After the market closed on Thursday, Alphabet Inc. GOOGL is set to announce its first-quarter earnings results. The company is poised to benefit from the growth of artificial intelligence (AI) and may currently be undervalued. Investors are questioning whether they should buy now or wait for the earnings report. Here’s a closer look at the situation.

Alphabet Inc. Poised for Earnings Growth Driven by AI Innovations

Q1 Earnings Forecast: AI’s Impact on Alphabet

This year, Alphabet’s shares have dropped by 20% as the overall market struggled with tariff pressures. The parent company of Google has also faced difficulties keeping pace with competitors in the AI sector. Despite this, revenue and earnings are expected to improve in the first quarter. This positive trend comes as Alphabet continues integrating AI into various applications such as cloud infrastructure, workplace collaboration tools, and its search engine.

The Google Gemini AI plays a significant role across Alphabet’s platforms, serving over 2 billion users. Samsung has adopted Gemini for its smartphone AI assistant, aiming for 500 million users by year-end with the partnership’s help. Additionally, Alphabet plans to introduce an ad-supported version of Gemini to bolster ad revenues.

CEO Sundar Pichai is focused on enhancing search functionality through its Circle to Search feature, now available on 200 million Android devices. Furthermore, strong demand for AI cloud services is expected to drive Google Cloud revenues higher in the first quarter.

Looking ahead, Google Cloud revenues are predicted to maintain robust growth. The demand for cloud-based AI services is expected to increase by 30% annually through 2032. Consequently, Alphabet is projected to have a strong first quarter due to AI contributions, with expected revenues of $75.53 billion—up 11.7% from last year—and earnings per share (EPS) anticipated at $2.01 compared to $1.89 last year.

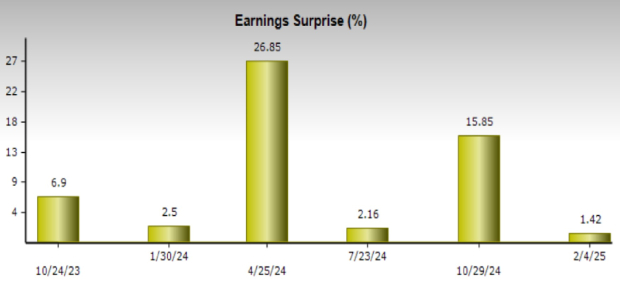

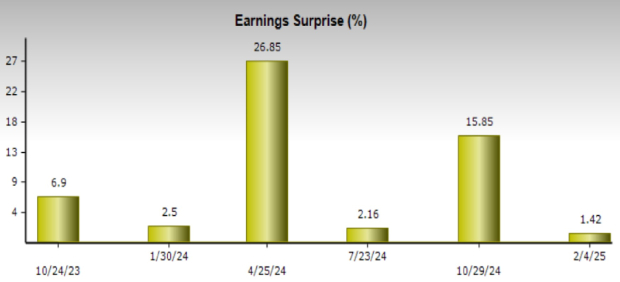

Additionally, Alphabet has historically delivered a positive trailing four-quarter earnings surprise of 11.6%, suggesting potential earnings growth in the upcoming quarter. (Explore the latest EPS estimates and surprises on Zacks earnings Calendar.)

Image Source: Zacks Investment Research

Alphabet Confronts Tariff Impacts and Ad Revenue Challenges

The tariffs imposed by the Trump administration, which began in April, may not directly affect Alphabet’s first-quarter earnings, but they could pose challenges in the near term. While software typically remains unaffected by tariffs, companies facing such issues may cut costs by reducing investments in AI and cybersecurity tools, indirectly impacting Alphabet’s AI services revenues.

The rise of large language models (LLMs), such as ChatGPT, could diminish demand for services like YouTube and Google, affecting Alphabet’s advertising revenues. Moreover, Amazon.com, Inc. AMZN’s foray into the advertising sector through partnerships with Snap Inc. SNAP and Pinterest, Inc. PINS might disrupt Alphabet’s ad business growth.

Investment Strategy: Navigating Alphabet Stock Before Q1 Earnings

Strong first-quarter earnings are expected from Alphabet, driven by AI advancements and platform enhancements. This positive outlook encourages stakeholders to maintain their Alphabet stock.

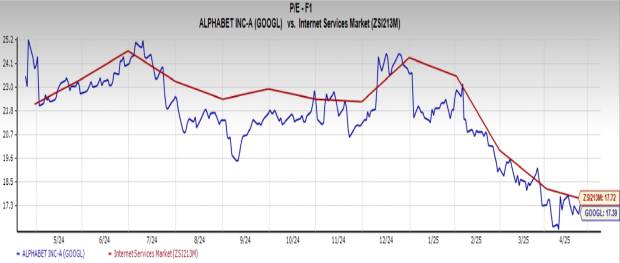

In comparison with its peers, Alphabet appears to be a financially attractive option, encouraging potential new investment in stock. Currently, Alphabet trades at a price-to-earnings (P/E) ratio of 17.39 times forward earnings, versus 17.72 for the Internet – Services industry.

Image Source: Zacks Investment Research

However, investors should exercise caution despite the current attractive valuation. Increased competition in the advertising sector and tariff impacts may hinder Alphabet’s long-term growth. It may be prudent to wait for the earnings call updates before making decisions regarding Alphabet stock. Presently, Alphabet holds a Zacks Rank of #3 (Hold). Consider reviewing the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

The 7 Best Stocks for the Next 30 Days

Experts have recently identified 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They label these tickers as “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market by more than 2X, averaging gains of +23.9% per year. Keep these 7 stocks on your radar for potential investment opportunities.

Want the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days for further insights.

Amazon.com, Inc. (AMZN) : Stock Analysis report available.

Alphabet Inc. (GOOGL) : Stock Analysis report available.

Snap Inc. (SNAP) : Stock Analysis report available.

Pinterest, Inc. (PINS) : Stock Analysis report available.

The views and opinions expressed herein are those of the author and do not necessarily reflect official positions.