all the market’s ups and downs, your investment would have more than tripled in value today.

The Vanguard S&P 500 ETF is particularly noteworthy for its low fees. With an expense ratio of only 0.03%, investors pay just $3 annually for every $10,000 invested. This low cost structure can lead to substantial savings over the long term compared to higher-fee alternatives.

Estimating Your Potential Earnings Over Time

The stock market always carries risks, and the current climate is more uncertain than usual.

However, the S&P 500 has a long history, with average annual returns of roughly 10% over the decades. While this doesn’t guarantee yearly returns of that amount, historical trends suggest a consistent average over time.

For illustrative purposes, let’s assume potential average annual returns of 8%, 10%, or 12%—with the latter aligning with the index’s performance over the previous decade. For a monthly investment of $200, here’s an estimate of how your investment could grow over the following decades:

| Number of Years | Total Portfolio Value: 8% Avg. Annual Return | Total Portfolio Value: 10% Avg. Annual Return | Total Portfolio Value: 12% Avg. Annual Return |

|---|---|---|---|

| 20 | $110,000 | $137,000 | $173,000 |

| 25 | $175,000 | $236,000 | $320,000 |

| 30 | $272,000 | $395,000 | $579,000 |

| 35 | $414,000 | $650,000 | $1,036,000 |

Data source: author’s calculations via investor.gov.

Even if the S&P 500 averages below its historical returns, investing $200 each month could still accumulate significant wealth over time. Increasing your contributions or extending your investment horizon will enhance your potential returns.

Though the market’s current environment is unstable, historical trends indicate a positive long-term outlook. Investing in the Vanguard S&P 500 ETF offers a sound investment option, which, with patience, might lead to substantial wealth accumulation.

Is Vanguard S&P 500 ETF a Smart $1,000 Investment Right Now?

Before purchasing shares in the Vanguard S&P 500 ETF, consider the following:

The Motley Fool Stock Advisor analyst team has pinpointed their selection of the 10 best stocks for investors at this time, and the Vanguard S&P 500 ETF was not included. These selections could yield tremendous returns in the years ahead.

For instance, when Netflix made this list on December 17, 2004, a $1,000 investment then would be worth $495,226!* Similarly, Nvidia was recommended on April 15, 2005, and that same $1,000 investment would now be $679,900!*

Notably, Stock Advisor has posted an impressive average return of 796%, significantly outperforming the S&P 500’s 155% over the same period. Don’t miss the latest top-ten list when you join Stock Advisor.

*Stock Advisor returns as of April 10, 2025

Katie Brockman has positions in Vanguard S&P 500 ETF. The Motley Fool holds positions in and recommends Apple, Microsoft, and Vanguard S&P 500 ETF. The Motley Fool’s disclosure policy includes various options including long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.