Analyzing Advanced Micro Devices’ Near-Term Stock Outlook

Advanced Micro Devices (AMD) remains a focal point for investors, particularly among visitors to Zacks.com. Evaluating key factors that may impact the company’s near-term performance could prove beneficial as investors consider their strategies.

Over the past month, AMD’s shares have declined by -17.8%, compared to a -5.6% change for the Zacks S&P 500 composite. The Zacks Computer – Integrated Systems industry, which includes Advanced Micro, has also faced challenges with a loss of 13.2% during this timeframe. This raises an important question for investors: Where could the Stock be heading next?

While media reports or rumors can significantly influence a company’s stock price, fundamental factors consistently drive long-term buy-and-hold decisions. Understanding these driving forces is essential.

Earnings Estimate Revisions

At Zacks, we place a premium on tracking changes in earnings projections for a company. These changes significantly inform the fair value of its Stock. We closely monitor how analysts adjust their earnings estimates based on the latest market trends. Generally, if analysts revise up their earnings forecasts, the fair value of the Stock will also rise, prompting increased investor interest and price movement. This correlation between earnings estimate revisions and Stock price changes is well-documented.

For the current quarter, AMD is projected to report earnings of $0.93 per share, reflecting a year-over-year increase of +50%. However, in the past 30 days, the Zacks Consensus Estimate has dropped by -0.6%.

The consensus earnings estimate for the full fiscal year stands at $4.59, marking a +38.7% change from the previous year. This estimate has decreased by -0.1% over the last month.

Looking ahead to the next fiscal year, the projected earnings estimate is $5.99, indicating a +30.5% rise compared to last year’s expectations. Notably, this estimate has remained stable over the past month.

The Zacks Rank, which evaluates Stock performance based on earnings estimate revisions among other factors, currently assigns AMD a rank of #3 (Hold). This ranking suggests a performance in line with the broader market.

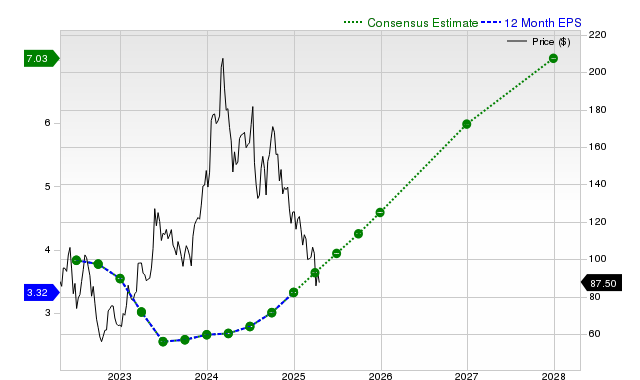

Below is the chart showing the evolution of AMD’s forward 12-month consensus EPS estimate:

12-Month EPS

Revenue Growth Forecast

While earnings growth is a strong indicator of financial health, revenue growth is vital for sustainability. Companies must increase revenue to maintain earnings growth over time.

Advanced Micro’s consensus sales estimate for the current quarter is $7.12 billion, representing a year-over-year change of +30.1%. For the current and next fiscal years, the sales estimates of $31.72 billion and $37.72 billion correspond to growth rates of +23% and +18.9%, respectively.

Last Reported Results and Surprise History

In its most recent quarter, Advanced Micro reported revenues of $7.66 billion, which translates to a +24.2% increase compared to the previous year. The EPS for this period was $1.09, up from $0.77 a year earlier.

This performance surpassed the Zacks Consensus Estimate of $7.52 billion, resulting in a surprise of +1.9%. The EPS also exceeded consensus estimates by +1.87%.

AMD has consistently beaten consensus EPS expectations over the last four quarters, while also surpassing revenue estimates each time.

Valuation

Understanding a Stock‘s valuation is crucial for making sound investment decisions. Determining whether a stock’s current price accurately reflects its intrinsic value relative to its growth prospects is essential for forecasting future performance.

By comparing current valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF), against historical values, we can assess if a Stock is fair value, overvalued, or undervalued. Relative comparisons to peers also provide insights into the stock’s pricing rationale.

The Zacks Value Style Score, which evaluates stocks on a scale from A to F based on various valuation metrics, indicates that Advanced Micro is graded D. This suggests that it is trading at a premium compared to its peers. For further details on the valuation metrics that inform this grade, click here.

Conclusion

The insights presented here, along with additional data from Zacks.com, can guide investors in assessing market sentiment surrounding Advanced Micro. Notably, its Zacks Rank #3 implies that the stock may align closely with broader market performance in the near future.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our research team has identified five stocks with the highest potential for +100% growth in the near future. Among these, Sheraz Mian, the Director of Research, highlights one particular Stock poised for substantial gains.

This leading pick is from a highly innovative financial firm with a rapidly expanding customer base exceeding 50 million, backed by a range of advanced solutions. While past selections haven’t all succeeded, this stock could outperform previous Zacks’ selections, such as Nano-X Imaging, which surged +129.6% in just nine months.

See our top stock and four additional recommendations.

For the latest recommendations from Zacks Investment Research, download our report on the 7 Best Stocks for the Next 30 Days. Click for your free copy.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.