Adobe’s Q1 Earnings: Expectations Amid Market Volatility

Adobe ADBE will be a focal point of this week’s earnings calendar, with the software powerhouse set to announce its fiscal first-quarter results after market close on Wednesday, March 12.

Investors are feeling cautious as the tech-heavy Nasdaq index experienced its worst daily drop since 2022, plummeting 4% on Monday, and ADBE shares dropped 3%. Trading 21% below its 52-week highs, Adobe’s stock price stands at approximately $435 per share, leading investors to reconsider their buy, sell, or hold strategies regarding Adobe Stock.

Adobe’s Q1 Forecast

According to Zacks estimates, Adobe’s Q1 sales are projected to rise by 9%, reaching $5.65 billion, up from $5.18 billion in the same quarter last year. On the earnings side, the expected Q1 EPS is anticipated to increase by 11% to $4.97, compared to $4.48 per share a year earlier.

Notably, Adobe has consistently exceeded the Zacks EPS consensus for 24 consecutive quarters, dating back to March 2019. Over the previous four quarters, the average EPS surprise has been 2.55%.

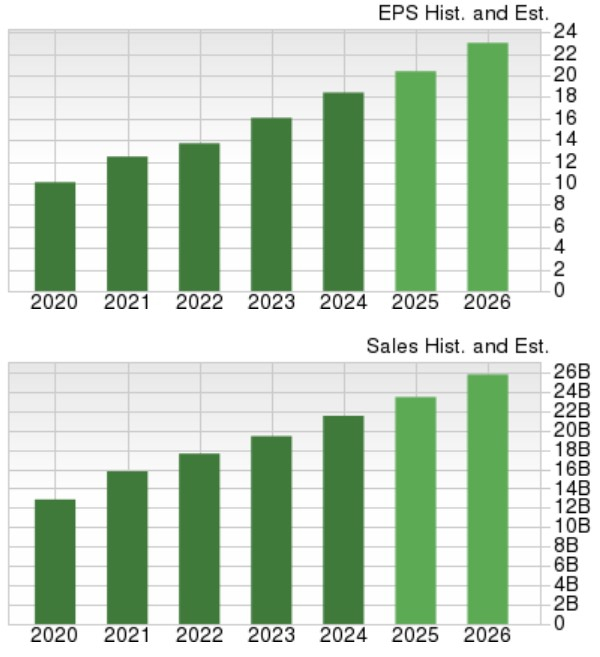

Image Source: Zacks Investment Research

Future Projections for Adobe

Looking ahead, Adobe’s total sales are projected to grow by 9% in fiscal year 2025, with expectations of a further 10% expansion in FY26, reaching $25.78 billion. Earnings per share are also forecasted to rise 10% this year, climbing to $23.03 per share by FY26, marking a 13% increase.

Image Source: Zacks Investment Research

Performance and Valuation of ADBE

Currently, Adobe’s Stock has retraced its year-to-date gains, now down 2% in 2025, closely aligning with the benchmark S&P 500, while the Nasdaq has dipped 9%. Over the past two years, ADBE has gained +34%, lagging behind broader market rebounds of over +50%.

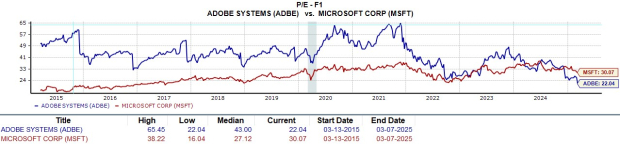

Image Source: Zacks Investment Research

At a forward P/E of 22x, ADBE is currently valued at its lowest price-to-earnings ratio in the past decade, comparable to the market’s average. Additionally, ADBE is slightly below the Zacks Computer-Software Industry average P/E of 29.8x and trades lower than its industry peer, Microsoft MSFT, which is at 30x.

Image Source: Zacks Investment Research

Conclusion on Adobe’s Outlook

Currently, Adobe Stock holds a Zacks Rank #3 (Hold). Given Adobe’s promising growth trajectory and favorable valuation, it remains prudent to hold ADBE shares in light of recent market fluctuations. The company’s future performance will depend significantly on delivering robust Q1 results and optimistic guidance to enhance investor confidence.

5 Stocks Positioned to Double

Each of these stocks was chosen by a Zacks expert as a top candidate to gain +100% or more in 2024. While performance can vary, past recommendations have surged significantly—+143.0%, +175.9%, +498.3%, and +673.0%.

Many of these selections are currently off Wall Street’s radar, representing a unique early investment opportunity.

Discover These 5 Potential Home Runs >>

Want the latest insights from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days today. Click to access this free report.

Adobe Inc. (ADBE): Free Stock Analysis report.

Microsoft Corporation (MSFT): Free Stock Analysis report.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views and opinions of Nasdaq, Inc.