AI Technology Revolutionizes Trading During Market Volatility

Editor’s Note: When the market experiences significant sell-offs, panic often leads many to sell their investments. This response is understandable, yet it’s not advisable. Instead, you should refine your trading approach to maximize protection and profit during turmoil.

Keith Kaplan, CEO of TradeSmith, has developed an innovative trading strategy leveraging AI. This technology utilizes machine learning models trained on over 1.3 quadrillion data points and 50,000+ backtests, offering predictive analytics to identify stocks’ potential movements within the coming month.

The outcome? A strategic edge that is unprecedented in the market.

Discover more about this at The AI Predictive Power Event on April 16 at 8 p.m. Eastern. Reserve your spot now!

Now, here’s Keith with insights on how this strategy can benefit you…

*********************

It felt as though the world was falling apart.

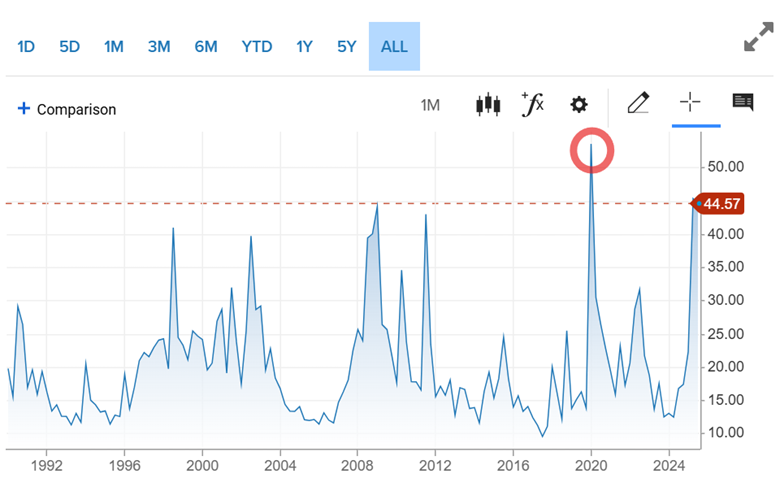

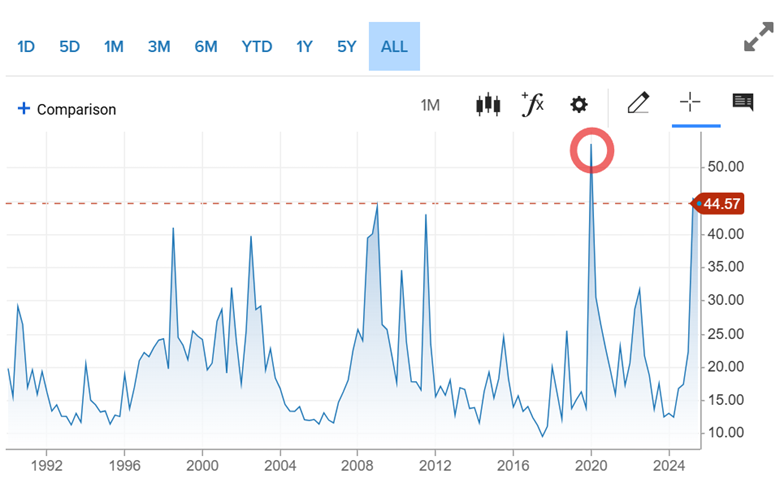

Nearly five years ago, amid the escalation of the COVID-19 pandemic, the CBOE Volatility Index (VIX)—the market’s “fear index”—reached its highest recorded level.

Simultaneously, the S&P 500 faced its third-largest single-day percentage drop on record with an 11.98% plunge.

This week similarly struck a chord, as the S&P 500 dipped by 10%, resulting in a staggering $5 trillion loss following President Trump’s tariff announcement on April 2.

Fortunately, the market has since rebounded after the president decided to postpone reciprocal tariffs on countries outside of China.

Like in 2020, when uncertainty peaks, the key is not to flee but to adapt your trading strategy.

TradeSmith’s latest innovation may offer the perfect solution.

We are witnessing the transformative power of artificial intelligence like never before.

Profit and Protect in Times of Market Panic

Much of the current discourse surrounding AI focuses on future possibilities and its potential benefits.

However, at TradeSmith, our future is already here.

We’ve harnessed AI to create a system that delivers market-beating returns—even during challenging periods.

This innovative approach emphasizes not only identifying opportunities but also avoiding pitfalls. Our proprietary AI, known as An-E (analytical engine), excels in this regard.

An-E distinguishes itself by accurately forecasting stock prices for the month ahead, with many of its projections proving highly reliable.

This tool is not limited to identifying rising stocks—An-E also highlights potential declines.

In today’s volatile climate, focusing on defensive strategies can be just as crucial as seeking offensive opportunities, and An-E effectively addresses both.

For instance, consider Occidental Petroleum Corp. (OXY).

- Price at Projection: $46.21

- Projected Price: $49.23 by April 2, 2025

- Confidence Level: 70%

On March 3, 2025, An-E predicted OXY would increase from $46.21 to $49.23 within 21 trading days, marking a 6.53% gain with strong confidence behind the estimate.

Ultimately, OXY reached $49.19 by April 1, 2025, locking in a 6.44% gain in just 20 trading days.

These gains contribute significantly to profitability when replicated consistently throughout a year.

However, An-E’s utility extends beyond merely identifying winners.

On March 4, 2025, An-E projected that Light & Wonder Inc. (LNW) would fall from $106.60 to $92.52 within 21 trading days, indicating a 13.20% decrease with a confidence level of 63%.

As anticipated, by April 2, 2025, LNW dropped to $91.95, resulting in a 13.74% actual loss.

Contemplate this: if you knew a stock had a 63% chance of declining in the approaching month, would you still consider purchasing it? likely not.

In turbulent market conditions, successfully avoiding losses can be as advantageous—or more so—than discovering profitable positions.

Mastering the Data: Winning Strategies and Risk Management

An-E is more than just an additional resource; it is a transformative innovation that empowers traders. As volatility increases across markets, this technology provides the accuracy and insight required to stay agile, ensuring better outcomes even in uncertain times.

# Navigating Market Turbulence with AI: Join the An-E Event

The future of trading is entering a new phase, guided by An-E’s innovative capabilities.

We developed An-E to provide precise price predictions for thousands of stocks, funds, and ETFs over the next 21 trading days.

Designed with user-friendliness in mind, An-E allows traders to operate without being tethered to their screens for long hours. Instead of anxiously monitoring minute-by-minute price movements, users simply review email alerts when potential trades arise.

This straightforward approach has sparked impressive demand for the service, making it one of our most favored technologies in recent years.

Amidst current market volatility, TradeSmith is stepping up with an important online event aimed at providing strategies for navigating through this uncertainty.

On Wednesday, April 16 at 8:00 p.m. EDT, we will host the AI Predictive Power Event. This session will detail how An-E accurately forecasts stock prices one month ahead and how you can leverage this information to uncover high-probability trades that capture short-term profits.

Today, we are experiencing one of the most significant economic transformations in recent history. Global trade patterns are changing, markets are in a state of flux, and many investors are striving to adapt.

This environment is precisely what AI technologies like An-E were created for. As market volatility increases, traditional “buy and hold” strategies are becoming less effective. Savvy investors are learning to align their strategies with market movements, and AI is essential for this adaptability.

Click here to register for the event.

Sincerely,

Keith Kaplan

CEO, TradeSmith

P.S. When you sign up for the event, you will receive five of An-E’s most bearish forecasts for the upcoming month. These insights will help you identify stocks to avoid during current market fluctuations.