“`html

Palantir and Microsoft: A Comparative Analysis

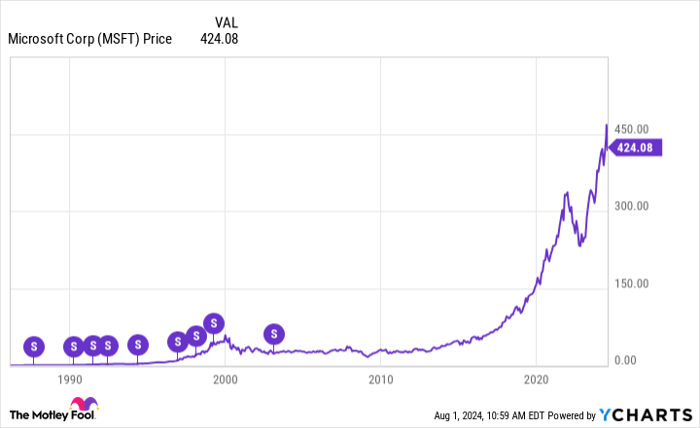

Palantir Technologies’ stock price has surged over 100% this year, largely driven by increased interest in artificial intelligence (AI), yet its price-to-earnings ratio stands at approximately 165, indicating a risky valuation. In contrast, Microsoft reported a strong revenue of $77.7 billion in its first quarter of fiscal 2026, an 18% increase year-over-year, with its cloud revenue climbing 26% to $49.1 billion.

Affected by investor reassessment of AI stocks, the Nasdaq Composite has experienced a downturn from recent highs. Microsoft is seen as a more diversified investment option amid this volatility, whereas Palantir’s high reliance on government contracts and overvaluation suggests it may be more vulnerable to shifts in market sentiment.

“`